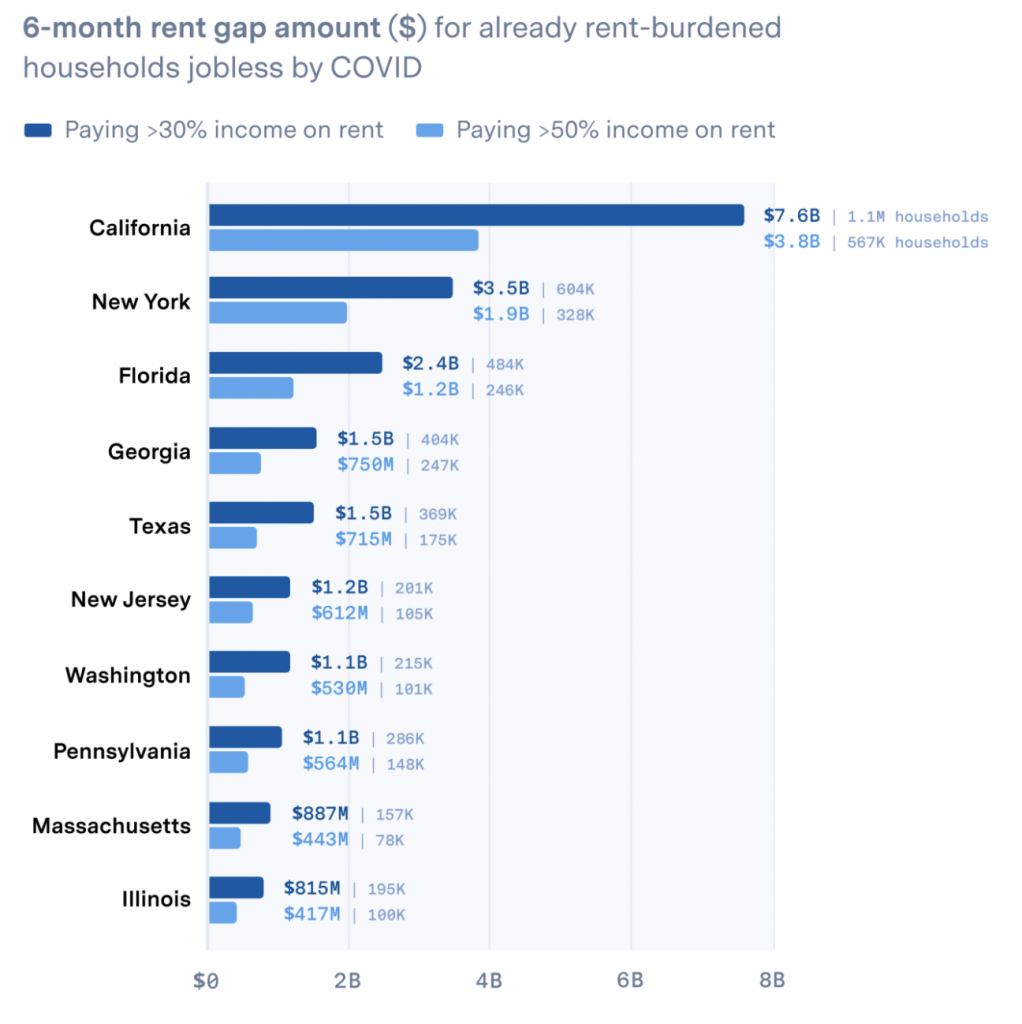

Despite the continued increase in coronavirus cases across the US and many Americans still unemployed, the federal government’s employment insurance aid is set to expire by the end of July, and various eviction bans are beginning to be lifted. However, according to a recent analysis by UrbanFootprint, there could soon be up to 6.7 American households facing evictions in the coming months.

According to the UrbanFootprint report, which based its analysis on the cost of housing and unemployment claims, New York, Georgia, California, Texas, and Florida carry the highest risks of an eviction crisis. Unless the rent-burdened households are alleviated via a rapid economic recovery, the federal government will have to provide additional aid. Although the House of Representatives have passed a bill which would see $100 billion go towards rental assistance programs as well as extend the federal eviction ban to March of next year, it is not likely to pass through Senate.

However, even before the current coronavirus-induced rental housing crisis, the US was already facing a much deeper crisis: the lack of affordable housing. UrbanFootprint found that nearly half of households that rent could not afford to make their payments even before the pandemic, with a quarter of those households having to spend over half of their monthly income on rent.

Information for this briefing was found via CNBC and UrbanFootprint. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.