The oil and gas sector has found an unlikely ally as of last night. In a surprise turn of events, Elon Musk, whom is known for being one of the driving forces behind renewable energy and the electrification of vehicles, has voiced support for the further development of the oil and gas sector.

In a tweet last night, he commented that the US needs to “increase oil & gas output immediately.” Expecting some degree of blowback given his typical stance on fossil fuels, he followed this up in the same tweet by stating that “extraordinary times demand extraordinary measures.”

Obviously, this would negatively affect Tesla, but sustainable energy solutions simply cannot react instantaneously to make up for Russian oil & gas exports.

— Elon Musk (@elonmusk) March 5, 2022

He is, of course, speaking in relation to the recent invasion of Ukraine by that of Russia, a major oil and gas supplier on the global stage. A subsequent tweet addressed this directly, stating “sustainable energy solutions simply cannot react instantaneously to make up for Russian oil & gas exports.”

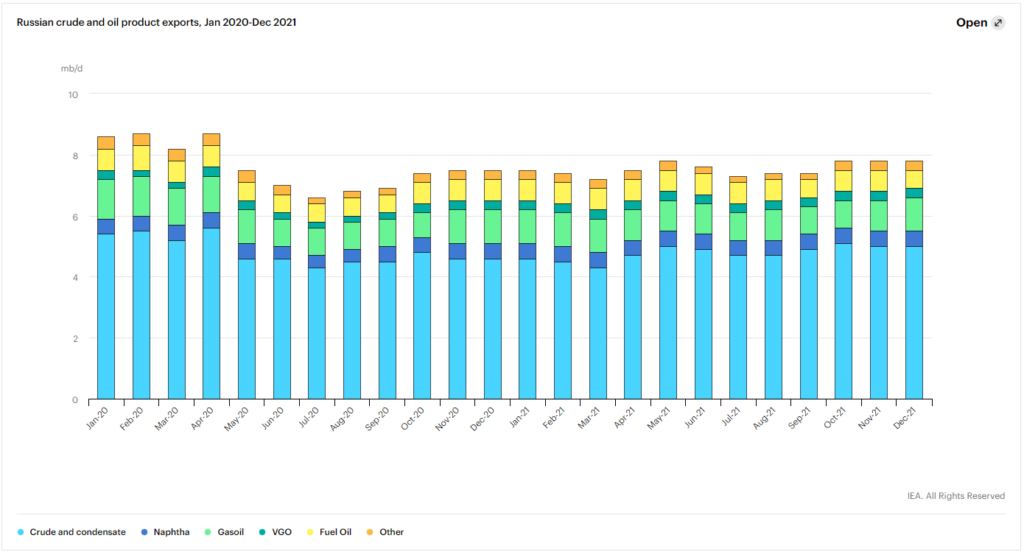

Russia currently is the third largest oil producer globally, producing 11.3 million barrels of oil per day in January of this year. The country is behind just the United States and Saudi Arabia in terms of global oil production, however in terms of exports, it plays the largest role globally. December saw the country export 7.8 million barrels per day of oil, which amounts to over two thirds of its daily production.

60% of those exports go directly to Europe. And in terms of imports, roughly 9% of oil product imports in the United States are sourced via Russia as per the IEA, despite the US being the largest producer globally.

When it comes to natural gas, Russia has steadily been growing its stake in the European markets. The country has seen its exports grow from 25% of natural gas imported in Europe, to that of 32% in a span of just nine years. The increase is not due to increased natural gas consumption, but rather falling production regionally.

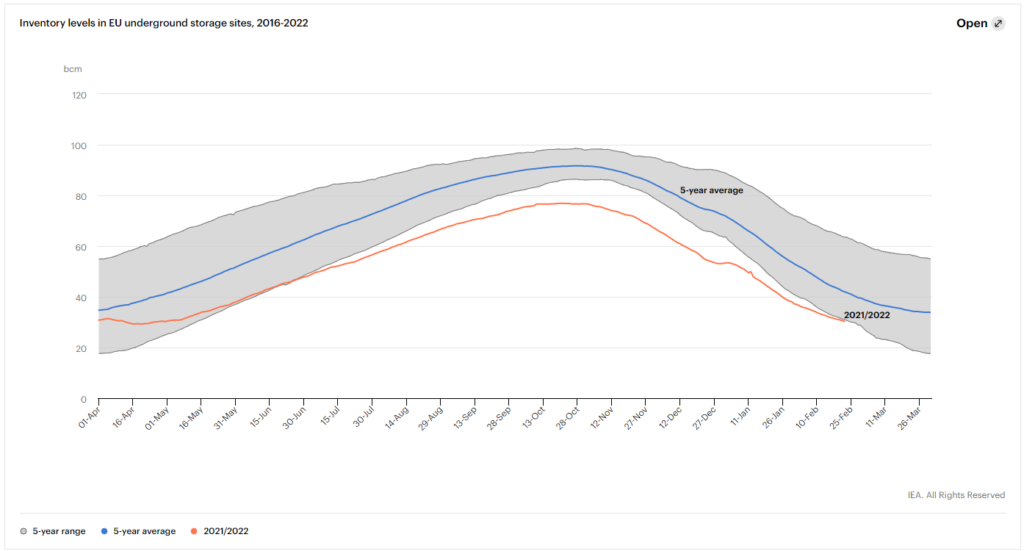

Here, the highly publicized suspension of Nord Stream 2 is expected to have long term implications for the region, while Germany has already begun sourcing other suppliers. Russia had already begun throttling the EU from receiving natural gas, as it looked to exert pressure to receive certification of Nord Stream 2. Deliveries to the EU reportedly declined 25% in the fourth quarter as a result. That being said, Europe gas storages are well below averages, with storage at less than a third of capacity.

While the lack of supply and concerns about where the supply will come from in the future have driven European natural gas prices sky high – they flew to over $44 per million BTU at the onset of the invasion – prices in North America have been rather flat. This is due to the high cost of transporting natural gas, which leads to the sector being a more localized industry than that of its energy peers.

Despite it being heavily localized, that doesn’t mean exports don’t occur. The US as a whole exported 6,653,357 million cubic feet of natural gas in 2021, of which 3,560,818 million was via LNG, which is typically transported via ship to global destinations. The country is also expected to be the largest global exporter in 2022, ahead of Australia and Qatar. Current estimates peg 2022 exports at 11.5 billion cubic feet per day.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RNSD3ZGAXFLJXO3PLEJVZOK2B4.png)

That all being said, its clear that Musk in saying that the US needs to increase both oil and gas production immediately is a roundabout means of stating that exports from Russia need to effectively be kneecapped. And perhaps it was an opportunistic time to also show support for one of the major industries in his new state of residence, Texas.

His tweet against Russian energy imports was followed an hour later by the billionaire directly voicing support for Ukraine.

🇺🇦🇺🇦🇺🇦 Hold Strong Ukraine 🇺🇦🇺🇦🇺🇦

— Elon Musk (@elonmusk) March 5, 2022

Information for this briefing was found via Twitter, the IEA and Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.