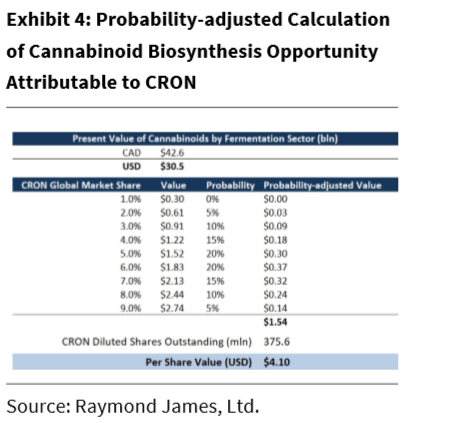

Raymond James recently upgraded Cronos Group (TSX: CRON) (NASDAQ: CRON) to an Outperform 2 rating as well as almost doubling their price target to C$13.52 / U$10. The justification behind this was that they believe Cronos’ partnership with Ginkgo Bioworks currently adds $1.54 billion or US$4.10 a share in value. After all, Raymond James has created a valuation method specific to cannabinoid biosynthesis.

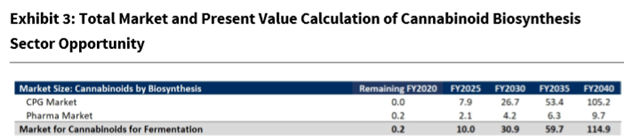

Raymond James estimates that the global market for products made by cannabinoid biosynthesis will grow from C$10 billion in 2025 to C$115 billion in 2040 with an estimated EBITDA coming in at C$1.3 billion and C$15.2 billion respectively for the sector. Furthermore, its estimated that the present value for the sector is currently ~C$40 billion as a result. The firm says Cronos will begin to see “material revenues for CRON within 12-18 months” from the Ginkgos partnership as a result, although they do not change their revenue estimates for Cronos, which is U$71.5m in revenue with a gross profit of C$35.6m for FY2020.

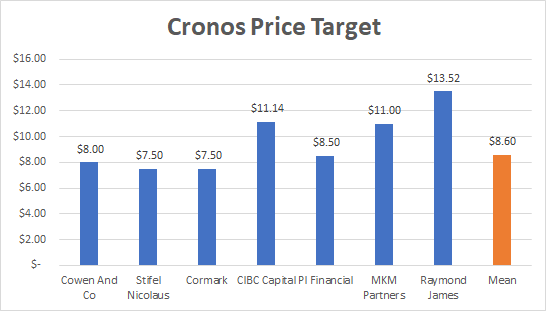

This updated outlook from Raymond James is noteworthy because with this upgrade they believe there is a ~60% upside to the stock, the highest out of any analyst. With the mean analyst price target being C$8.60, not only is their price target considerably different from their peers but so is their rating, with the firm having an Outperform 2 rating for Cronos, the highest rating Cronos currently has.

There are 12 analysts currently providing a rating, and Raymond has the only outperform rating while only one other firm has a buy rating. The remainder have holds (7) or strong sells (2).

Information for this briefing was found via Sedar, Raymond James and Cronos Group. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.