On November 11th, Cresco Labs (CSE: CL) reported its third-quarter financial results. The company reported revenues of $215.5 million, a 2.6% quarter-over-quarter increase but a 40.6% year-over-year growth. Gross profit for the quarter was $108.32 million or a 50.3% profit margin while SG&A expenses totaled $69.5 million for the quarter. The company reported an adjusted EBITDA of $56.4 million, an increase of 24% quarter over quarter.

Additionally, the company reaffirmed its year-end guidance that consists of:

- Gross profit margins in excess of 50.0% in the remainder of 2021

- Adjusted EBITDA margin of at least 30.0% by the end of 2021

- Revenue in the fourth quarter between $235 million and $245 million

A number of analysts changed their 12-month price target on Cresco Labs after the results, bringing the average 12-month price target to C$22.77, an 89% upside to the current price. Cresco Labs has 17 analysts covering the stock with 5 having strong buy ratings, 11 have buy ratings and 1 analyst has a hold rating. The street high sits at C$33 while the lowest price target is C$16.

In Canaccord’s third quarter review, they reiterate their buy rating but lowered their 12-month price target from C$18 to C$16, saying that the company is in good shape going into year-end and well-positioned to invest in its core markets while building out its value chain, brands, and distribution.

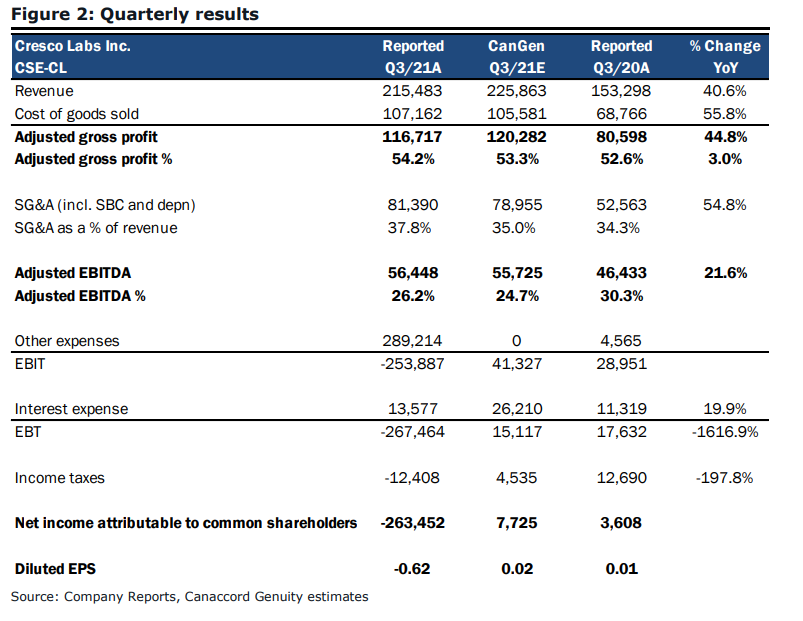

For the third quarter results, Cresco Lab’s revenue came in below Canaccord’s $225.86 million estimates, while gross profits also came slightly below estimates of $120.28 million. Although gross margins came in higher at 54.2% versus Canaccord’s 53.3%, Canaccord focuses heavily in their note on Cresco Lab’s margins, saying that it has been able to generate better margins as the company starts to realize revenue for assets it has been investing in during the first 6 months of the quarter.

Lastly, Canaccord notes that Cresco Labs took a $291 million impairment of its investment in California related to its distribution, as about a month ago it decided to focus on wholesale of its own brands.

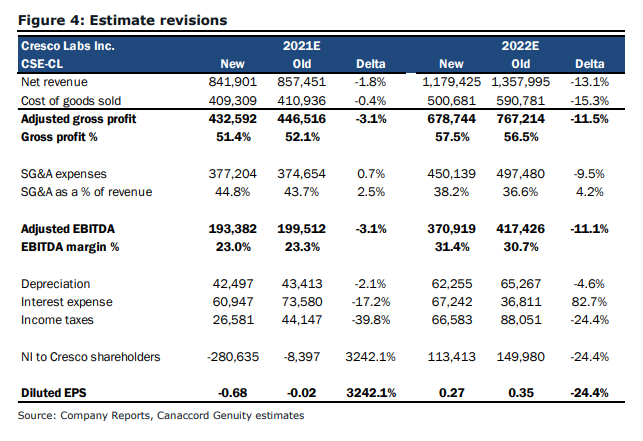

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.