Eldorado Gold (TSX: ELD) earlier this week announced its second-quarter production results. The company announced that it produced 113,462 ounces of gold during the second quarter, down from a year ago. The firms Kisladag mine produced 27,973 ounces, while Lamaque produced 46,917 ounces, Efemcukuru produced 22,793, and Olympias produced 15,779 ounces.

The company has produced 206,671 ounces during the first half of the year, and they have reiterated their production guidance of 460,000 to 490,000 ounces for all of 2022.

There are currently 11 analysts covering Eldorado Gold with an average 12-month price target of C$17.44, or an upside of 135%. Out of the 11 analysts, 6 have buy ratings, 4 analysts have hold ratings and a single analyst has a sell rating on the stock. The street high price target sits at C$22, representing an upside of 200%.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and C$18 12-month price target, saying that the production results generally came in line with their expectations.

On the results, BMO was expecting Eldorado Gold to produce 118,100 ounces of gold while the company actually produced 113,462 ounces. BMO expects that the Kisladag mine will see a strong second half of the year. Though production during the quarter at the mine was below BMO’s estimate of 33,700 ounces, they expect that the company will continue to put higher-grade ore on the leach pad during the second half of the year.

Lastly, BMO says that the company optimized its Canadian operations, as they say, “[at] the Lamaque Mine, optimization efforts produced 46.9koz of gold, which was higher than anticipated and slightly ahead of our model of 44.0koz.”

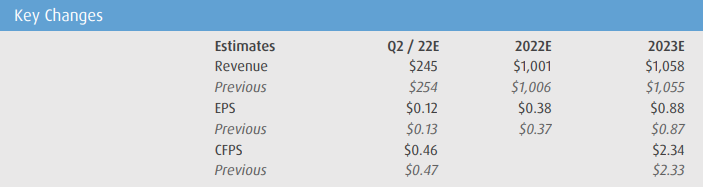

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.