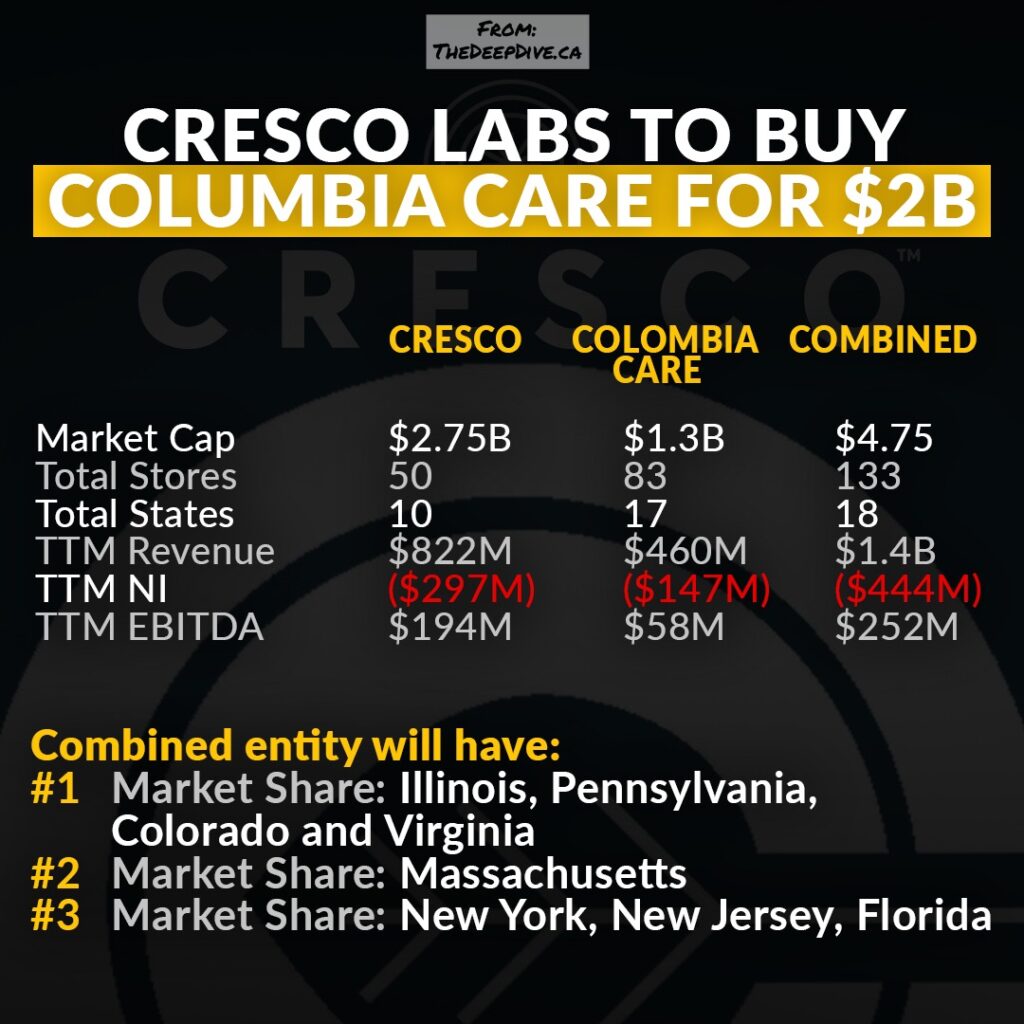

Consolidation within the US cannabis space continued this morning with the proposed combination of Columbia Care (NEO: CCHW) and Cresco Labs (CSE: CL) hitting the wire. Originally leaked last night via Twitter user @BettingBruiser before being picked up by Reuters, the combination is valued at US$2.0 billion.

The proposed transaction, which is expected to close in the fourth quarter of this year, will see Cresco acquire Columbia Care in an all-stock transaction. Columbia Care shareholders are to receive 0.5579 subordinate voting shares of Cresco for each share of Columbia Care held. The figure represents a small premium of 16% over yesterdays closing price of the equity.

“This acquisition brings together two of the leading operators in the industry, pairing a leading footprint with proven operational, brand and competitive excellence. The combination is highly complementary and provides unmatched scale, depth, diversification and long-term growth. On a pro-forma basis, the combined Company will be the largest cannabis company by revenue, the number one wholesaler of branded cannabis products, and the largest nationwide retail footprint outside of Florida,” said Cresco Labs CEO Charles Bachtell.

The transaction represents a continued trend of consolidation within the cannabis space. The development follows last years high-profile combination of Harvest Health and Trulieve (CSE: TRUL), which saw Trulieve pay $2.1 billion for the Arizona-based operator.

What would you call the merged company? #MSOgang

— Betting Bruiser (@BettingBruiser) March 22, 2022

Based on current performance metrics, upon closing the purchase of Columbia Care by Cresco is expected to create the largest multi-state cannabis operator within the US, unseating Curaleaf Holdings (CSE: CURA) from the number one spot. On a pro-forma basis, the company is expected to generate $1.4 billion in annual revenue, via operations spread across 18 markets and 130 retail locations.

On a combined basis, the firm is expected to have the top market share in major markets that include Illinois, Pennsylvania, Colorado and Virginia, while placing second in Massachusetts. The company will also see significant operations in Florida, New Jersey and New York, while having a presence in numerous additional states.

Naturally, the company is also leveraging the opportunity for “synergies and de-levering” as a reason for the combination, stating it expects to increase retail productivity, while reducing redundant capital and operations, which includes selling off redundant licenses and assets in certain markets. Further details however of potential savings were not provded.

Both firms will see their shareholders vote on the arrangement, with 25% of Columbia Care shareholders agreeing to vote in favour already, along with 35% of Cresco’s shareholders. A $65 million termination fee is also in effect.

Columbia Care shareholders are expected to own 35% of Cresco Labs on a post-closing basis.

Cresco Labs last traded at $8.20 on the CSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.