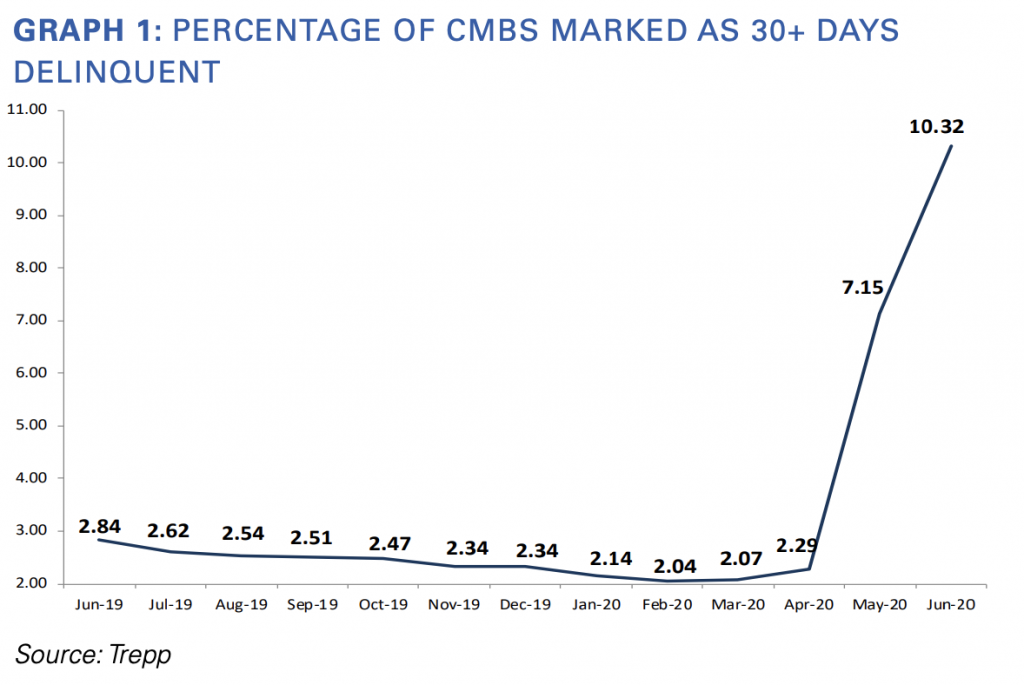

During the height of the pandemic, the US economy suffered a serious blow, resulting in soaring unemployment numbers, bankruptcies, and of course- rampant loan delinquencies. According to Trepp, which provides analysis and insights into commercial mortgage-backed securities (CMBS) and financial markets, the CMBS delinquency rate has been soaring for the past three months, and has neared an all-time high set back in 2012.

Trepp determined the CMBS delinquency rate for June to be at 10.32%, which translates to an increase of 317 basis points since May. Approximately 5% of that number is accounted for in loans that are 30 days delinquent, while 3.2% are comprised of loans that are now 60 days overdue. According to servicer data for the month of June, the percentage of loans entering special servicing increased from 6.07% in May, to 8.28% in June.

So far, 4.1% of loans by balance have neglected June payment, but are still only less than 30 days overdue. In the meantime, the percentage of loans that span beyond the delinquency grace period have fallen to 7.6% in May from 8.1% in April. Nonetheless, the month of July could very well see a continuation of previous delinquency numbers given the current volatile and uncertain state of the US economy.

Information for this briefing was found via Trepp CMBS Research. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.