El Salvador is not just a bitcoin country anymore. On Wednesday, its Legislative Assembly passed a law establishing a legal framework for digital assets other than bitcoin. The country’s National Bitcoin Office (ONBTC) believes the new law would allow it to “offer unprecedented consumer protection from bad actors in the ‘crypto’ space.”

Today El Salvador builds on our first-mover advantage by passing landmark legislation establishing a legal framework for all digital assets that are not bitcoin. As well as those issued on bitcoin.

— The Bitcoin Office (@bitcoinofficesv) January 11, 2023

The law also paves the way for volcano bonds which we will soon begin issuing.

In September 2021, the Central American nation made history when it became the first country to adopt bitcoin as legal tender. It makes history once more for establishing a regulatory framework for digital securities.

First introduced by President Nayib Bukele’s party, Nuevas Ideas, at the end of November last year, the Digital Asset Issuance law includes the creation of a regulating agency, the National Digital Assets Commission. The “landmark legislation” will pave the way for the issuance of the ‘Volcano Bond.’

Bukele first announced plans for bitcoin-backed bonds back in November 2021, with the goal of raising $1 billion. The bond is dubbed the ‘Volcano Bond’ because part of its proceeds will be used to fund bitcoin mining infrastructure for ‘Bitcoin City,’ which will be powered by geothermal energy from the Conchagua volcano.

The other portion of the proceeds El Salvador would benefit to use to help pay down its sovereign debt. The government is facing default on its dollar-denominated debt and is currently rated CCC+ by S&P Global Ratings, which puts it seven levels below investment grade.

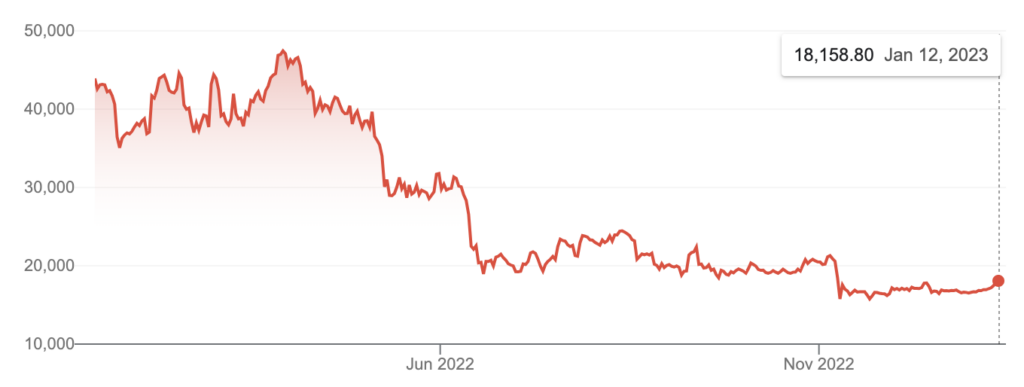

Bukele has continued to staunchly advocate bitcoin even though the price decline has lost his country’s already strained coffers at least $60 million. The passing of this new legislation allows Bukele’s administration to position El Salvador as the center of the bitcoin economy.

The planned ‘Bitcoin City’ will be a special economic zone at the Gulf of Fonseca on the country’s southern coast. Apart from ESG-friendly renewable energy-powered bitcoin mining infrastructure, it would offer tax advantages, friendly regulations, and incentives for bitcoin entrepreneurs that would open businesses in the country.

#Bitcoin City is coming along beautifully ❤️ pic.twitter.com/A6ay8aAREW

— Nayib Bukele (@nayibbukele) May 9, 2022

Information for this briefing was found via Twitter, Coindesk, Bitfinex, Watcher.Guru, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.