On October 12th, Eldorado Gold (TSX: ELD) announced their third quarter 2021 preliminary production results. The company announced that they produced 125,459 ounces of gold, down from 2020 third quarter production. The company has now produced 353,268 ounces of gold year to date, which is also down from last year’s 390,654 ounces.

Eldorado Gold currently has 12 analysts with an average 12-month price target of US$13.97. Out of the 12 analysts, 6 have buy ratings, 5 have holds and 1 analyst has a sell rating. The street high sits at US$18 from CIBC Capital Markets and the lowest comes in at US$8.75.

In BMO’s note, they reiterated their outperform rating and $20 price target, writing, “Q3/21 Production Beat; Strong YTD Production Leads to FY2021 Guidance Review.” The company beat BMO’s estimate of 115,800 ounces which was driven primarily by a beat at Kisladag where the company reported 51,000 ounces versus BMO’s estimate of 36,700 ounces. Although, Lamaque, which produced 37,400 ounces came in lower than BMO’s 41,000-ounce estimate, while Efemcukuru and Olympias came roughly in line with expectations.

BMO believes that there is a potential upside for Eldorado since they have produced 353,268 ounces year to date which is roughly 80% towards their full-year 2021 production guidance. BMO writes, “With Kisladag having already achieved the lower end of its guidance range after three quarters, we find it hard to envision a scenario where ELD does not raise the top end of its consolidated production guidance range”

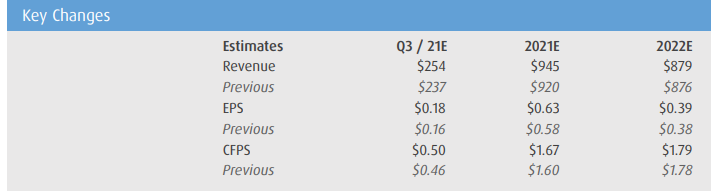

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.