On May 30, Eguana Technologies (TSXV: EGT) announced its second-quarter financial results. The company reported quarterly revenues of $0.3 million, down slightly from $0.4 million a year ago, for which the firm says is due to a “lack of Canadian supplied circuit boards and management decision to transition and fully commission Omega EMS.”

Eguana saw its gross margins increase from 4% last year to 25.1% this year, for gross margins of $71,600 for the quarter. They say that this increase comes from a favourable inventory adjustment which was partially offset by rising freight costs.

Lastly, Eguana announced that it ended the quarter with positive working capital, coming in at $4.4 million, which is up from the deficit of $12.2 million it was running a year ago.

In a note on the results, Stifel-GMP reiterated its buy rating on the stock while raising its 12-month price target from C$0.65 to C$0.70, saying that the company is progressing as expected with its new facility all operational, which “should allow for a meaningful uptick in revenue in 2Q22E,”

On the results, Stifel says that due to the “reconfiguration and relocation of production capabilities,” the results came in line with their estimates. They say that this relocation was a smart decision by the company as it improves the reliability of its production line.

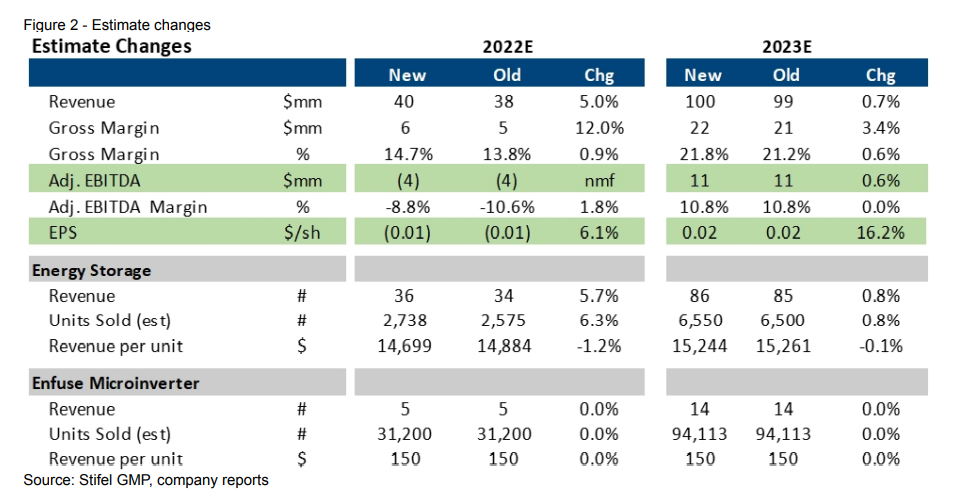

On the production move, Stifel-GMP says that the Omega facility will, “create better reliability in production runs and better access to key inputs,” as the company sees increased demand for its products. They believe that annualized demand could be between $40 and $60 million by the end of this year, which is much higher than their prior estimate of $14 million. This also makes the firm believe that the consolidated revenue for Eguana could be >$100 million.

Stifel is forecasting that the company will sell 6,550 energy store systems in 2023e, which is below Eguana’s long-term production capacity of 800/month. They expect that the company will not use its full production capacity until supply chains improve or more suppliers are added.

On another note, Stifel believes that the company could see new commercial opportunities and remain focused on the PowerCenter+ partnership, as they “believe this is the key to the stock’s future performance.”

Below you can see Stifel’s updated estimates.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.

One Response

What is projected timeline for this analysis to materialize?