Although much of the US has been steadily lifting restrictions and reopening for business, Americans still continue to fear the soaring number of coronavirus cases. As a result, many have been avoiding activities that carry an elevated risk of potential infection, including air travel.

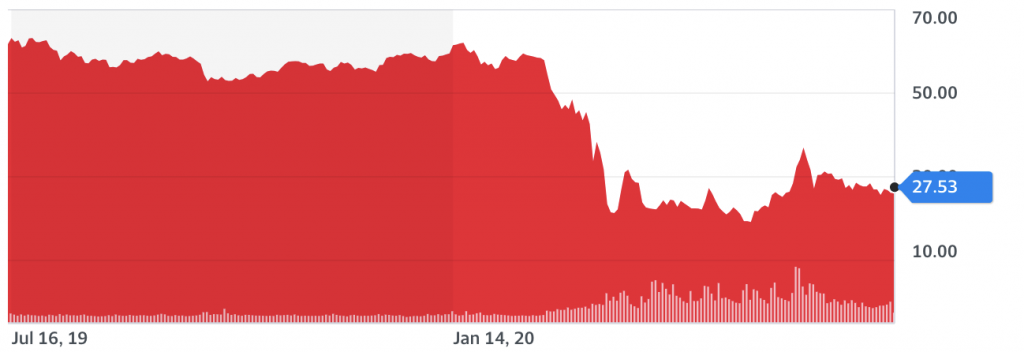

The demand for air travel continues to remain low, as consumers continue to be weary of the coronavirus. This lack of demand has certainly had a significant impact on Delta Airlines, causing the Atlanta-based conglomerate to post a $5.7 billion second quarter net loss – the largest decline since 2008. In response to the losses, Delta’s shares fell by over 3%, despite other airline stocks trading much higher.

Furthermore, Delta also reduced its cash burn from $100 million per day at the end of March, to $27 million per day by the end of June. The airline also posted it has approximately 19 months-worth of liquidity left, with $15.7 billion remaining at the end of the second quarter. In the meantime, Delta’s revenue by the end of June fell by 88% to $1.47 billion compared to the same time a year prior.

As Delta scrambles to decrease its payroll obligations, it has been urging employees to accept early retirement packages or buyouts. Although the airline is prohibited from laying off employees until October 1 as per the conditions of its $25 billion government bailout, the air travel conglomerate has already been warning of upcoming cuts come the October deadline.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.