Earlier this week, Eight Capital launched coverage on a basket of psychedelic companies. This comes after they produced an industry primer during the summer months. The third company on this list is Field Trip Health (CSE: FTRP) with a C$10.20 12-month price target and buy rating.

Field Trip Health currently has 3 analysts covering the stock with an average 12-month price target of C$16.24. or 182% upside. All 3 analysts have buy ratings. The street high sits at C$20.71 while the lowest comes in at C$10.

Eight Capital says that Field Trip operates in 2 sub-categories of the psychedelic space with one segment focused on providing psychedelic-assisted therapies, while the second segment is a drug development pipeline. The company currently has 7 sites but is expected to expand to 20 that are either in operation or under construction by the end of this year, while having a target of 75 locations by 2024.

Eight Capital calls 2022 a key inflection point for the company as, “there is more demand for healthcare services related to mental health, as 40% of adults reported mental health challenges like depression and anxiety this past year.” Additionally, with major pipeline catalysts coming out of the psychedelic sector in 2022, Field Trip will ultimately benefit from more psychedelic-treatment options coming available.

They also believe that the company’s clinics are differentiated from peers who are doing similar work, since they are focusing on the patient’s mindset and environmental setting to help improve outcomes. They say, “We believe current clinics networks are mostly focused on only administering ketamine treatments, and as a result, clinics do not have the resources, to adequately prepare the patient’s mindset prior to and during infusions.” While Field Trip’s clinics are purposed built with in-house therapists help to set the mindset and setting.

Eight Capital believes that Field Trip is developing the next-generation derivatives of psychedelics. The companies keystone drug is FT-104, which was “developed as an improvement upon the shortcomings of existing psychedelic drugs,” with this drug “trip” time be shorter than the 3-8 hour long timeframe for Ketamine. The company plans to have this drug in a phase 1 trial in the first quarter of 2022 and Eight Capital estimates that it comes to market starting in 2028.

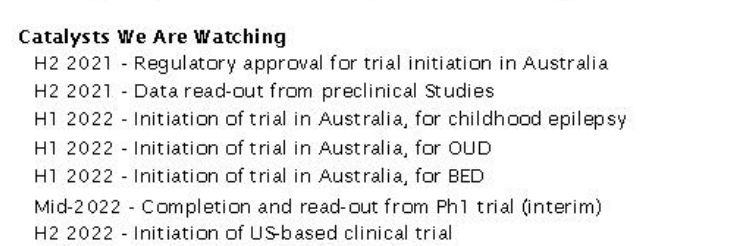

Below you can see the catalysts Eight Capital is looking out for.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.