This week Eldorado Gold (TSX: ELD) provided full year 2022 production and cost guidance as well as a 5-year production outlook. By 2022, Eldorado expects total gold production to be 460,000 to 490,000 ounces, or about 7% higher than the prior guidance. Cash operating costs are expected to be between $640 and $690 per ounce, while the all-in sustaining costs are expected to be between $1,075 and $1,175.

Eldorado Gold also raised their 2023 and 2024 production guidance, bringing them up 4% and 7% respectively. The company additionally expects by 2026 to be producing between 510,000 and 540,000 ounces of gold per year.

Eldorado Gold currently has 11 analysts covering the stock with an average 12-month price target of US$13.50, or a 42% upside to the current stock price. Out of the 11 analysts, 6 have buy ratings, 4 have hold ratings and the last analyst has a sell rating. The street high price target sits at US$17.51, or an 85% upside to the current stock price while the lowest comes in at US$9.25.

In BMO Capital Markets’ note, they reiterate their outperform rating and $20 12-month price target saying that the company is “approaching the growth spurt.”

For the 2022 guidance, production came in line with BMO’s 471,000-ounce estimate while all-in sustaining costs came in slightly above their $1,070 per ounce estimate. Onto the improved 5 year guidance, they say that the outlook looks a little above their expectations.

Lastly, they say that if you take the midpoint of the 2025 guidance, which is 550,000 ounces produced, it would be a 5% 3-year organic CAGR, which is “a rarity among intermediate and senior producers at present.”

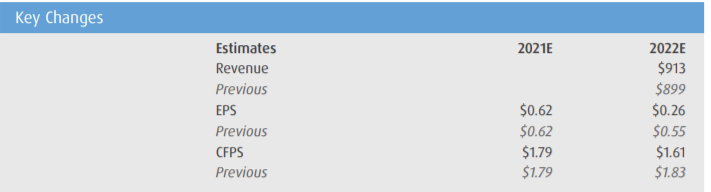

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.