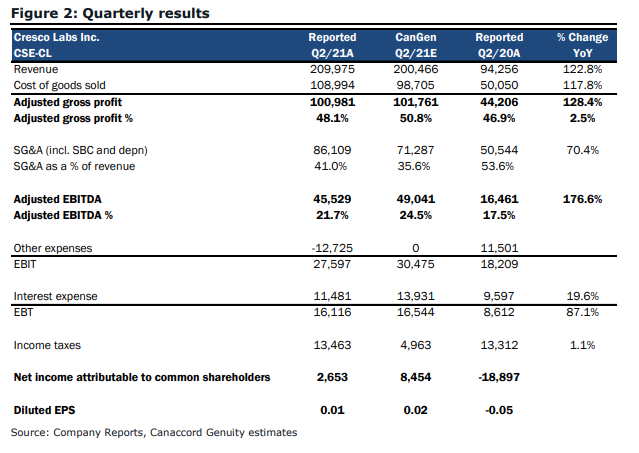

On August 13, Cresco Labs (CSE: CL) announced its second quarter financials. The company had record revenues, coming in at $210 million, up 17.7% sequentially and 122.8% year over year. Gross profit came in at $107 million, or 51% gross margin, up 22.2% sequentially and 233.3% year over year. Adjusted EBITDA came in at $45.5 million, up 30.1% sequentially for the second quarter. The company also reaffirmed its full year 2021 guidance of a revenue run-rate of $1 billion by the fourth quarter, gross profits higher than 50%, and an adjusted EBITDA margin of 30% or higher.

A few analysts changed their 12-month price target on Cresco Labs, slightly raising the average consensus to $23.69 from $23.31 before the results. Cresco Labs has 17 analysts covering the stock, with 5 having strong buy ratings, 11 have buy ratings and 1 analyst has a hold rating. The street high sits at $34 from Stifel-GMP while the lowest comes in at $18.

Canaccord Genuity was one of the firms to change their 12-month price target on the stock. They lowered their price target to $18 from $19 but reiterated their buy rating saying that this quarter showed strong top-line growth.

Cresco Labs reported better than expected top-line growth but below that, everything else was pretty much in line with Canaccord Genuity estimates. Even with the better than expected revenue, the company came up short for adjusted EBITDA, where Canaccord was forecasting $49.04 million, or a 24.5% margin.

Canaccord says, “In our view, Cresco is well-positioned to capitalize on the increasing acceptance of cannabis within its core states, boasts a best-in-class management team, and offers investors a differentiated cannabis opportunity through its focus on both wholesale and retail.”

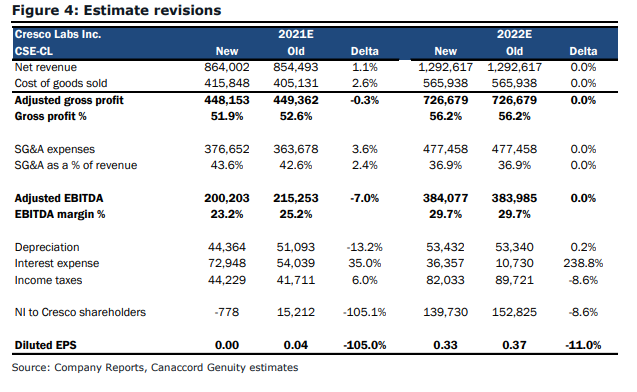

Below you can see Canaccord Genuity’s new full year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.