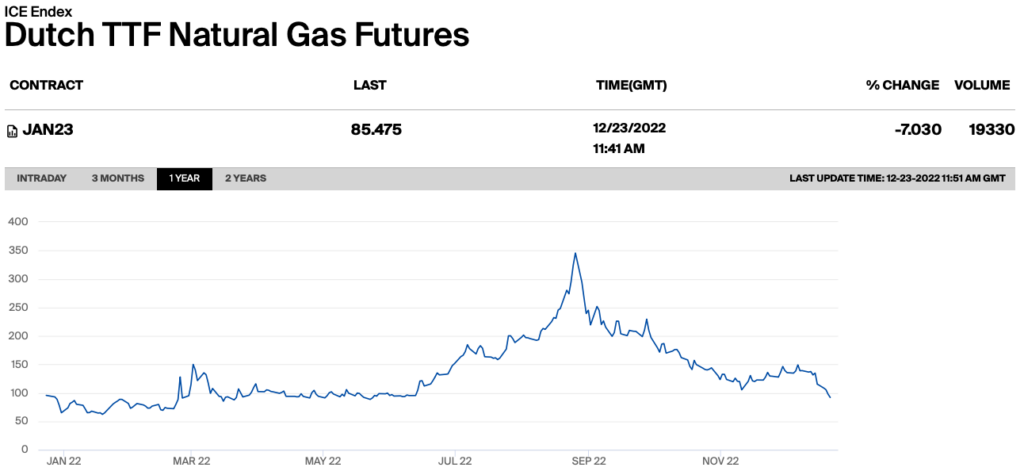

Natural gas prices in Europe fell for the sixth day in a row, with front-month Dutch gas futures trading at around €85 MWh, the lowest level in over six months. It’s also the first time the benchmark went below the €90-mark since May of this year.

In parallel, US natural gas futures also fell below $5 per million metric British thermal units (MMBtu) for the first time since March 2022, from around $7 MMBtu from last week.

The falling prices are chiefly being attributed to a softer winter which decreased the demand for gas. Storage facilities in Germany were 87.2% full, while the EU average remained at 83.2%, still higher than the five-year seasonal normal.

The union also had record LNG imports and increased wind generation; coupled with fuller-than-normal stockpiles, the reserves tamed concerns about shortages.

Meanwhile, US utilities withdrew last week 87 billion cubic feet (bcf) of gas from storage, falling short of market estimates of 93 bcf and falling far short of the five-year average reduction of 124 bcf. The milder draw stems from lower demand for heating.

The European Union’s energy ministers decided on Monday to set a €180 MWh gas price ceiling, expected to take effect on February 15 next year. It will be triggered if the Dutch TTF natural gas futures price exceeds €180/MWh for three days and and if the price of LNG is above €35/MWh.

The decline comes after fears of gas crisis in Europe as the region prepares for winter. Germany was concerned that it may have to resort to drastic rationing in the new year, should gas storage levels dip below critical levels.

“We will struggle to avoid a gas emergency this winter without at least 20% savings in private households, businesses and industry,” said German energy regulator Bundesnetzagentur head Klaus Mueller.

Information for this briefing was found via sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.