On March 18th, Cresco Labs (CSE: CL) announced the acquisition of Cultivate, a Massachusetts-based vertically integrated operator, for $90 million, plus an earnout of up to $68 million. The acquisition nets Cresco Labs two open dispensaries and one dispensary that is expected to be up by the second quarter of this year along with roughly 42 thousand square feet of cultivation space.

Cresco Labs currently has 16 analysts covering the company with a weighted 12-month price target of C$22.22. This is up from last month, which was C$20.36. Four analysts have strong buy ratings, while the majority, 11, have buy ratings. One analyst has a sell rating. The street high comes from Stifel-GMP with a C$36 price target, and the lowest is from Roth Capital Partners with a C$17.50 price target.

Canaccord Genuity increased its 12-month price target from C$20.50 to C$22 on the back of the news while maintaining their speculative buy rating on the company. Derek Dley, Canaccord’s analyst headlines, “Accretive acquisition provides a key foothold in Massachusetts.”

He believes that his deal is immediately accretive and says that is the reason why he increased their price target. He writes, “The transaction is immediately accretive to Cresco, with the total consideration of $158 million implying an EV/2021E EBITDA multiple of 4.0-4.5x, well below Cresco’s 19.2x trading multiple at the time of announcement.”

Dley believes that after the deal is finalized Cresco will be in the top three for market share in Massachusetts, with them hitting both the dispensary as well as the cultivation space.

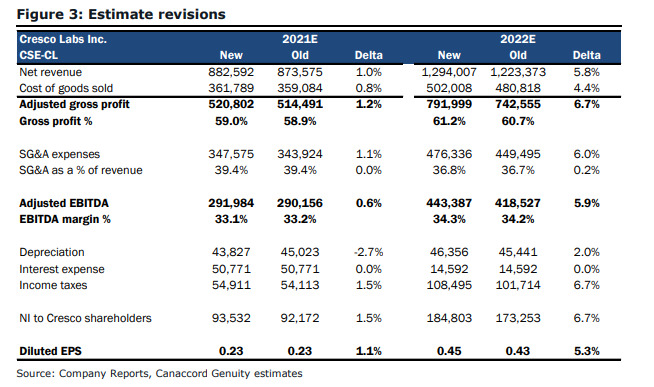

Below you can see Canaccord’s revised estimates for 2021 and 2022.

Onto Haywood’s note, their analyst Neal Gilmer reiterates his C$29.50 price target alongside their buy rating. He writes, “We believe this announcement demonstrates a continued execution of the Company’s strategy of going deep in its core markets with an emphasis on expanding wholesale capacity that is supported by owned and operated retail.”

Gilmer adds that the Massachusetts market is one of the largest cannabis markets. Its current run rate is over $1 billion, with 6.9 million people, and had a large tourist market. He says that it was approximated that Massachusetts had roughly 26.8 million domestic visitors and 2.5 million international visitors before COVID. He writes, “As a result of its proximity to such a large population without adult-use markets as well as demand within Massachusetts, it has become one of the most supply-constrained market in the U.S.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.