The coronavirus pandemic has caused significant shifts in the typical office environment, as many employees flee for the safety of their homes where they can conduct their job remotely whilst escaping the growing COVID-19 infection risk. As a result, the remote work environment has lead to the emergence of both tangible and intangible gains, such as increased convenience, flexibility, and job security. Likewise, many remote employees are able to forego costs that are associated with going to the office everyday, such as travel, eating out, and clothing.

However, according to Deutsche Bank, the newly-discovered benefits of remote work should not go unnoticed, and need to be taxed accordingly. The Deutsche Bank recently released a report detailing hypothetical measures that economies should consider adapting in order to rebuild following the coronavirus pandemic. In the report, researchers at the German bank call on a 5% work-from-home tax, that would be deducted from the salaries of those that have access to an office, but voluntarily chose to work from home.

Conversely, employers that do not provide their workers with a permanent desk would instead be levied the tax, which would be then distributed to low-income earners, or those that do not have the option to conduct their job remotely. According to the Deutsche Bank researcher’s calculations, the work-from-home tax would generate approximately $49 billion per year in the US, $9.3 billion annually in the UK, and $23.6 billion in Germany.

However, the report says that workers classified as self-employed, or low-income earners would exempt from the tax. Moreover, the 5% tax would not be waged in countries where governments have advised people to work from home, given that the tax would otherwise be deemed unfair.

The report argued in favour of such a tax, noting that remote workers contribute less to an economy’s infrastructure while still receiving its full benefits. According to Deutsche Bank thematist strategist Luke Templeman, this is the first time in history that such a large amount of people have been able to detach themselves from the face-to-face world while still lead a thorough economic life. Templeman said that for the average American worker earning $55,000 annually, the tax would come out to $10 per day.

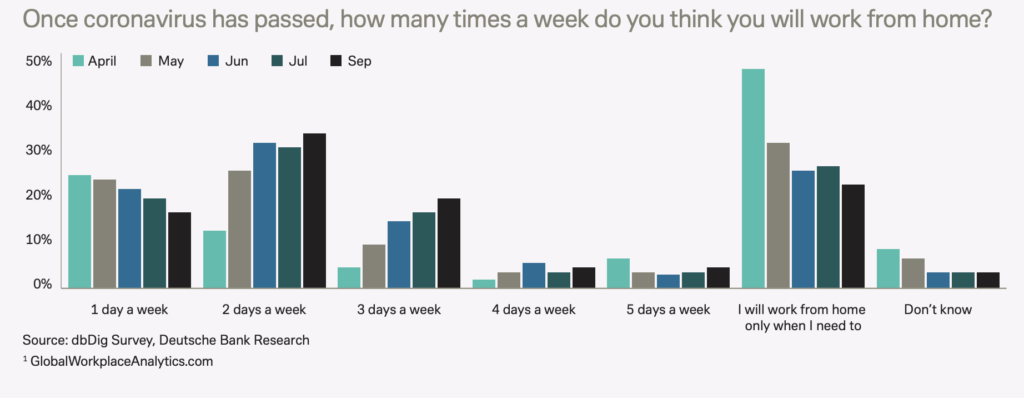

In the US, the Centers for Disease Control and Prevention (CDC) has not made any formal calls for the shut-down of work places since the onset of the pandemic, despite the growing number of cases being recorded each day. However, more and more people across the US are reverting to at-home work environments, as has been noted with the mass exodus out of big cities in preference for suburban and rural communities. And, it also appears that the shifting trend towards home offices will likely stay for the foreseeable future.

Back in July, Google had issued an extension of its work-from-home policies until at least summer 2021, while Twitter told its staff that they can now work from home forever. Other companies including Airbnb, American Express, and Microsoft have also emphasized their work-from-home policies and extended them into next year, which they based on the likelihood of a widely available vaccine.

Information for this briefing was found via Deutsche Bank Research. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Or how about a 5% tax on Deutsche Bank as a penalty for its pattern of criminal activity.