An unexplained bout of optimism came over the marijuana markets this past week, as the clouds cleared for a moment and offered a break to a months-long downpour. The Horizons Canadian Marijuana ETF (TSX: HMMJ) posted its largest percentage gain since the beginning of August, and its cousin Horizon US Marijuana ETF (TSX: HMUS)’s 13% 2 day gain was the largest of its brief existence. The chart looks like the ramp at a bottom of a water slide, and an ever-engaged public wants so badly for this action to be a bounce off of a bottom that it’s in danger of becoming a self fulfilling prophecy.

Outlook Matters

The power-of-positive-thinking crowd who swear by the notion that personal affirmation and keeping a PMA are the lynch pins to a low-stress, high-value life have effectively cut out the religious middle man to delude themselves through tautology. Given the right mindset, all of the things that made you miserable will still be there, but if you don’t let them get to you, then they won’t! Not as long as you can keep ignoring them and thinking happy thoughts.

In a paradox of collective marketing psychology, the hive mind has a non-zero chance of bootstrapping itself into a trend-reversal. It all hinges on whether or not the irrational optimism can hold out long enough to manifest a supply of the fuel that got it going in the first place: cash.

Because reality is in no mood to save these ventures. North of the border, we are seeing very few business profiles of marijuana companies who have been able to successfully scale their operations. It’s more common that big raises were spent on operations that are still having the kinks worked out of them. Presently, only 78 of Canada’s 227 cannabis licenses are allowed to sell cannabis to provincial distributors and contribute significant product volume to this national market directly. Licensing body Health Canada doesn’t seem too bothered by that, and here’s why:

