The European Central Bank on Thursday announced yet another rate hike, this time a 50 basis-point increase.

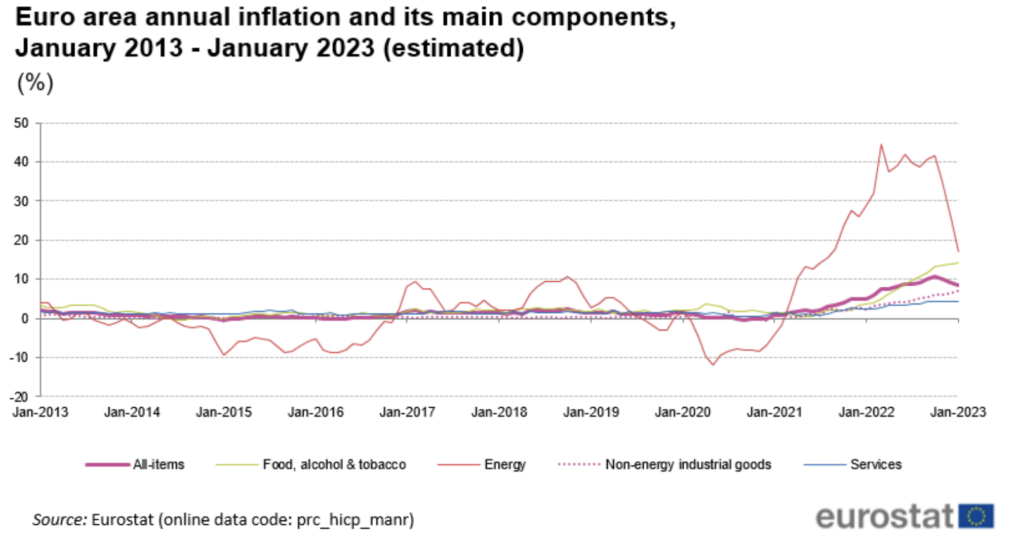

The central bank’s key rate now sits at 2.5%, marking the fourth straight hike that propelled EU borrowing costs out of negative territory for the first time since 2014. “Price pressures remain strong, partly because high energy costs are spreading throughout the economy,” said ECB president Christine Lagarde in justification of the latest hawkish policy move.

🇪🇺 The ECB hiked all its policy rates by 50bp, as expected. The deposit rate will raise to 2.50%, a 14-year high.

— Frederik Ducrozet (@fwred) February 2, 2023

In terms of guidance, the ECB will "stay the course". Another 50bp hike in March, and "it will then evaluate the subsequent path of its monetary policy". pic.twitter.com/9izKEcsHQu

Thanks to the central bank’s unprecedented money printing over the past 10 years aimed at boosting growth throughout various economic crises, consumer prices remain stubbornly elevated, with latest flash estimates for January putting headline inflation at an annualized 8.5%.

In the ECB’s accompanying statement, policy makers promised to “stay the course in raising interest rates significantly at a steady pace,” with hawkish language insinuating another forthcoming 50 basis-point hike come March. However, Lagarde conceded that the bank’s tightening cycle is impending economic output, as growth in the fourth quarter slowed to a paltry 0.1%. However, “the risks to the outlook for economic growth have become more balanced,” she added.

Information for this story was found via the ECB and Eurostat. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.