Elon Musk and Twitter (NYSE: TWTR) are reportedly still working on ironing out the details of sticking to the original US$44-billion buyout agreement. This comes even after the Tesla chief recently filed to resume the acquisition talks with the social media platform based on the original terms.

According to what some of the people familiar with the matter told The Wall Street Journal, some of the sticking points include what would be required from both parties for the stalled deal’s litigation to be abandoned and if the deal’s conclusion would be predicated on Musk receiving the requisite debt financing.

Musk and Twitter’s saga was a whirlwind that involved his appointment to the board (which he declined the next day), his proposal to fully acquire Twitter (which he reneged twice), and a legal clash after the firm’s board sued him for backing out of the deal.

Now, Musk is ready to go back to the original acquisition terms. But prior to that, the people said the two parties held unsuccessful talks regarding lowering the US$44 billion price tag for the social media platform.

The informal negotiations about lowering the acquisition price occurred in recent weeks over a series of conference calls between lawyers and concluded after the two parties failed to agree on parameters of a potential settlement, according to the sources.

The price-cut talks had already ended when Musk surprised Twitter by sending its lawyers a two-sentence letter proposing to proceed on the original terms.

There was initially hope that a compromise could be reached, averting a trial set to begin on Oct. 17. According to some sources, the two parties agreed to postpone Musk’s deposition, which was due to begin Thursday in Texas, in order to continue efforts to reach an agreement on how to proceed.

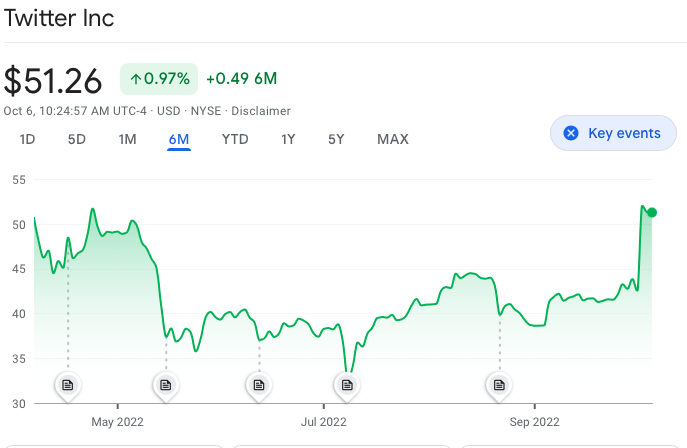

Musk signifying his intent to go back to the original proposal sets nothing in stone yet. What it did, however, is send Twitter shares soaring 21% to close at a five-month high earlier this week (and closer to the acquisition price of US$54.20 per share). The price has since come back down slightly, closing Friday’ session at $49.18.

Information for this briefing was found via The Wall Street Journal the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.