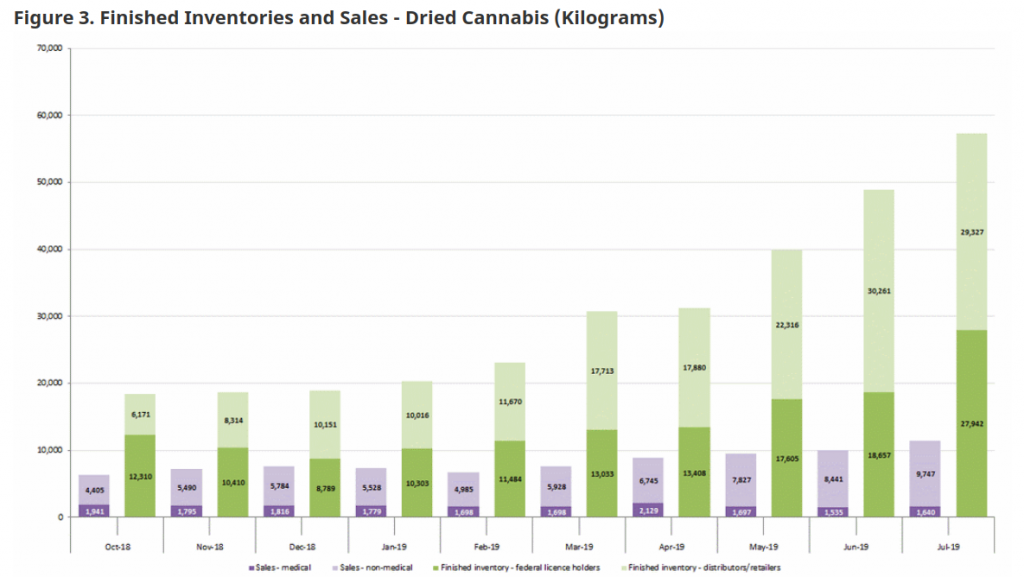

Wholesale

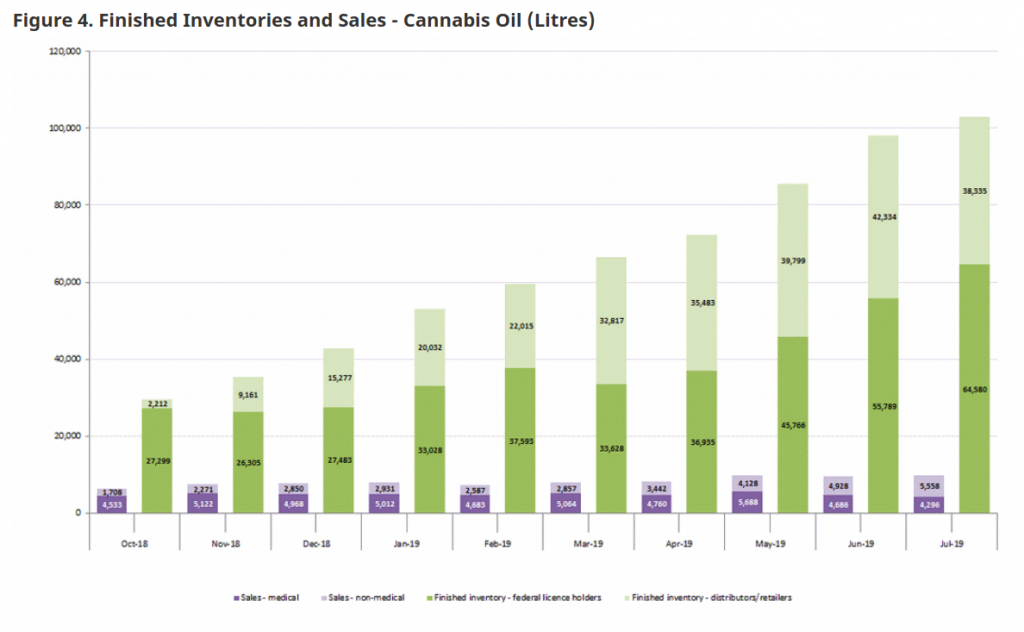

The just-released July sales and inventory totals show a 14% bump in total dried flower sales, which might seem like a lot, but it doesn’t mean much along side a 17% growth in a finished inventory stockpile that’s already five times sales, and a total inventory that’s 25 times sales. Much of that unfinished inventory could be destined for the extracts market, opening up in January. Based on the makeup of more mature markets, we forecast that edibles and extracts will struggle to keep pace with flower in terms of sales volume.

Oil managed to not fall two months in a row, but it looks like the LP’s are getting the message about sales plateauing as the rate of total inventory growth has finally slowed. These are the macro graphics of a market that has stagnated, leaving a guild of producers to fight each other for it.

At the rate Canada’s legal cannabis products are selling, the country has quite enough of it. This is an opportunity for better operators to distinguish themselves by earning bigger shares of the provincial markets, out working the producers of low-test mids in the lucrative dried flower market, and leaving the warehouse weed to fight over McExtracts.

