The US Justice Department and the Securities and Exchange Commission are reportedly using computer algorithms to examine preplanned share sales by corporate executives. According to persons familiar with the matter, investigators are concerned that some people are tampering with stock-sale procedures, which are designed to thwart the possibility of insider trading by allowing them to schedule transactions in advance and on certain dates.

Based on some sources who told Bloomberg, federal officials requested information from executives earlier this year and some are currently preparing to bring multiple cases.

The alleged move by the US authorities follow the SEC’s recently published rules requiring securities exchanges to adopt listing criteria requiring issuers to develop and implement a program allowing for the recovery of erroneously granted incentive-based remuneration to current or former executive officers. All these are the most recent examples of regulators cracking down on long-standing Wall Street trading abuses during the Biden administration.

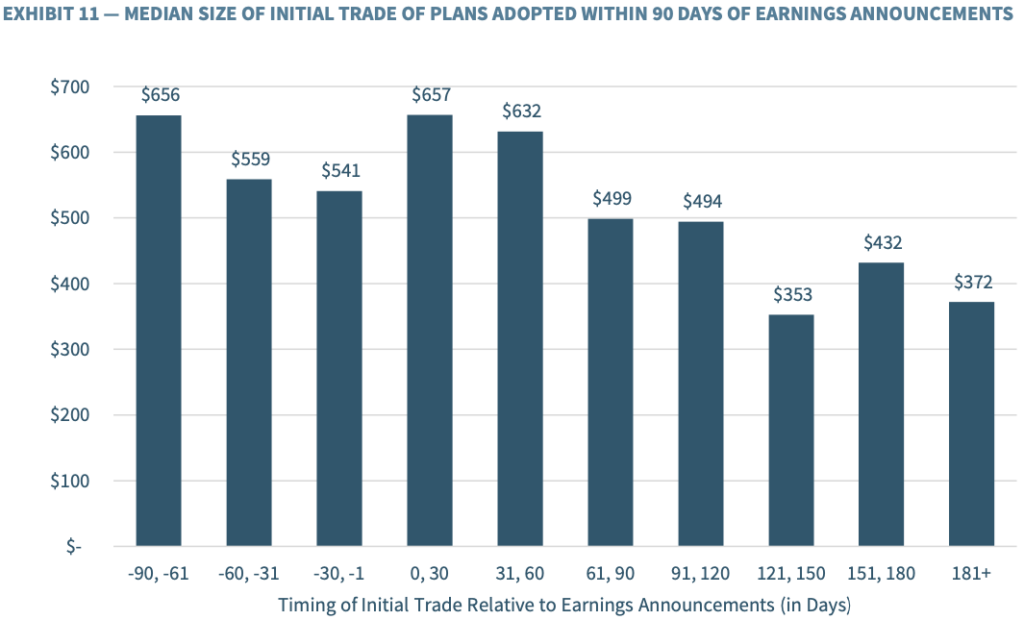

According to critics, the current system contain numerous potential flaws. Because there is no cooling-off period, executives may adopt one and then trade on it just days later. Insiders can cancel scheduled trades that might cause them to miss out on a stock price increase caused by positive corporate news. Furthermore, executives may have various, overlapping strategies, increasing the possibility of such abuses.

Preplanned stock sales are appealing to firms and executives because, when utilized correctly, they can provide a strong defense against claims of insider trading.

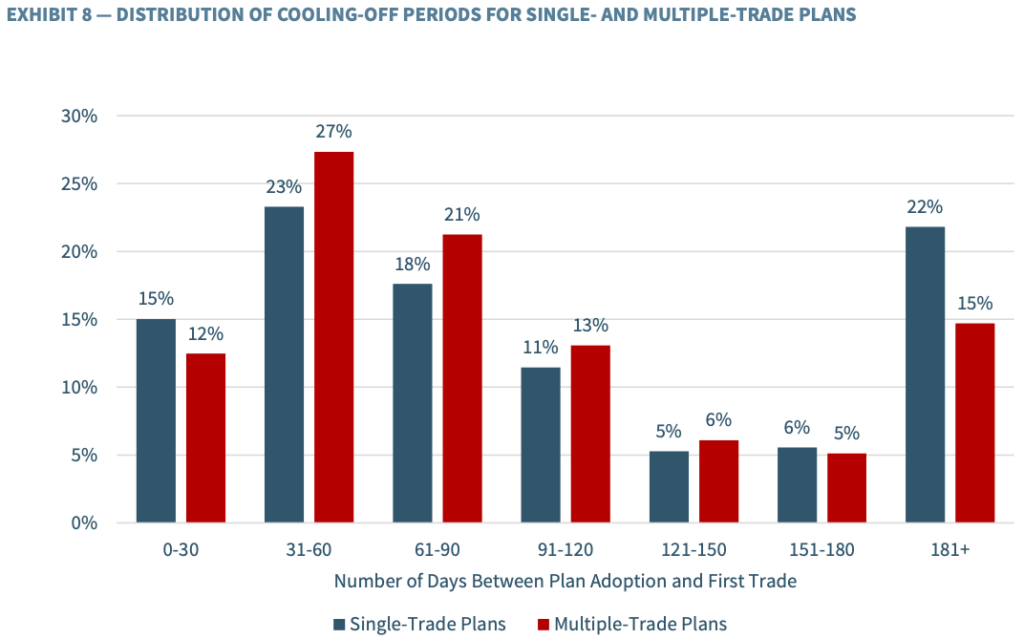

But the executives are finding loopholes in the periods of implementation. According to studies from Stanford University, the University of Pennsylvania and the University of Washington, there’s a significant difference in the amount of time between the adoption of a strategy and the first trade. Approximately 82% had so-called cooling-off periods of less than six months; executives frequently use short-term trading plans, sometimes only for a single transaction.

In a Leland Standford Junior University study, the researchers identified “three ‘red flags’ associated with opportunistic use of 10b5-1 plans: plans with a short cooling-off period, plans that entail only a single trade, plans adopted in a given quarter that begin trading before that quarter’s earnings announcement.”

The SEC has proposed changes to the plans last December, including a four-month waiting time for executives between the adoption of a plan and the sale of shares.

Breast implant manufacturer Sientra Inc. revealed in October that it had received subpoenas from both the DOJ and the SEC seeking records related to former CEO Jeffrey Nugent’s trading actions in 2019 and 2020. In his defense, the former chief’s “stock sales were executed pursuant to a valid Rule 10b5-1 trading plan,” according to his lawyer.

Recently, the SEC castigated China-based Cheetah Mobile’s CEO Sheng Fu and its former president Ming Xu for selling the company’s American Depositary Shares. According to the regulatory body, the two executives planned to sell shares in 2016 after learning that the firm’s revenue from a key advertiser was declining. The timely sales saved them around $300,000 in losses.

Without admitting or denying wrongdoing, the two decided to settle with the regulator by paying a total of $756,000. The SEC, however, did not charge the corporation with violating any securities laws.

For years, records of scheduled trades were given to the SEC on paper, preserved in filing cabinets, and eventually destroyed. The submissions are now being made public online by the government.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.