Netflix (Nasdaq: NFLX) announced on Tuesday its financial and operational results for Q2 2022. The firm saw its forecasted membership decline number cut in half and recorded losing 1.0 million users during the quarter — deeming the quarter “better-than-expected” on subscriber “growth.”

Netflix loses 1 million subscribers but defections are fewer than feared $NFLX

— The Dive Feed (@TheDeepDiveFeed) July 20, 2022

The firm recorded a 200,000-subscriber loss in Q1 2022, its first subscriber decline in more than 10 years, vis-a-vis then its expected 2.5 million net subscriber additions. The firm attributes the decline to the suspension of its service in Russia and the winding-down of all Russian paid subscriptions.

Now in Q2 2022, the streaming platform recorded 220.7 million users for the quarter and is forecasting the numbers to go up again to 221.7 million in Q3 2022, guiding to 1.0-million net additions. This is an improvement on the company’s previous guidance that it will lose 2.0 million net subscribers during this quarter.

Seen on WSB: $NFLX executes the "set the bar so low you can't disappoint" strategy to perfection

— Market Rebellion (@MarketRebels) July 20, 2022

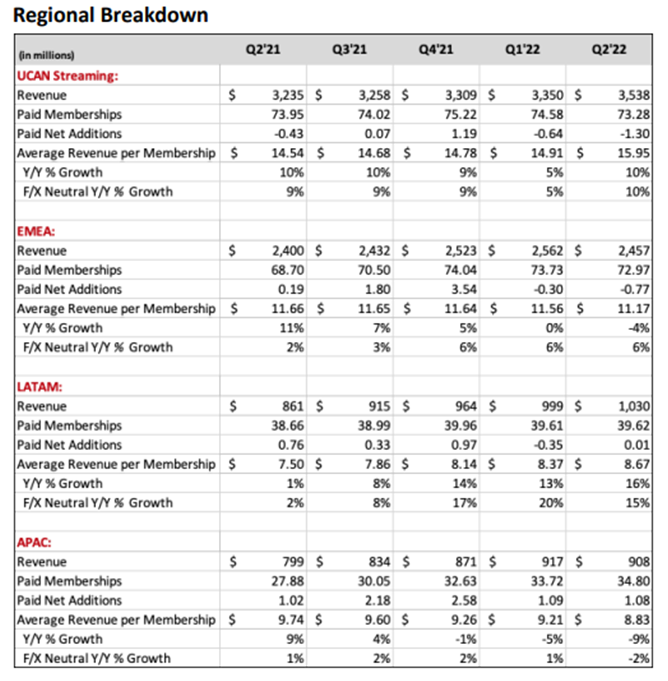

Breaking down the firm’s subscriber numbers, Netflix recorded losing 1.3 million net subscribers in the UCAN market and 0.8 million net subscribers in the EMEA markets. This was offset by 1.1 million net additions in the APAC region.

