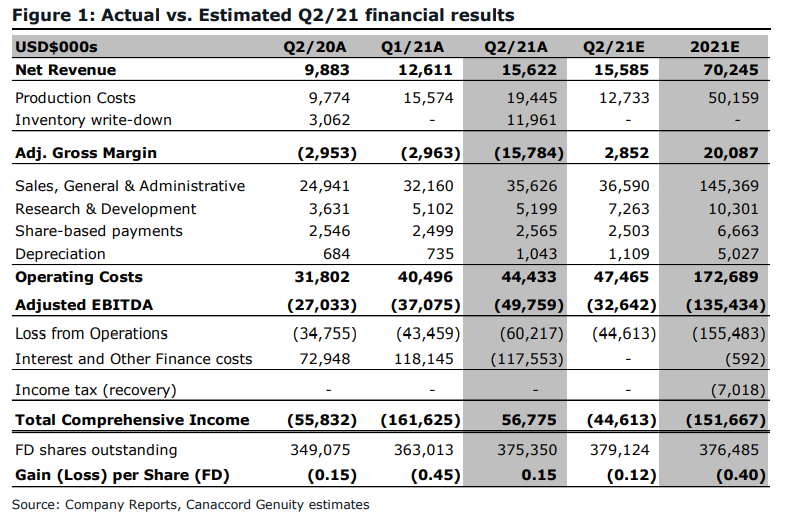

Last week, Cronos Group (TSX: CRON) reported its second quarter financial results. The company generated $15.62 million in net revenue, an increase of 24% quarter over quarter. Gross profit meanwhile declined more than 100% to -$15.78 million due to Cronos’ cost of sales being higher than their revenue, plus an additional almost $12 million in inventory write-downs. Even though the company had negative gross margins, the company reported positive earnings per share and net income of $0.15 and $70.64 million due to a gain on financial derivatives.

A total of 3 analysts lowered their 12-month price target on Cronos after the earnings, bringing the average price target to C$9.15, down from the C$9.48 it was a day before the earnings. The street high sits at C$14.44 from Raymond James, while the lowest comes in at C$5.90. Cronos has 12 analysts covering the stock, of which 2 have buy ratings, 7 have hold ratings, while 1 analyst has a sell rating and 2 have strong sells on the stock.

Canaccord Genuity was one of the firms to lower their outlook on Cronos, bringing their 12-month price target down to C$7.00, and reiterated their sell rating. The firm cited a lower sales ramp, adjusted EBITDA profitability taking longer, and that the stock price is detached from the fundamentals of the company.

For the quarter, the company’s net revenue came in line with Canaccord’s C$15.58 million estimates. The companies US CBD business declined 8% while it’s Canadian/international revenue increased by 31% quarter over quarter. The company missed completely on its gross margins, which is their seventh (7!) straight quarter of negative gross margins. Operating costs came in roughly $3 million lower than Canaccord had estimated. Cronos had an adjusted EBITDA loss of $49.8 million, which got worse by 34% this quarter, the company also burned $42.31 million and had $1.1 billion of cash on hand.

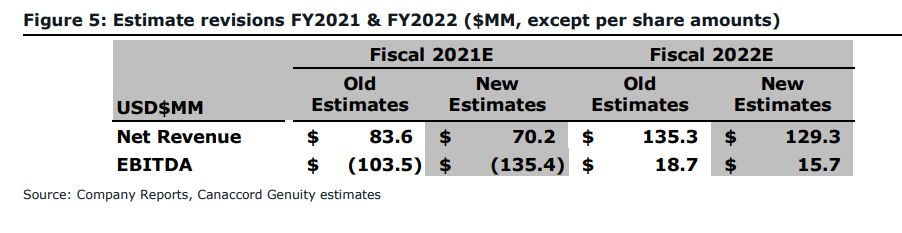

Below you can see Canaccord’s new fiscal 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.