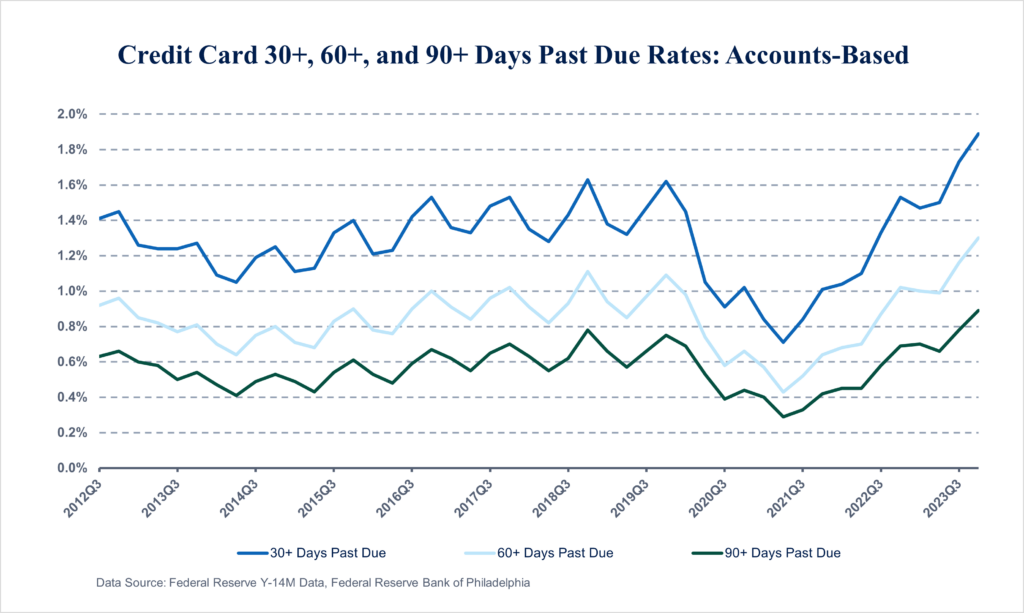

Americans are increasingly struggling to keep up with their credit card payments as high interest rates and persistent inflation strain household budgets. New data from the Federal Reserve Bank of Philadelphia reveals a concerning spike in credit card delinquency rates across all stages – 30, 60, and 90 days past due.

The share of credit card balances at least 30 days overdue reached 3.5% by the end of 2023, the highest level since the Fed began tracking this metric in 2012. Delinquency rates at the 60 and 90-day marks also rose significantly. The report noted that over a third more accounts made only minimum payments compared to the previous quarter.

While end-of-year holiday spending typically leads to a temporary increase in delinquencies, the current levels represent an alarming trend. The Philadelphia Fed stated that the fourth quarter of 2023 featured “the worst card performance in the series” with all delinquency measures hitting record highs.

The struggles are compounded by sky-high interest rates, with the average credit card APR holding at a record 20.75%. This means consumers carrying the $5,000 average balance would pay over $8,000 in interest making minimum payments.

The spike in delinquencies comes as the Federal Reserve fights stubborn inflation through aggressive rate hikes designed to cool the economy. While inflation has moderated, it remains elevated at 3.5% year-over-year as of the latest data.

The pressures are disproportionately hitting lower-income Americans whose paychecks are heavily impacted by rising costs for essentials like food and rent. Recent data from Discover Financial Services (NYSE: DFS) further illustrates the strain, with their credit card delinquency rate quadrupling from 1.5% to 5.7% since early 2022.

BREAKING: Credit card delinquency rates at Discover Financial, the 6th largest credit card issuer in America, just spiked to 2008 levels, according to Reventure.

— The Kobeissi Letter (@KobeissiLetter) April 22, 2024

At Discover, credit card delinquency rates in Q1 2024 jumped from 4.7% to 5.7% in Q1 2024.

To put this in… pic.twitter.com/63aorYmUZM

Information for this story was found via Bloomberg, the Philadelphia Fed, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.