The degree to which a compelling biotech story is able to create lift in the equities market, and sustain that lift, is ultimately a function of the cap table of the company telling the story. There are a lot of moving parts in a proper equity structure analysis so, for our purposes as stock pickers, in a deliberate attempt to keep it simple, we’re going to focus on the outstanding shares that are freely trading, and their original cost.

Shady Trading Doesn’t Advertise

The disclosed holdings of registered insiders, paradoxically, are often the last ones to hit the bid. In a well-promoted stock, the message-board crowd is going to know about an insider’s sale before the guy’s wife knows, and make it literal headline news in the unofficial company gazette. Sophisticated promotions use executive stock as a paper cornerstone; the stake meant to buy the founders all football teams in the other shareholders’ imagined futures. It’s worth going to SEDI.CA or Canadianinsider.com to get a sense of who’s holding what, but those aren’t usually the positions to be worried about.

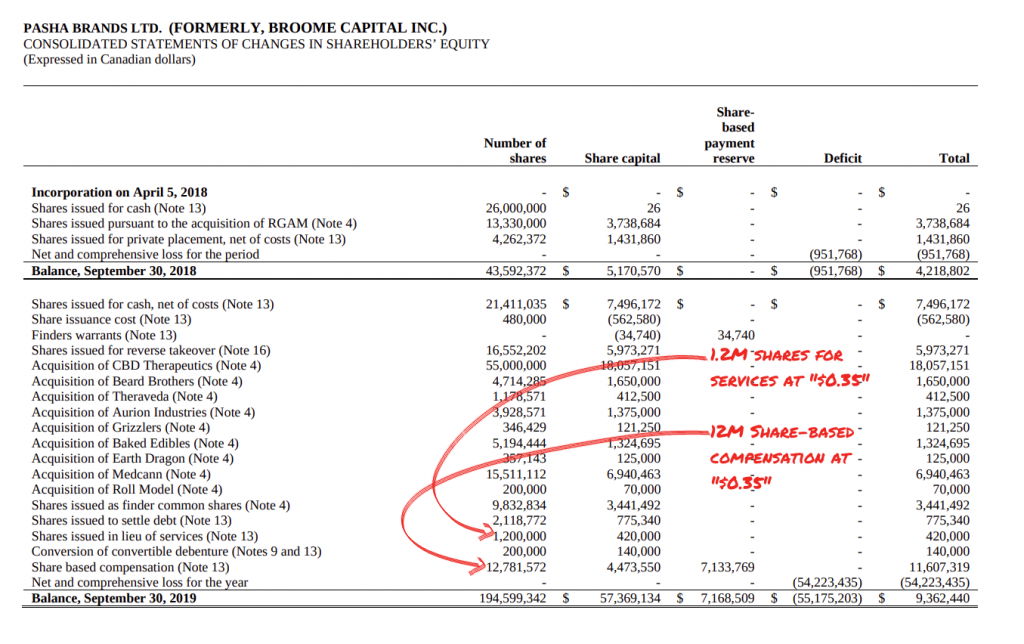

The exercise here is to ascertain how much cheap stock is floating around and how cheap it all is. Nobody ever publishes a full, transparent cap table, but it can be pieced together from the list of outstanding warrants and options, and the Statement of Shareholders’ Equity that one can usually find jammed sideways into the financial statements just ahead of the Cashflow Statement.

You might have to go back through a few iterations to get a full picture but, with a bit of patience, a researcher can put together a reasonable picture of what’s floating around and how much (or how little) it cost the people who bought it in the first place between the statement of equity and the associated notes.

