On April 7th, Curaleaf Holdings (CSE: CURA) announced that they completed $312 million acquisition of related party European company EMMAC Life Sciences, and subsequently they sold 31.5% of the company off to a single institutional investor for U$130 million. This money will be used to pay the $50 million cash tender while the rest of the cash will be used to fund Curaleaf international’s CAPEX through 2022.

Curaleaf currently has 14 analysts covering the company with a weighted 12-month price target of C$27.86. This is up from the average from last month of C$25.14. Four analysts have strong buy ratings and the other ten analysts have buy ratings. The street high comes from BTIG with a C$34 12-month price target and the lowest is C$24 from Cormark Securities.

Canaccord Genuity’s analyst, Matt Bottomley writes, “we believe the potential long-term optionality afforded by entrance into these geographies could be very attractive relative to its current purchase price, time while representing an international platform for potential M&A as these markets develop.” Bottomley believes that this $80 million will go towards the expansion into UK, Germany, Italy, Spain, and Portugal.

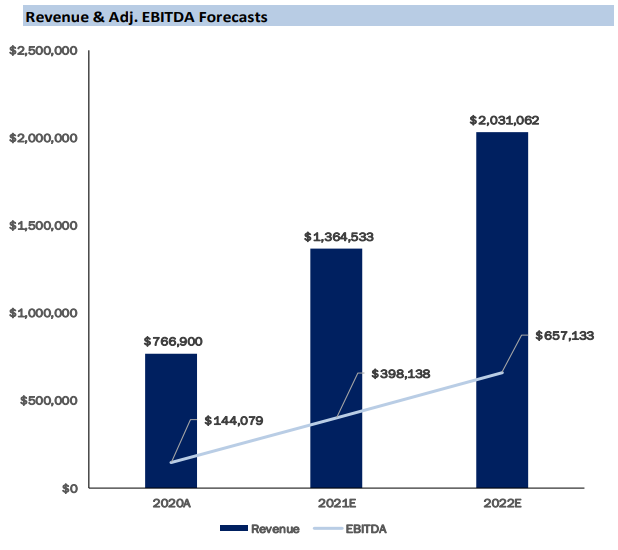

Bottomley makes a note that they believe Curaleafs $1.2 – $1.3 billion revenue and 30% EBITDA margin guided by management does not include 1) any contributions from EMMAC and 2) adult-use sales in New Jersey, which is included in their U$1.36 billion 2021 revenue estimate.

Meanwhile, Haywood’s analyst Neal Gilmer says, “The addition of EMMAC not only provides international exposure but positions the company to be a leader in the global cannabis market,” and adds that the strategic investment by a single investor gives legitimacy to the European market. Gilmer also adds that Curaleaf estimates that in 2020 the European medical cannabis market was $1 billion and is expected to >5x in the next three years.

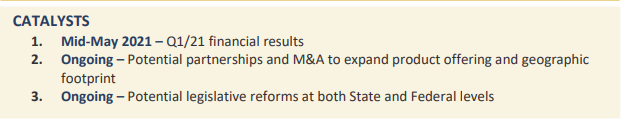

Haywood gives three upcoming catalysts, which you can see below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.