Is this the beginning of the end?

It appears that investors are finally getting cold feet following the Luna/Terra fallout, sparking a broader market selloff of risker assets and a bank run on crypto lender Celsius Network.

Crypto contagion.

— Dylan LeClair 🟠 (@DylanLeClair_) May 11, 2022

A whole lot of funds/companies/products blew up their treasuries with UST yield on Anchor. Billions of $$ of promises – gone.

I wouldn’t want to have any value in in a crypto yield product. I suspect we have some yet to be announced insolvencies here.

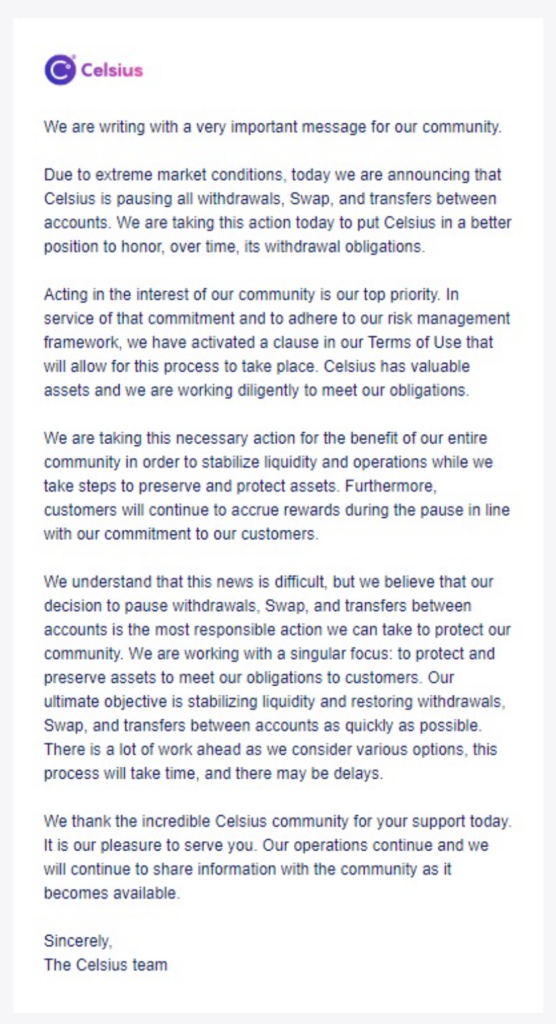

On Sunday night, Celsius suddenly announced it will halt all withdrawals, transfers and swaps after traders continued to question the validity of high-yield tokens following the collapse of the Terra blockchain last month. In the blog post, Celsius said the action was necessary to “stabilize liquidity and operations,” prompting the lender to unstake $247 million in Wrapped Bitcoin from Aave and transfer it to FTX exchange.

“We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations,” the lender wrote. “We are taking this necessary action for the benefit of our entire community in order to stabilize liquidity and operations while we take steps to preserve and protect assets. Furthermore, customers will continue to accrue rewards during the pause in line with our commitment to our customers.”

The abrupt announcement came one day after Celsius CEO Alex Mashibky took to Twitter to dispel any rumours of a potential bank run, accusing naysayers of spreading misinformation after the crypto lending company. But, it appears that his assurances fell on deaf ears, as traders began to raise comparisons between the recent Terra collapse and the scandalous Bitconnect Ponzi scheme. Since Sunday night, though, Mashinky’s twitter account was all crickets, aside from sharing the company’s memo.

Celsius CEO the day before the collapse pic.twitter.com/Rp2dhCmdPu

— Nate Anderson (@ClarityToast) June 13, 2022

Celsius’s CEL token was sent plummeting on the news, shedding about 70% of its value in a matter of one hour to around $0.19 at the time of writing. The broader crypto market also continued to drastically shed value, with bitcoin falling to around $24,700— the lowest since December 2020.

Celsius first launched in 2017, and diversified itself by offering crypto investors high yields for their deposits, which in turn were lent out to various other crypto companies. However, the network soon ran into trouble with regulars in New York, who ordered the platform to cease all operations in the state after unlawfully offering interest-bearing lending products to customers. Shortly after, the activities even caught the attention of the SEC, which in January launched an examination into whether or not Celsius’s lending products should be registered as securities.

What if regulators had acted in 2019 when they first heard about it instead of letting Celsius Network grow into an $11 billion Ponzi scheme?

— Jacob Ma-Weaver (@cablecarcapital) June 13, 2022

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.