In a show of financial might, Tesla CEO Elon Musk filed a report with the Securities and Exchange Commission detailing the fresh batch of equity commitments he was able to secure related to his proposed acquisition of Twitter (NYSE: TWTR).

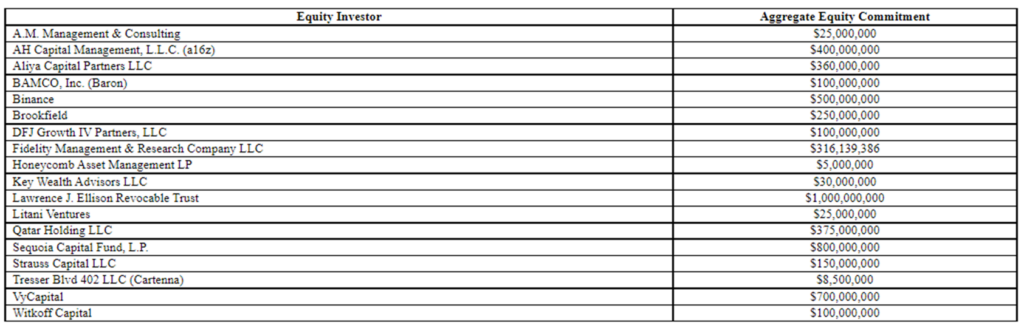

Musk, currently the largest single shareholder with 9.6% equity, outlined 18 equity investors who committed a total of US$7.139 billion in financing. This is on top of the commitments secured by the Tesla chief totaling US$46.5 billion, all in an effort to satisfy the acquisition price of US$43 billion.

With a US$1-billion financing commitment, Lawrence J. Ellison Revocable Trust (owned by the co-founder and CTO of Oracle Corporation Larry Ellison) has the largest share in the fresh batch of equity commitments. Notably, Binance has also committed US$500.0 million to the endeavor.

Certain equity investors have retained the option to satisfy the commitment with common shares at the value same as the US$54.20 per share offer price.

Meanwhile, Saudi Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud committed his existing shares held–around 34.9 million shares–to retain his equity in the firm following Musk’s acquisition.

Twitter last traded at US$49.06 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

43 billion not 43 million