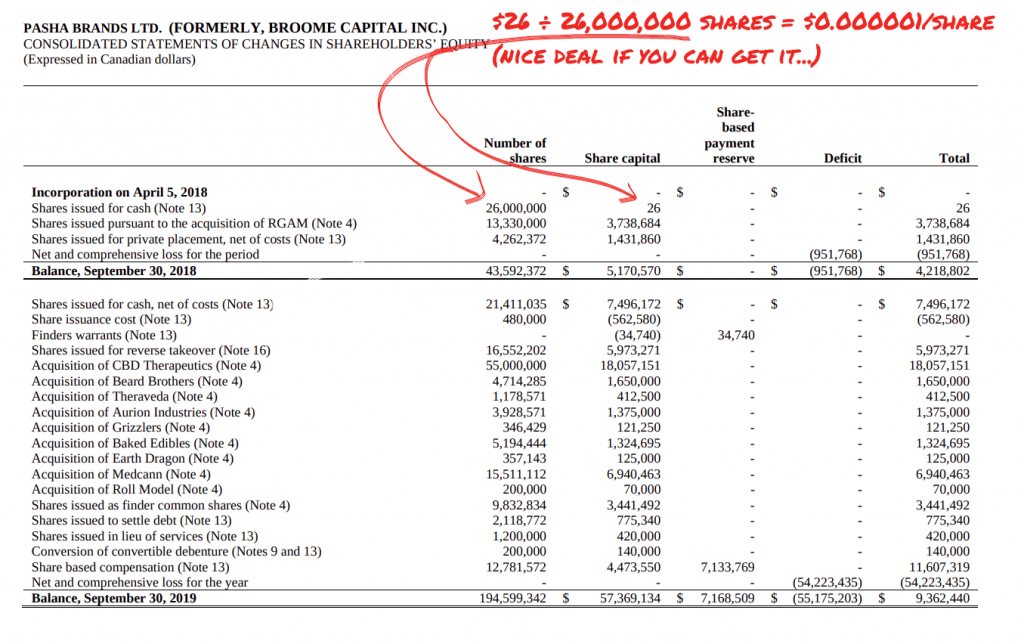

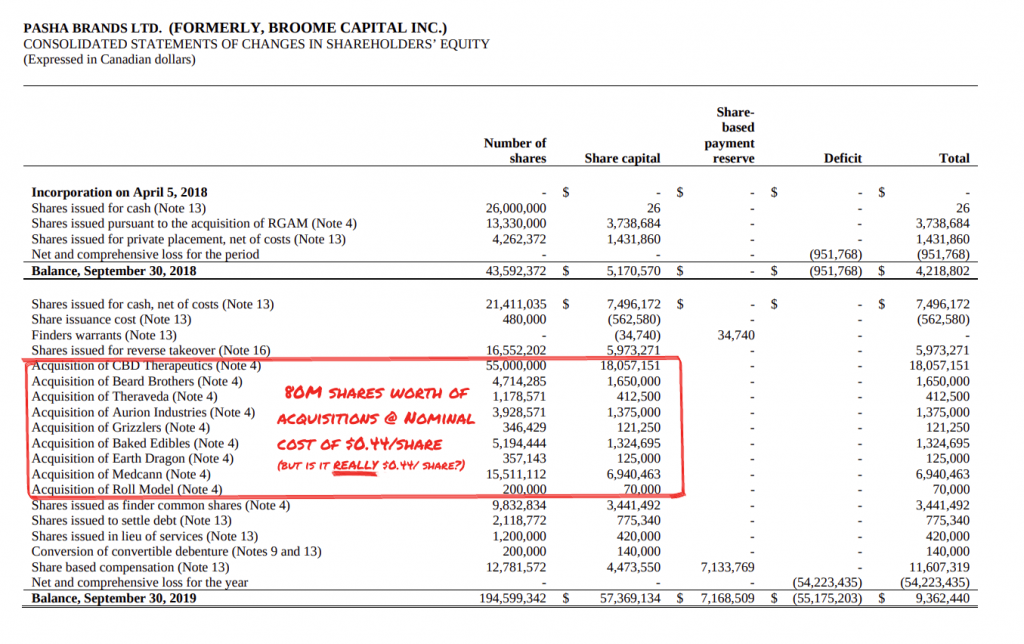

An egregious example

The most pure and transparent version of this hustle in recent memory was Pasha Brands (since re-titled as BC Craft Supply Co. (CSE: CRFT)) which was formed out of whole cloth to be listed as a pubco with the $0.000001 stock listed right in the financial statements.

