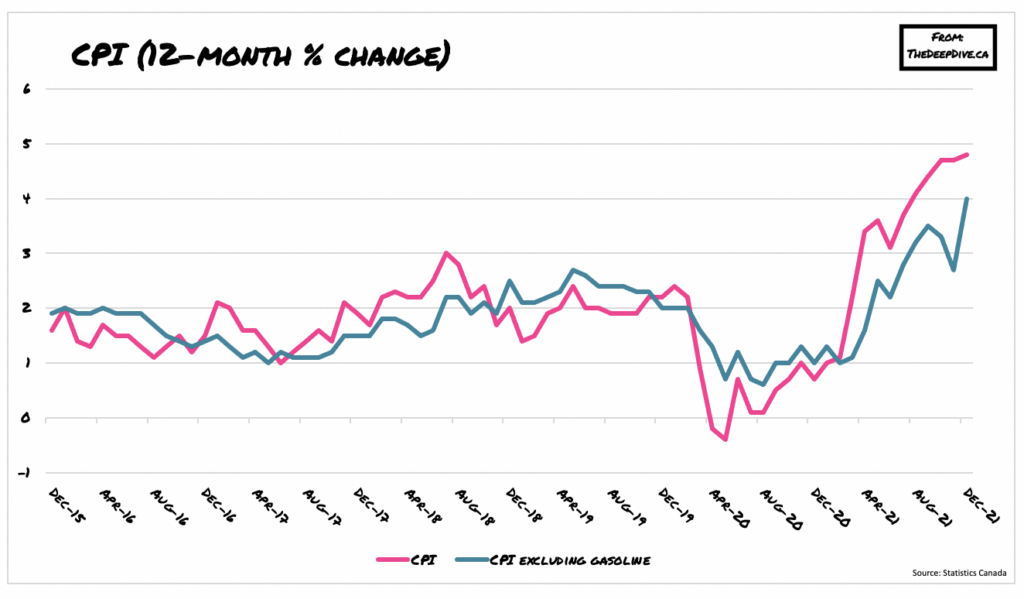

Consumer prices continued to weigh down heavily on Canadians’ pocketbooks, as inflation soared to the highest level in three decades last month.

Latest Statistics Canada data showed that CPI jumped by another 4.8% from December 2021, following an annual increase of 4.7% in the month prior. On a monthly basis, however, prices fell 0.1%, marking the first decline since December of last year, due to a drop in gasoline prices amid lower demand. Core CPI, which does not account for gasoline, was up 4% year-over-year.

Indeed, it appears that ongoing supply chain disruptions and adverse climate conditions continue to push prices for various consumer goods higher, as all eight of the major CPI components increased last month. Durable goods, including vehicles and household appliances also saw higher prices last month, while elevated construction costs added to increasing insurance costs for mortgages and homes.

The cost of groceries continued to increase in December, climbing 5.7% from the year before and marking the sharpest annual increase since November 2011. Prices for fresh fruit and vegetables were up due to poor weather conditions in growing regions as well as supply chain disruptions, while bakery products saw prices rise 4.7% year-over-year amid drought conditions plaguing Western Canada for much of last summer.

The CPI figures will reinforce the market’s expectations that the Bank of Canada will begin to raise historically low borrowing costs as early as next week. As cited by Bloomberg, investors are forecasting at least 6 rate hikes in 2022.

Information for this briefing was found via Statistics Canada and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.