Dollarama Inc (TSX: DOL) is scheduled to report its fourth-quarter financial results on March 30th before the market opens. The consensus estimate for revenue for the fourth quarter is C$1.23 billion, which would put their full-year revenues at C$4.34 billion. Analysts expect the company to see its gross margins slip a bit to 43.78%, while earnings per share are expected to grow from $0.61 to $0.71 sequentially.

Dollarama currently has 14 analysts covering the stock with an average 12-month price target of C$67.69, essentially putting it at fair value compared to the current stock price. Out of the 14 analysts, 1 has a strong buy rating, 9 have buys and 4 have hold ratings. The street high sits at C$77, which represents a 12% upside to the current stock price.

Canaccord Genuity raised their 12-month price target on Dollarama and reiterated their hold rating on the name. They raised their 12-month price target to C$65 from C$57 saying they believe that strong holidays sales and soft comps will help the company deliver a strong fourth quarter.

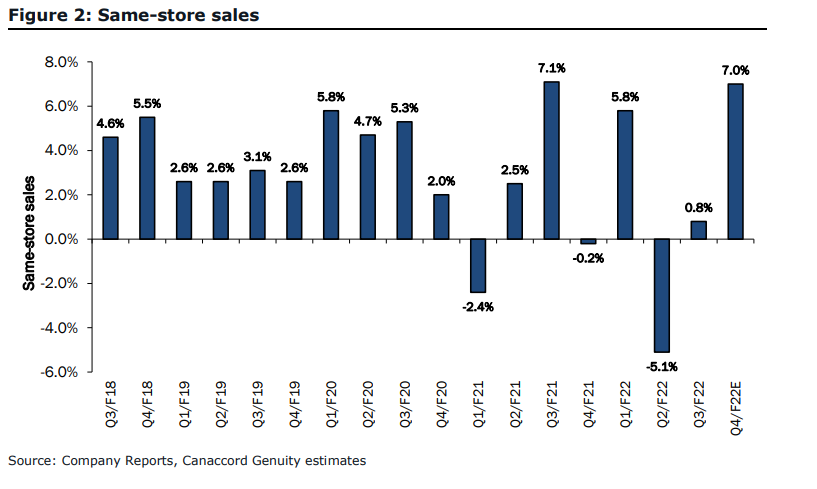

Canaccord expects that Dollarama’s strong results will follow into the fourth quarter. During the third quarter results, management told investors that its early holiday sales were up 4% year over year without having the full holiday sales period in that estimate. Canaccord also notes that during last year’s fourth quarter, the company was impacted by “more stringent retail restrictions.” For these reasons, they are anticipating a 7% year-over-year increase in same-store sales.

Canaccord cautions investors as they expect gross margins to be impacted by a number of unfavorable items, because of this they are forecasting gross margins to be down 1% year over year to 44.5% for the fourth quarter. They expect an unfavorable product mix shift, primarily due to fewer restrictions and ongoing supply chain issues and inflationary pressures to cause this margin decrease.

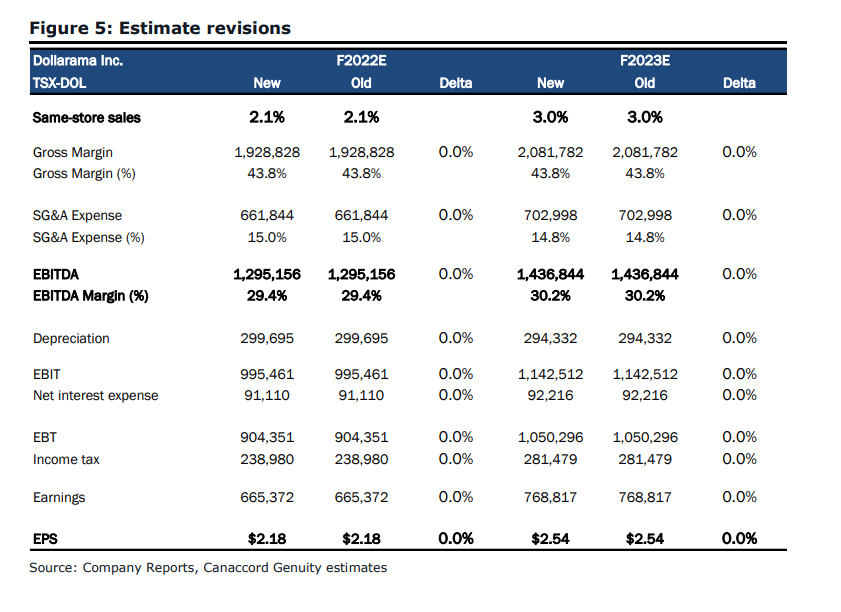

Below you can see Canaccord’s updated full-year 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.