Earlier this month, Curaleaf Holdings, Inc. (CSE: CURA reported its fourth quarter and full year 2021 results. The company announced that its revenue grew 93% on a year over year basis to $1.2 billion with gross profits of $588 million or a 48.5% margin. Adjusted EBITDA meanwhile grew to $298 million, up 107% year over year.

A number of analysts slashed their 12-month price target on Curaleaf after the results, bringing the average 12-month price target to C$20.18, down from $24.10 last month. The company currently has 16 analysts covering the stock with 5 having strong buy ratings, 9 having buy ratings, and 2 analysts having hold ratings. The street high sits at C$27, which represents a 250% upside to the current stock price.

In Canaccord’s fourth quarter review, they reiterate their buy rating but lower their 12-month price target from C$18 to C$15.50, saying that Curaleaf reported better than expected margins on a decelerating revenue base. Overall, Canaccord was surprised to see how strong margins came in with the company citing a number of different margin pressures such as wholesale pricing and supply chain inflation.

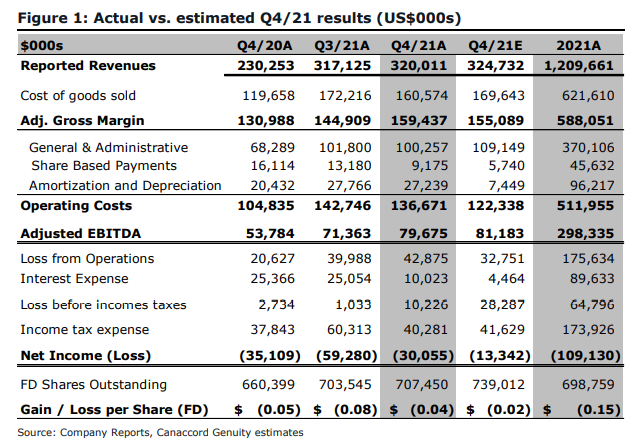

On the results, Canaccord expected revenues of $324.7 million, above the actual $320 million estimates, with the company missing Cannacords estimate with $320.0 million in Q4 revenues. Though the company saw better gross margins, coming in at $159 million versus Canaccord’s $155 million estimates. Canaccord says that the revenue miss is largely attributed to a decrease in all legal U.S cannabis sales by 4% in the fourth quarter, while the modest ~$3 million sequential growth came from new stores in Florida and Arizona.

For the better than expected gross margin, Canaccord calls this number impressive as the space has seen a lot of pricing pressures throughout many of the states Curaleaf has production in. With that, they note that Curaleaf does continue to generate more than 70% of its revenue through vertically integrated retail sales which will take longer to see any pricing pressures.

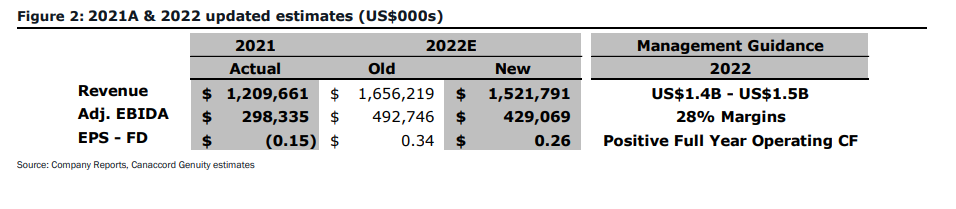

Curaleaf’s 2022 guidance currently estimates full year revenues to come in between $1.4 and $1.5 billion, adjusted EBITDA margins of 28%, and positive cash flow from operations for the full year. Canaccord says that the revenue estimate is roughly 8% below the consensus estimate which points to the growth headwinds continuing into this year.

Below you can see Canaccord’s updated 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.