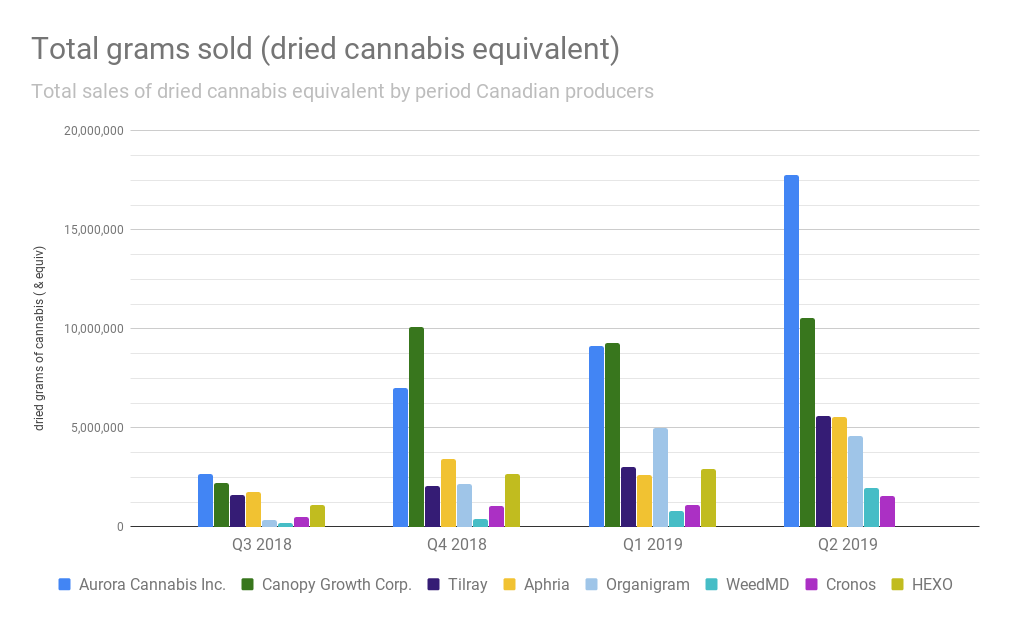

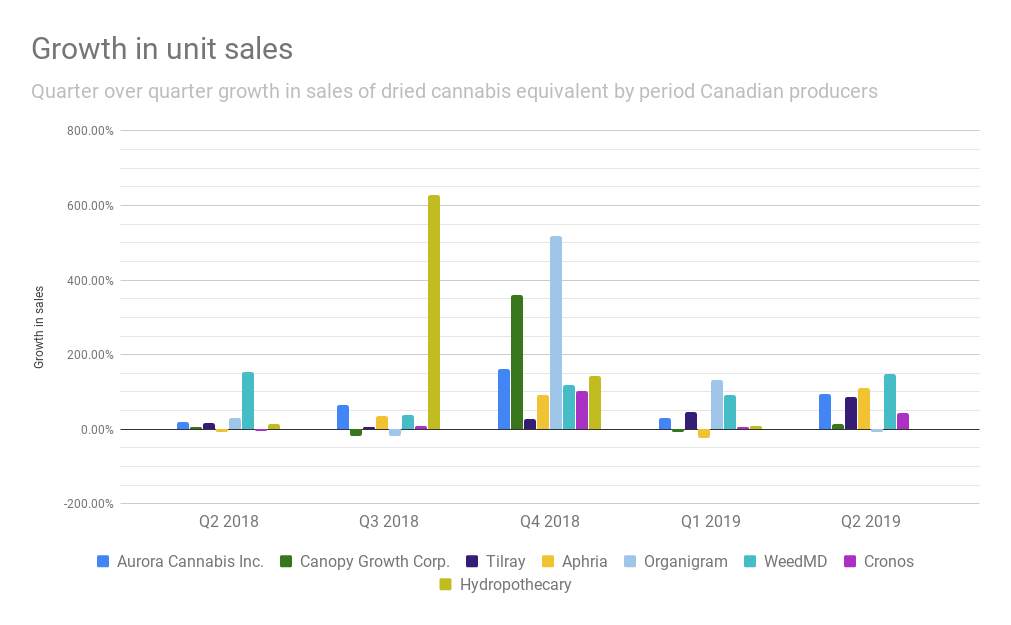

Not all companies report their total sales weight. Supreme Cannabis (TSX: FIRE), as we’ve noted, is the largest company by revenue that still hasn’t published their unit sales. The Green Organic Dutchman (TSX: TGOD) is the largest by market cap that doesn’t publish units. We’ve charted the total sales of everyone who does publish for the past four quarters. Given our theory that the better producers are fixing to out-work each other at this juncture, the rate of growth in unit sales might be more important.

At the individual company level, we’re due to start seeing orders lag at LP’s as the distributors stop ordering the finished product that doesn’t sell. Naturally, there’s nothing to say for sure that Canada’s extract market HAS to follow the pattern of the more mature markets, where extracts and edibles sales lag flower. And if this market believes in a business case for these companies with all its heart, then the fairy capital mothers might just find a way to make their wishes come true.

