The European Central Bank delivered another rate hike on Thursday, with plans to adjust the conditions of its extremely cheap commercial bank loans in an effort to reduce its colossal balance sheet and stave off surging inflation.

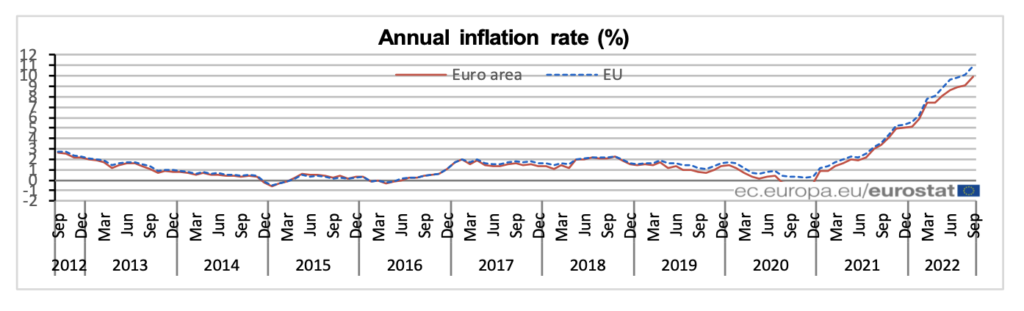

With mounting concerns that price pressures may become entrenched in the EU economy, the bloc’s central bank is embarking on one of the fastest tightening cycles in its history, opting to raise interest rates by another 75 basis points to combat decades-worth of bottomless money-printing. The ECB’s deposit rate now sits at 1.5%— the highest since 2009, after sitting in negative territory since July.

The hawkish move was made in response to an inflation rate currently sitting above 10%— five times higher than the central bank’s target range. The ECB warned that such persistent price pressures are going to reinforce wage-price spirals. “Incoming wage data and recent wage agreements indicate that the growth of wages may be picking up,” said ECB president Christine Lagarde. Despite mounting concerns that the bank’s sharp tightening cycle may throw some EU countries into a recession, policy makers reaffirmed their objective to fight inflation.

“Everyone has to do their job. Our job is price stability,” said Lagarde. “We have to do what we have to do. A central bank has to focus on its mandate.” The ECB also cut back the ultracheap 3-year loans issued to commercial banks, or Targeted Longer-Term Refinancing Operations, in an effort to reduce its €8 trillion balance sheet. “In view of the unexpected and extraordinary rise in inflation, it (TLTRO) needs to be recalibrated to ensure that it is consistent with the broader monetary policy normalization process and to reinforce the transmission of policy rate increases to bank lending conditions,” the central bank said.

Information for this briefing was found via the ECB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.