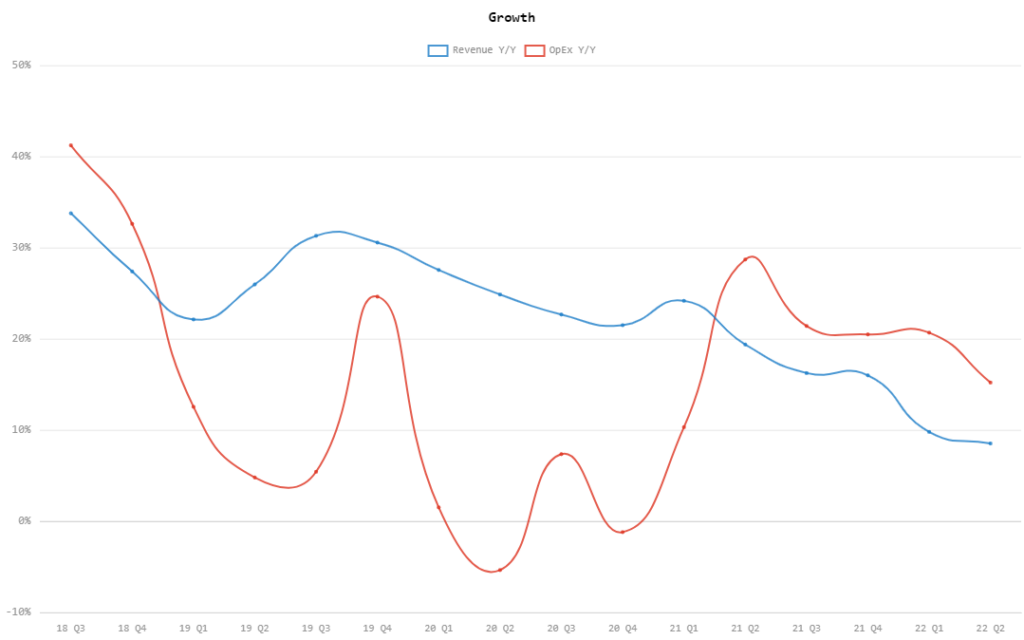

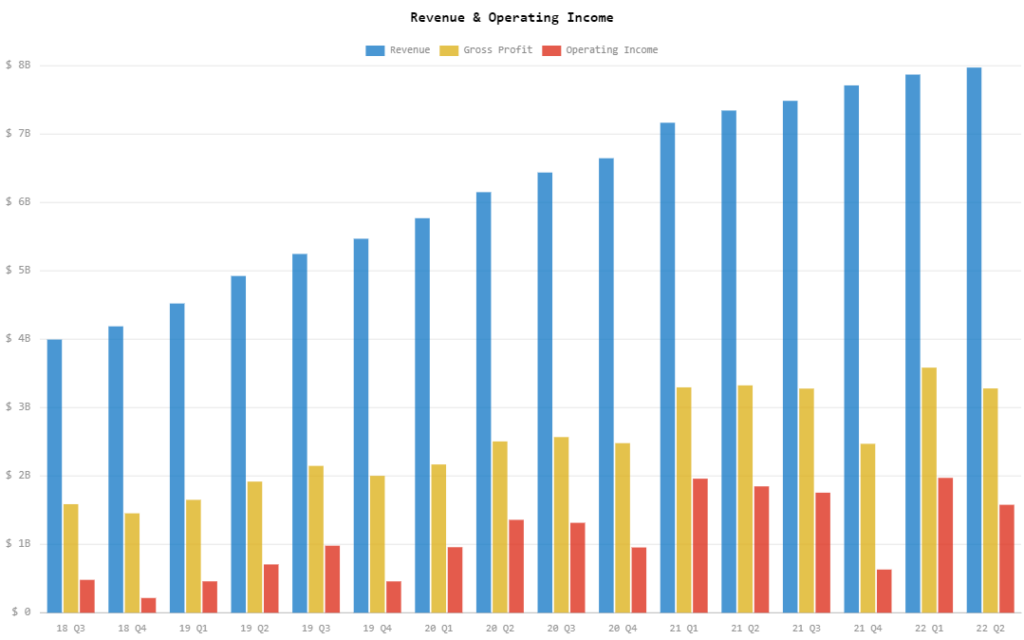

On the financials, the firm recorded US$7.97 billion in revenue, an increase from both Q1 2022’s US$7.87 billion and Q2 2021’s US$7.34 billion. This falls short of the street estimates of US$8.04 billion.

While the company touted that the quarterly figure is an 8.6% year-on-year growth, this is actually the company’s slowest annual growth in almost a decade.

The streaming platform is also guiding its Q3 2022 revenue to decline, ending at US$7.84 billion.

Further down, the company notched a quarterly operating income of US$1.58 billion, a decline both from Q1 2022’s US$1.97 billion and Q2 2021’s US$1.85 billion. For Q3, the firm is forecasting a further decline down to US$1.26 billion, or an operating margin of 16%.

$NFLX: they "only" lost 970K subs and the stock is higher. Op margins missed by 170 initial guide and new guide is for 380 bps lower from 2Q. Not metrics I get excited about.

