On June 25, Elemental Royalties Corp. (TSXV: ELE), a gold-focused royalty company, announced that continuous ore processing has begun at Capricorn Metals Limited’s (ASX: CMM) Karlawinda Gold Project in Western Australia. Elemental Royalties holds a 2% Net Smelter Return (NSR) on the property, which is in the Pilbara gold mining region in Western Australia.

NSR is the revenue, net of transportation and refining costs, that a mine operator pays the owner of a royalty agreement.

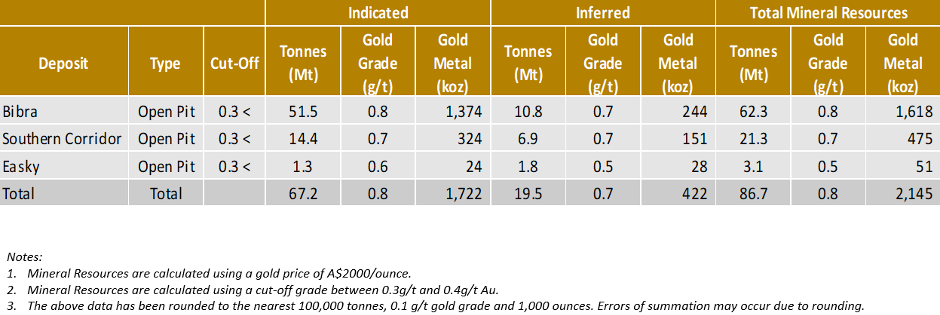

According to an April 2020 Mineral Resource Estimate, Karlawinda contains about 2.1 million ounces of gold on combined indicated and inferred bases. Elemental Royalties expects the Karlawinda NSR to nearly double its annualized revenues to about US$8 million per year. And since the royalty payment is all profit, the NSR should more than double Elemental Royalty’s EBITDA annualized run rate to about US$6.5 million from US$2.5 million.

Two other projects which could produce incremental revenue and EBITDA in the near and intermediate terms for Elemental Royalties are Mercedes (1% NSR) and Panton (0.5% NSR).

Mercedes

Equinox Gold (TSX: EQX) acquired 100% of Mercedes, an underground gold and silver mine in Sonora, Mexico that began production in 2011, through its purchase of Premier Gold Mines in April 2021. Mercedes produces about 50,000 ounces of gold per year. Equinox hopes to return the mine to a full production rate of 80,000-90,000 ounces annually around mid-2022.

Panton

Future Metals NL (ASE: FME) plans to begin a 10,000 meter drilling exploration program in 3Q 2021 at the 23 square-kilometer Panton Platinum Gold Metals (PGM) project in Western Australia. The company plans to issue an updated feasibility study for Panton in 2022.

Elemental Royalties Seems Likely to Raise Equity This Year

As of March 31, 2021, Elemental Royalties had US$6.6 million of cash and US$24 million of debt. Given this mismatch as well as cash that may be needed to finance growth, the company seems likely to raise equity via the public or private markets this year. Adjusted EBITDA has been positive for the last three reported quarters.

| (in thousands of US$, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| EBITDA, Adjusted for Share-Based Compensation Expense | $624 | $1,562 | $1,200 | ($61) | $960 |

| Operating Cash Flow | ($332) | $2,419 | $165 | ($679.28) | $183 |

| Cash – Period End | $6,573 | $10,921 | $8,757 | $20 | N/A |

| Debt – Period End | $24,034 | $0 | $0 | $236 | N/A |

| Shares Outstanding (Millions) | 69.0 | 44.5 | 44.5 | 44.5 | 21.4 |

Given its nature as a royalty investor, Elemental Royalties does not have operating risk. However, if production were to end prematurely at an important project in the company’s royalty portfolio, the stock could be affected rather significantly.

As the Karlawinda Gold Project commences operations, Elemental Royalties seems likely to post significant year-over-year adjusted EBITDA increases beginning in 3Q 2021. For a growth company, Elemental Royalties’ ratio of enterprise value to run-rate EBITDA looks like it may be reasonable at around 14x (US$94 million divided by US$6.6 million).

Elemental Royalties Corp. last traded at $1.32 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.