Retail

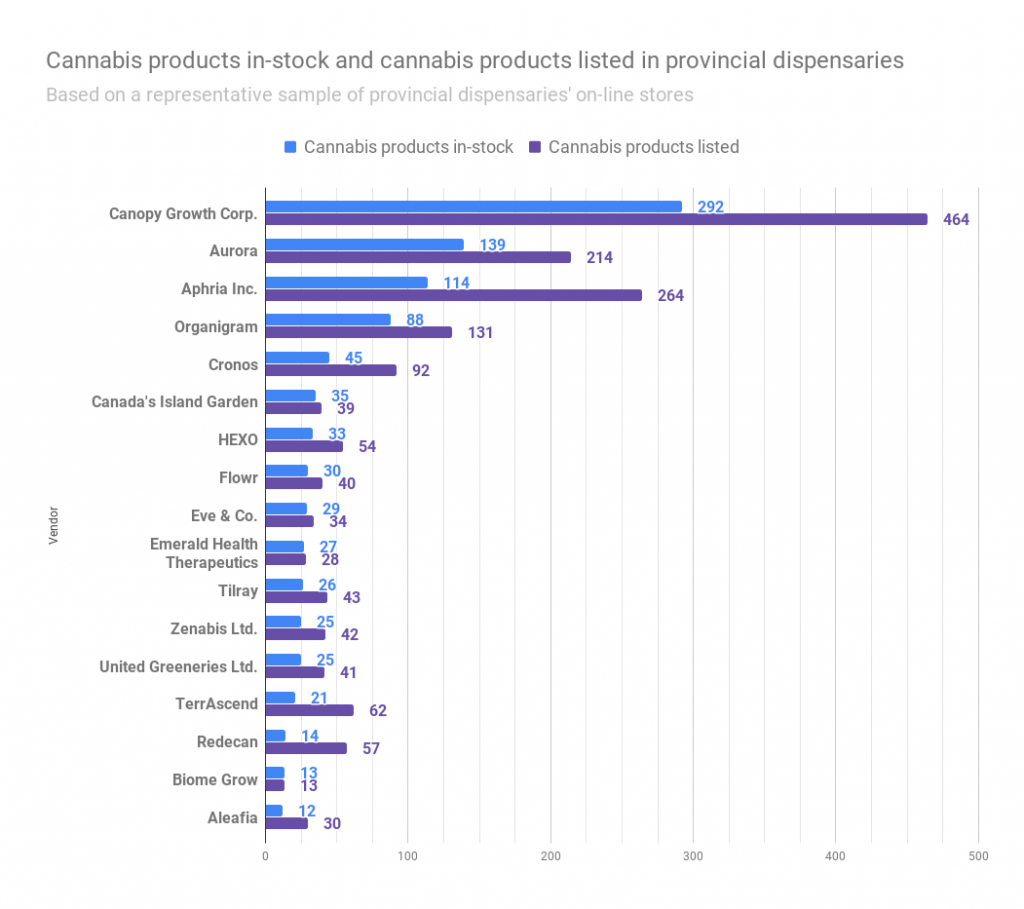

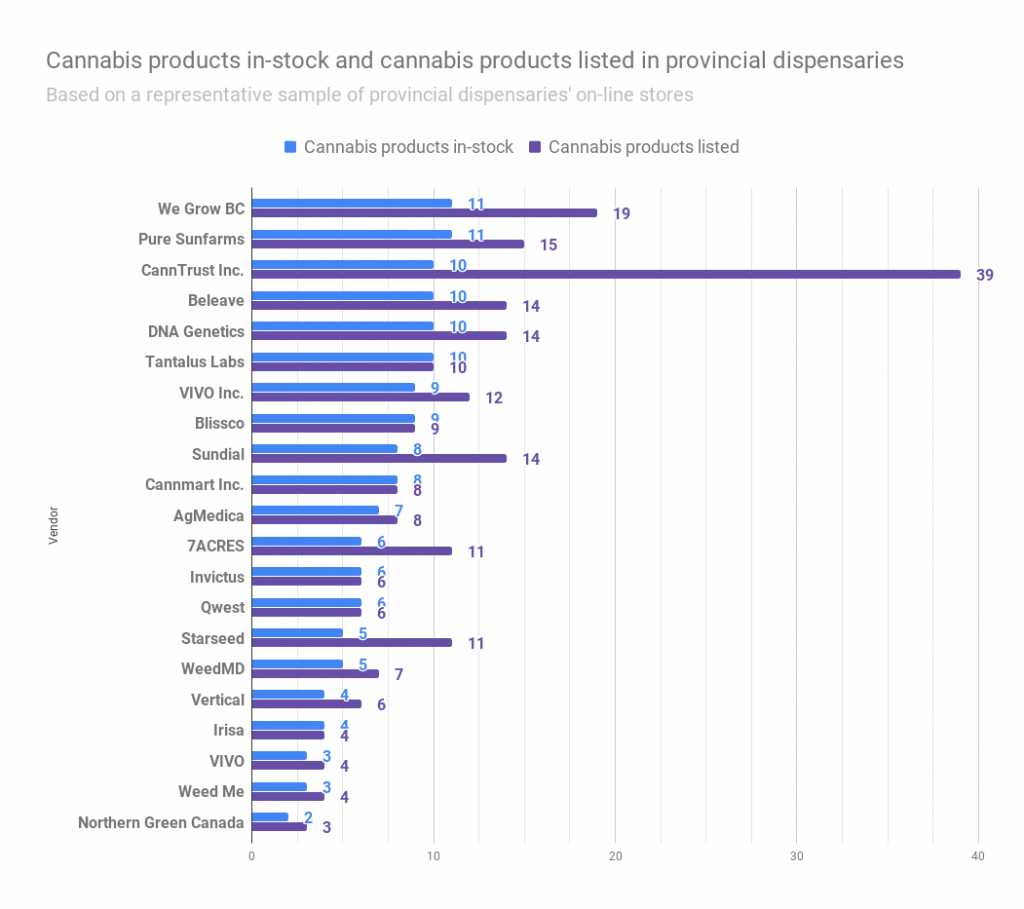

We track the product offerings at four online provincial dispensaries to get an idea of how the 79 producers allowed to sell to the Canadian dispensaries are competing for shelf space. Our scrapers produced this data October 4th.

These numbers are making us question the value of branding, or at least stockpiling of brands. Aurora is pounding Canopy in the total sales, and Canopy out-pacing them in product offerings 2:1 doesn’t appear to be much help. Much of these LP’s sales occur between each other, on the wholesale market, as evident by WeedMD, who sold more than Cronos last quarter, being bumped down to the second chart.

We considered all of the frothing at the mouth over “BRANDS!” last year to be drastically premature, and are still of the opinion that it’s a bit early. Consumer impression is important, but not as important as an ability to make product.

Playing it off a hop? Here’s what to look for

Capital doesn’t have a track record of being intelligent, and if it decides to get back into the pot market in a volume that takes it on another run, it won’t be discerning. Accordingly, investors inclined to pick their way through the cannabis space for fundamental standouts in a rising tide may consider paying close attention to net assets. Companies with low or no debt commitments have less to lug up the hill than their peers, laboring under convertibles who surely, will be forsaken by the market gods. Moreover, from here, the companies who are going to last will already be creating jumps in QoQ revenue and QoQ sales. A lag right now would be suspect.

Margin is the investment appeal in cannabis companies, and anyone who isn’t creating it now isn’t just going to start generating it over night. Careful capital scaling into these operations is going to use gross margin as a pathfinder to operating entities, as opposed to projects.

As important as cash is in this environment, it might be more important to consider where it’s coming from and how recently it arrived. Deep Dive client WeedMD’s recent $13 million bought deal financing projects both investor interest and access to capital. It’s the hallmark of a company who has laid the groundwork and planned out a solid business.

FULL DISCLOSURE: WeedMD is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover WeedMD on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

No other security covered within is currently a client of The Deep Dive. Information for this briefing was found via Sedar, provincial retailers, and Health Canada. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.