The Walt Disney Company (NYSE: DIS) reported on Wednesday its financial results for fiscal Q3 2022, highlighting a quarterly revenue of US$21.50 billion. This is an increase from Q2 2022’s US$19.25 billion and Q3 2021’s US$17.02 billion.

The company also saw its paid subscriber base across its streaming platforms, Disney +, ESPN +, and Hulu, increase to 221.1 million, topping for the first time Netflix’s plateauing 220.7 million users as of Q2 2022.

“We had an excellent quarter, with our world-class creative and business teams powering outstanding performance at our domestic theme parks, big increases in live-sports viewership, and significant subscriber growth at our streaming services,” said CEO Bob Chapek.

Following the earnings release, the company’s share price rose by 8.7% when the markets opened.

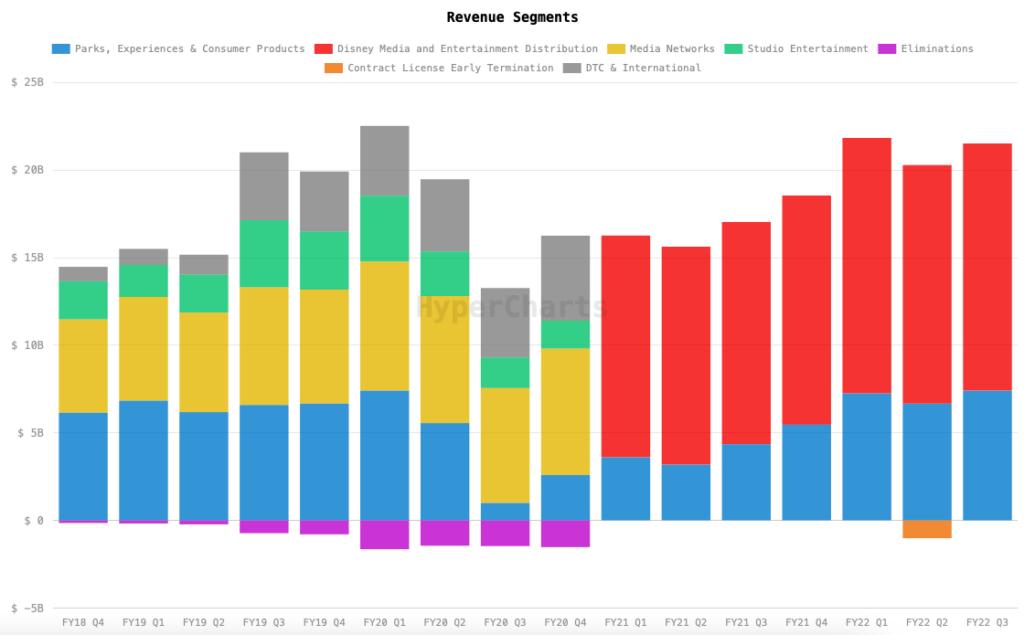

Breaking down the topline figure, Media and Entertainment Distribution contributed US$14.11 billion to the revenue while Parks, Experiences and Products added US$7.39 billion. Operating income from the two divisions came in at US$1.38 billion and US$2.19 billion, respectively.

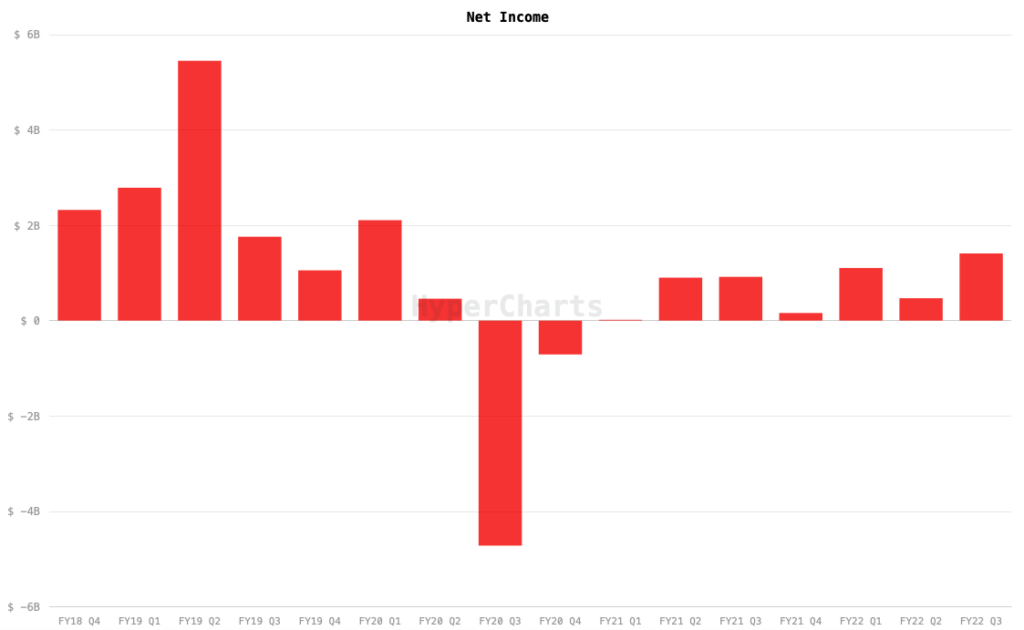

The company then ended the quarter with a net income of US$1.50 billion, up from last quarter’s US$470 million and last year’s US$1.12 billion. The quarterly income translates to US$0.77 earnings per share.

The media giant generated US$1.92 billion in operating cash flow and US$187 million in free cash flow compared to last year’s US$1.47 billion and US$528 million, respectively. The decline in free cash flow is primarily due to increase in capital expenditure on cruise ship fleet expansion.

The quarter also ended with US$13.00 billion in cash, cash equivalents, and restricted cash. This puts the balance of the current assets at US$31.42 billion while current liabilities ended at US$30.70 billion.

Disney last traded at US$117.69 on the NYSE, up 4.59% on the day.

Information for this briefing was found via Edgar and the companies mentioned. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.