— Stephanie Link (@Stephanie_Link) July 19, 2022

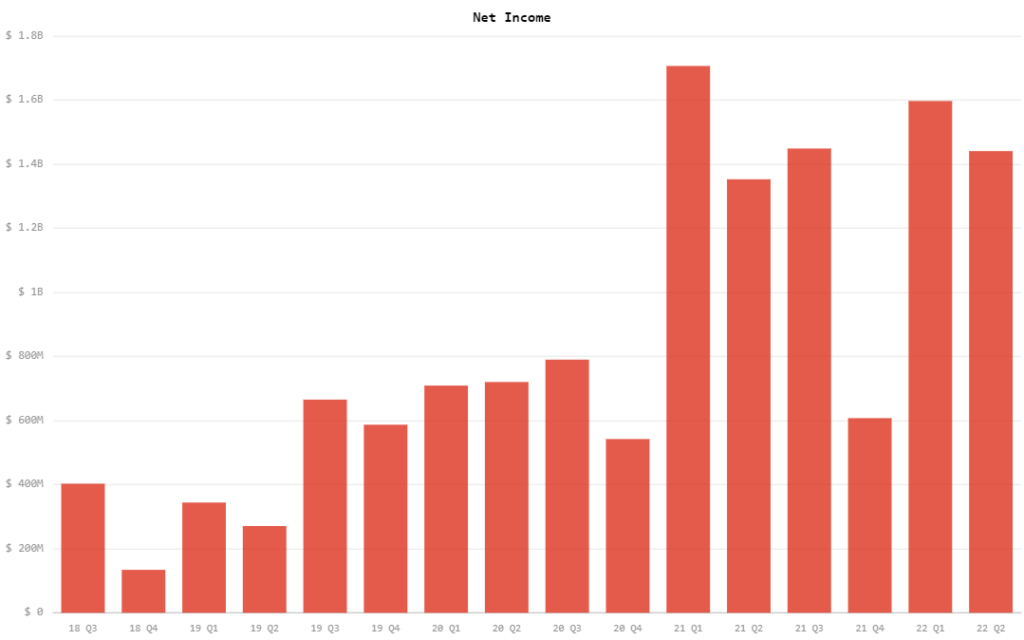

Net income came at US$1.44 billion, down from last quarter’s US$1.60 billion million but up from last year’s US$1.35 billion. The firm also anticipates a further decline in the bottomline, expecting net income to end in Q3 2022 at below the US$1-billion mark at US$0.96 billion.

The quarterly income translates to US$3.20 earnings per diluted share, beating the consensus US$2.94. For next quarter, the firm expects this to further go down to US$2.14.

Calibrating for financial items, adjusted EBITDA dwindled down to US$1.81 billion for the quarter compared to US$2.17 billion last quarter.

The firm generated net cash from operating activities at US$102.8 million, down from US$922.8 million generated last quarter. This leads to a cash balance of US$5.84 billion, putting the balance of current assets at US$7.84 billion. Current liabilities, meanwhile, ended at US$7.50 billion.

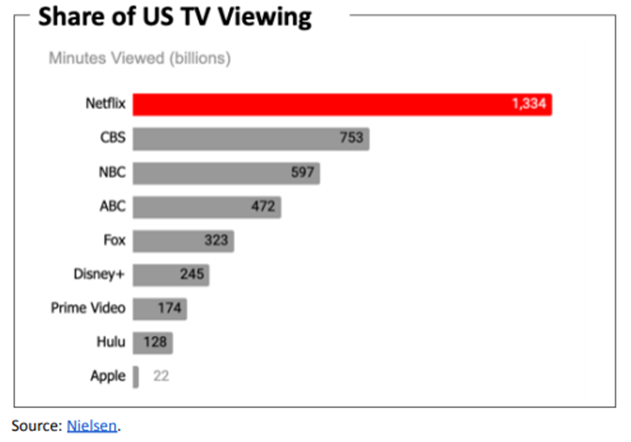

Despite the dwindling paid membership base, the company touted its victory over television viewership.

“While we always have room to improve, we’re very pleased with how far we’ve come in providing so much satisfaction and enjoyment to our members. For instance, in the US, which is one of the most competitive markets in the world, we drew more TV viewing time than any other outlet during the 2021-22 TV season,” the company said in its statement.

The streaming platform, batting to increase its revenue sources from its member base, also bared the aspects that will take its near-term focus. This includes the plan to offer an ad-based tier, which it said will complement its “existing plans” of remaining ad-free.

“Our global ARM has grown at a 5% compound annual rate from 2013 to 2021, so it makes sense now to give consumers a choice for a lower priced option with advertisements, if they desire it,” the company said.

The firm recently announced its planned partnership with Microsoft to realize the ad-based subscription offering.

Netflix split Ozark's final season over the first and second quarters.

— Jeremy C. Owens (@jowens510) July 19, 2022

Then it split the Stranger Things season over the second and third quarters.

While $NFLX ain't going to a weekly drop, it certainly is changing its standard release pattern to preserve the subscriber numbers https://t.co/tcLhb6hdJD

The tech giant also said it plans to “monetize the 100m+ households that are currently enjoying” the streaming platform through password sharing. The firm said it is looking to implement a paid sharing scheme, believed to be a tier-based subscription where additional users to the same account might have to pay.

“We know this will be a change for our members… Our goal is to find an easy-to-use paid sharing offering that we believe works for our members and our business that we can roll out in 2023,” the company added.

Netflix last traded at US$201.63 on the Nasdaq.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.