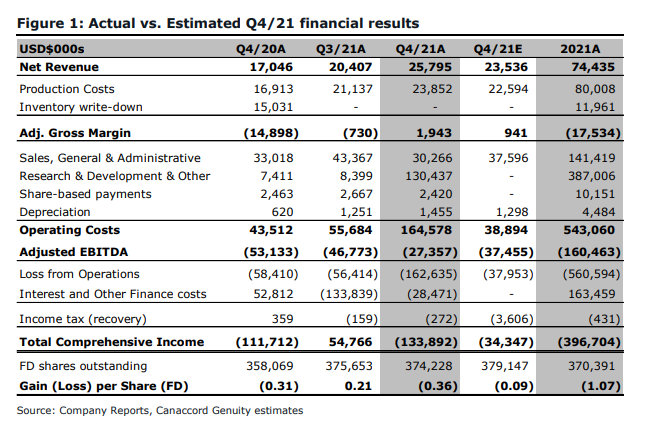

Yesterday, Cronos Group (TSX: CRON) reported their fourth-quarter and full-year financial results. The company reported revenues of $25.8 million for the quarter, of which $18.8 million came from cannabis flower revenue, $3.8 million came from extracts, and $3.1 million came from their US based CBD business. The company saw its gross margins come in at 8%, and an adjusted EBITDA of ($27.4) million for the quarter.

For the year end, the company reported full year revenues of $74.4 million, up 59% year over year. Of that $74.4 million, $55.2 million came from cannabis flower, $8.8 million from extracts, and $9.8 million from their CBD business. The company reported full-year gross margins of (24%) and an adjusted EBITDA of ($160.5) million.

Cronos currently has 12 analysts covering the stock with an average 12-month price target of C$6.39, which represents a 46% upside to the current stock price. Out of the 12 analysts, 2 have buy ratings, 8 have hold ratings, 1 analyst has a sell rating and another analyst has a strong sell rating on Cronos’ stock. The street high sits at C$12, which represents a 175% upside to the stock price.

In Canaccord’s fourth quarter review note, they reiterate their sell rating on the name and C$4.25 12-month price target, saying that the earnings somewhat surprised them with better than expected numbers. Though they say that the numbers got overshadowed by a material impairment of its legacy Peace Naturals production and cultivate site.

On the quarterly results, Canaccord was forecasting that revenue would be $23.5 million with a gross margin of $941 thousand. This minor beat comes as Cronos’ CBD business is seeing a rebound in sales from the previous quarter but still below last year’s sales. The company also reported another quarter of better than expected sequential cannabis sales, with the company seeing its cannabis revenue grow by 24% quarter over quarter. Canaccord now believes that Cronos has a sub 5% market share in branded adult-use cannabis sales.

Cronos also notably reported its first positive gross margin percentage in over two years, with the company continuing to right-size its operations. Canaccord believes that the company is turning a new leaf. The biggest thing to note from the company’s income statement is the larger $120 million impairment on its Peace Naturals production and cultivation facility. This comes after it reported a $236 million impairment last quarter.

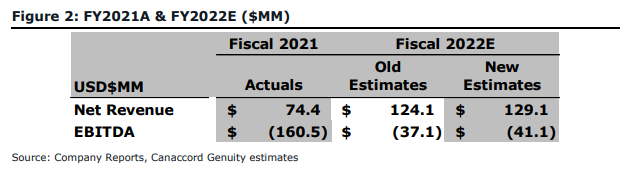

Below you can see Canaccord’s updated fiscal full year 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.