Cresco Labs (CSE: CL) reported its first-quarter financial results this past week. The company announced revenue of $178.4 million, a 9.9% increase quarter over quarter. Gross profit margin came in at 48.8%, and the company experienced record revenue in both its wholesale and retail segments. The company did come out with some sort of soft guidance, saying that they will have an annualized run rate of over $1 billion by the end of 2021 and gross profit margin will be above 50%.

Two out of 16 analysts lowered their 12-month price target on Cresco Labs, bringing the average 12-month price target down to C$22.74 from C$23.36 prior. The company has 16 analysts covering the stock with four of them having strong buy ratings, 11 have buy ratings and one analyst has a hold rating. The street high comes from Stifel-GMP with a C$34 price target, and the lowest target comes from Echelon Wealth with an C$18 price target.

In Canaccord’s note, their analyst Derek Dley reiterated his speculative buy rating but lowered their 12-month price target to C$19 from C$22,writing, “In our view, Cresco is well-positioned to capitalize on the increasing acceptance of cannabis within its core states.”

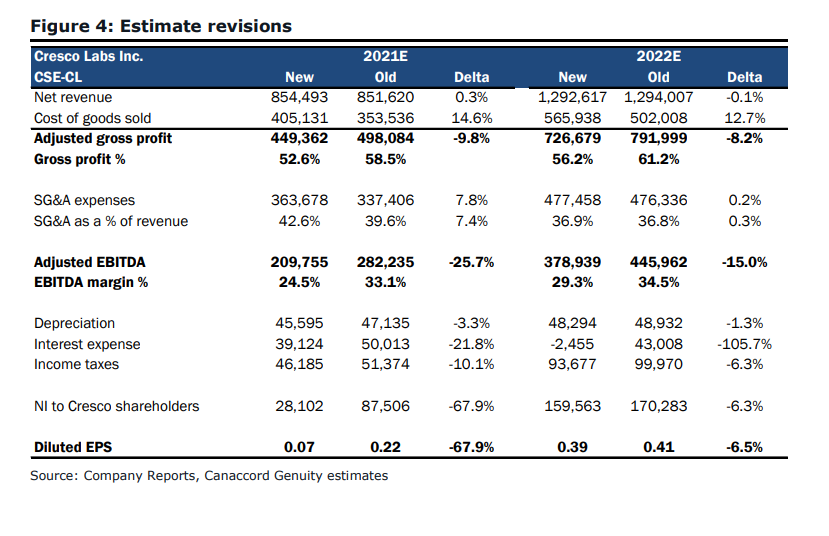

For the results, revenue beat Canaccord’s estimates of $173 million but came in shy on their EBITDA estimate of $41 million. The revenue beat mainly came from both wholesale and retail increasing consecutively. Net wholesale revenues rose 6% while retail rose 15%, slightly shifting the mix to a wholesale/retail revenue split of 54%/46%.

For the outlook, Dley says that the slowed-down opening of new dispensaries in Illinois hit Cresco’s wholesale revenue, but with 18 stores opened in March/April that should provide a solid tailwind for the top line.

Below you can see Canaccord’s updated 2021/2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.