As sure as money is made by selling things for more than their cost, there is a round of cheap stock hanging around on any issue with an active promotion. The less obvious chunks of cheap stock on this statement of equity are the acquisitions that were done in 2019, and the shares issued in lieu of services and in lieu of debt.

The actual value of a company like Baked Edibles (for example) is obviously subjective. For all we know, $1.3 million is a screaming bargain. But the fact that the vendors can’t pay their rent or anything else with 5.2 million shares of Pasha stock means that some portion of that stock is going to hit the market. Often, these sales are delayed – at least nominally – by lockup agreements or delayed issuance, and those events are described in the notes. But, sooner or later (usually sooner), that paper is hitting the market.

The (doomed) idea behind these types of deals is that the buying created by the promotion will afford the shareholders of the acquired companies an opportunity to cash out at multiples, but it does a better job of begging the question; if it was such a good business in the first place, why was it vended into a microcap to be used as a stock promotion?

Why not just make the fuel part of the plane!?

More to the point, that promotion isn’t free. And since the actual, cash money that has been raised is earmarked for lawyers, accountants and stock exchanges, the promoters tasked with creating this buying are going to need some stock, too.

Think of the cheap stock as excess cargo: it’s weight that has to be moved by the momentum (buying) being generated by the story. It hangs out, watching the message boards, paying attention to the traction being gained by the story, selling as the buying is created.. never hitting the bid. At first. Eventually, it stops caring. Usually right about the time the buying dries up and the holders are out of money.

It may seem like we’re picking on CRFT, and we are. By our count, 87% of the outstanding shares were issued to acquire “brands,” as dirt cheap founders’ stock, or to promoters. The company managed to make its first year into a case study. With far too large a float and far too hapless a promotion, being handled by operators who were racing to the exits with their own cheap paper, Pasha scraped out new lows for four months or so before it had to be halted to stop the bleeding. The prices and volume on the chart above are after the 12:1 rollback Pasha underwent in March.

The story at CRFT lacked any milestones and all believe-ability. It isn’t that everything went wrong all at once, it was just never going to go right.

Learn to spot the paper rallies

Price action gets everyone’s attention, but the vets learn to read the volume before jumping on the bait. Stocks with spotty volume, by definition, are never going to attract significant open-market buying, because an account looking for a $500,000 position isn’t going to mess around buying it $50,000 at a time over 10 days. What’s going to happen when they try to sell it?

Xphyto Pharmaceuticals (CSE: XPHY) is in the process of drawing an exciting price slide for its chart. Holders who bought in March have an on-paper double. But this company, which lists 54 million shares outstanding, has traded 22 million shares – total – in its entire entire existence. It only took $325,000 to move the stock 8% yesterday.

Low volume issues are suspect and price action on low volume is doubly suspect. Either green money got talked into grabbing an offer, or someone’s trying to paint the tape.

“Once upon a time not too long ago, when people wore pajamas and lived life slow…”

To some extent, and especially with the un-fathomed amount of capital pouring into the markets today, all stocks are story stocks. With regular volume, decent price action and a reasonable cap table all ticked off, it’s time to evaluate what makes a story good.

The sure way to tell when a story is getting enough attention to move a stock’s price is to watch the chart, but that isn’t much good if we want to be ahead of the move, is it?

There’s no one right answer, but it’s worth noting that mass appeal is what drives these things. Products whose business case is easy to understand, being served to juicy addressable markets is what tends to work, so forget about cult followings. Duane “The Rock” Johnson is a lot more popular than Terry Funk. Nickelback sells a lot more records than Phish.

Developing biotech companies don’t have earnings, so they get to define the terms of their own success to some extent. By defining milestones and bringing the company to and through those milestones, the assets become further and further de-risked and the company becomes more and more legitimate in the eyes of the market.

Much like their microcap counterparts in the resources and software sectors, the most realistic positive outcome is that the company will be acquired by a larger entity to whom the assets they’ve de-risked are valuable. Acquisitions are largely a function of the business climate and the multiples available to the companies who would reasonably do the acquiring.

Happy trading.

The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.