Denison Mines Corp. (TSX: DML) shared on Thursday its 2021 financial results, highlighting an annual revenue of $20.0 million. This is an increase from 2020 revenues of $14.4 million.

Breaking down the topline revenue figure, $8.8 million came from closed mine environmental services, $3.2 million from milling services, and $8.0 million from corporate management fees.

While the firm recorded $42.6 million in expenses for the year, it also earned $44.2 million in other income, mostly driven by its gain on investment in physical uranium related to its Wheeler River project.

“The financing [initiative]was designed to position our shareholders to benefit from the additional financial stability of our uranium holdings, while remaining fully leveraged to any future appreciation of uranium prices that might occur prior to the completion of a project financing for Wheeler River,” said CEO David Cates. “[The] uranium spot market has improved considerably… leading to a significant increase in the spot price in 2021 and a $41.4 million gain on Denison’s physical uranium holdings.”

This led the firm to record a net income of $19.0 million, up from a net loss of $16.3 million in 2020. This translates to $0.02 earnings per share.

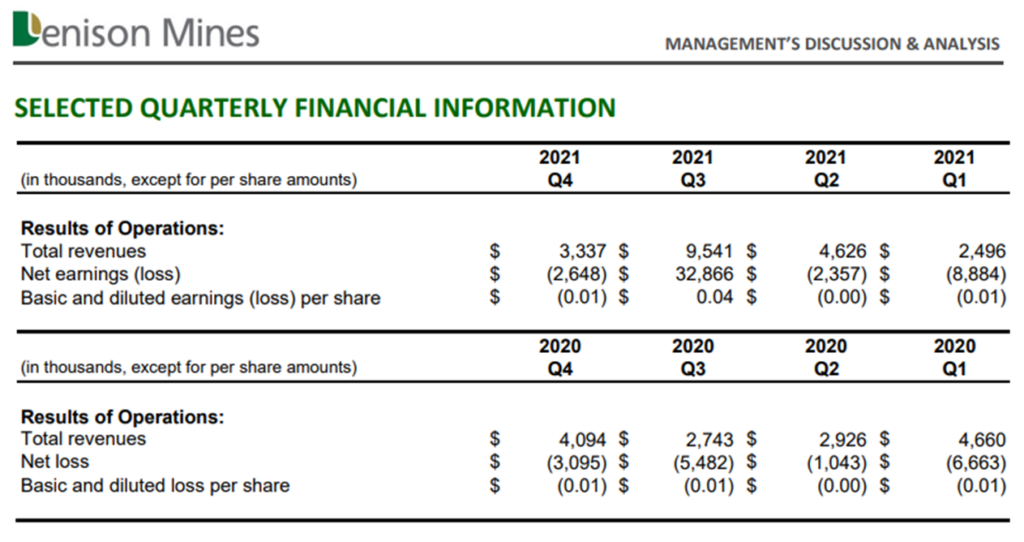

On a quarterly basis, the energy firm earned $3.3 million in revenue in Q4 2021, down from both Q3 2021’s $9.5 million and Q4 2020’s $4.1 million. The quarter also recorded a net loss of $2.6 million compared to last quarter’s net income of $32.9 million and last year’s net loss of $3.1 million.

The company burned net cash in operating activities for the year, amounting to $21.2 million. However, the firm ended the year with $64.0 million in cash and cash equivalents coming from a beginning balance of $25.0 million. The cash inflow is mostly driven by proceeds from the issuance of company units amounting to $135.6 million.

The firm’s current assets balance ended at $86.9 million while current liabilities ended at $16.4 million.

Denison Mines Corp. last traded at $1.92 on the TSX, down 4.0% on the day.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.