It isn’t that the small cap world didn’t notice the global equities selloff. The TSX Venture took as big a proportional hit as the Dow and the S&P 500 Monday. It’s just that we’re used to this sort of thing. Earthquakes are a way bigger deal in San Francisco than they are across the bay in Oakland, where people are a lot more used to sudden disasters and have a lot less to lose. One develops a callous.

At the moment, the dice hustle in the small cap ghetto is functionally on hold. It’ll be blamed on coronavirus or whatever, but the plain fact is that venture equities don’t work until there’s capital inclined to chase them for their speculative value or practical value that brings speculative value along with it. Small cap gold stands a chance of drafting off of any alpha that gets created in the metals and the majors, but the broader sector doesn’t figure to attract much capital in this environment, and low volume everywhere proves it. For now, the taps are off.

The real action is in the bond markets.

To the extent that this tantrum the equities markets are throwing is a reflection of a perceived or real slowdown of the real economy, such a slowdown will put a pinch on the cashflow of the companes who make up the economy. Many of these companies have borrowed money in the form of a bond issue, and some have even kept the cash that they borrowed in bond instruments of slightly higher quality than their own debt, issued by entities that are doing something similar, all down the line.

There’s a legitimate risk of one or more of these companies defaulting on a note, causing a company who was counting on the payment from that note to default on their own note, causing a ripple of unsteadiness to move through the whole house of cards, testing the weak links until it either finds one that breaks or a structural re-enforcement team shows up, spackles on some money and says: “There! That ought to hold ‘er!”

Let’s take a look at these corporate bonds, starting at the metaphorical foundation of the structure.

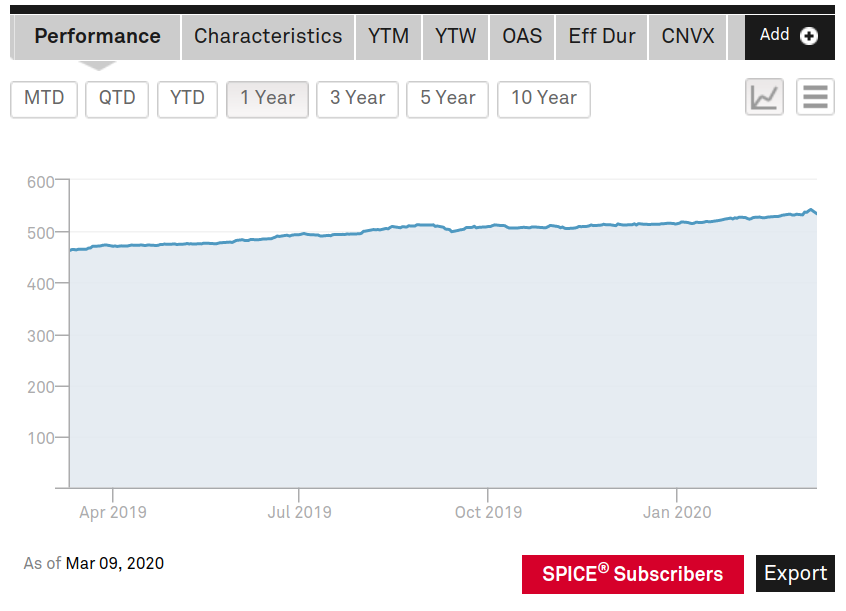

This index tracks the bonds of the non-bank components of the S&P 500. It’s drawing out a nice, boring performance graph over 12 months, and that’s fine. That’s just the way we want it.

The move came on the Option Adjusted Spread tab. The OAS is a model-based metric that accounts for moves in interest rates and the option of the debtors to repay the bond early or re-finance their debt. Between a rate drop and the re-financings or early repayments that would come with a cash crunch, this is to be expected. Still nothing to be concerned about down here on the foundation.

The fixed income universe is a lot larger than the equities universe in terms of the capital tied up in it, but consists of issues that are a lot more obscure. It trades less volume and doesn’t have the profile that the sell side has managed to cultivate for equities. The modern financial tendency towards securitizing everything has given us various flavours of corporate bond ETFs that ball up corporate debt of various grades in various weightings and serve them up to the investing public in a package that trades like a stock. Let’s take a look at those.

LKOR is a long term bond product. It contains corporate bonds with maturities of ten years. It tripped a bit today, but is holding on. This one doesn’t see a lot of action, though, and low volume traders don’t tell the full story of moves. Let’s try SPLB.

Another long term bond wrapper that sees more action. It made a solid downward move today through its moving average. This is, in-theory, a reflection of traders’ appetite for the corporate debt of GE Capital (NYSE:GE) and the CVS Health Corp. (NYSE:CVS) line of pharmacies among others. It’s showing the same trip yesterday and fall today, right through its 90 day moving average.

LQD is an iShares product that does more volume than its peers, and it’s telling us the same story. BIG double drop on big volume.

The “IT” in “VCIT” stands for “intermediate term.” It’s a packaging of near term bond issues that are most of the way through their lives, meant for investors who are looking for lower yield over a shorter time horizon. VCIT is showing us that same two day, high-volume pounding as the long term bonds, which makes it sound like the world is going to end if you say it without context.

Since ETFs trade like stocks and are held in portfolios with stocks, they get sold off like stocks when stocks sell off. Any margin account that had a corporate bond ETF in it as an equity component likely had it liquidated by a computer to balance the books following Monday’s seismic shift when the bottom fell out of everything all at once. Traders who aren’t under margin may well have been using these corporate bond ETFs as a cash component, and may have elected to sell them off to participate in Tuesday’s “rally” that saw the Dow gain back 1,000 points of the 2,000+ points it lost Monday, but they just as easily could have felt more comfortable in actual cash.

Through the noise of the ETF wrapper and the equities meltdown, these corporate bond groupings can’t be used as effective reads on investor confidence in the corporate bond market. At least, not over the past few days’ turmoil. Notice how the charts stay flat and form tops at the end of February when the DOW was falling apart. Here’s LQD plotted with the DJIA on a one month chart for illustration.

Corporate bonds are either late getting the memo about the economy melting down, or the equities are over-reacting. We’ll be watching the bond action closely over the next few days to see if it smells default anywhere, because that would be bad for this overbuilt financial market top to bottom.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.