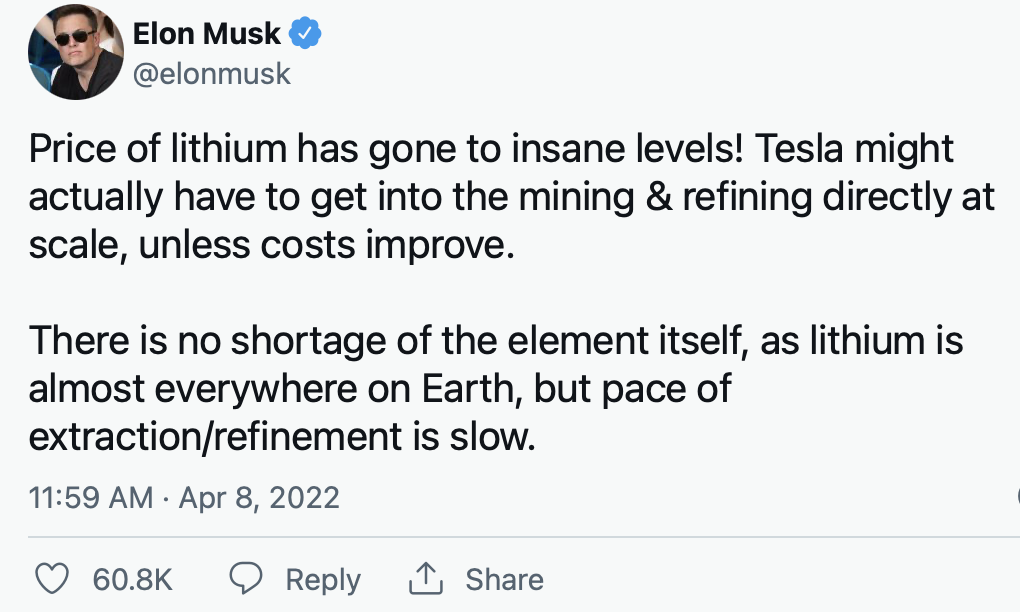

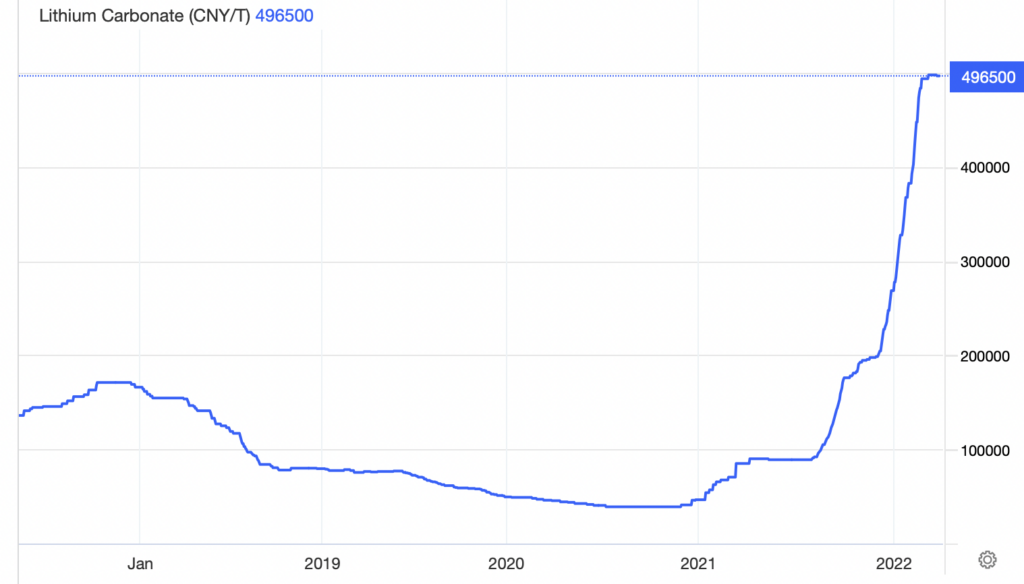

Tesla, Inc. (NASDAQ: TSLA) CEO Elon Musk, almost certainly the most influential business figure in the world (and perhaps the most influential person on the planet) currently, tweeted out on April 8 that Tesla may have to become directly involved in lithium mining. The price of lithium, which may be the most indispensable metal used in electric vehicle batteries, has soared nearly tenfold since year-end 2020 and has jumped 150% just over the last four months.

Mr. Musk made some fairly similar statements regarding the need to source lithium and nickel at Tesla’s September 2020 ‘Battery Day’ presentation, and Tesla proceeded to announce a number of sourcing deals for those metals over the next 2+ years. Given this, it is certainly possible that Tesla could announce significant long-term purchase contracts with lithium miners and/or announce plans to acquire a miner. In any event, after the April 8 remarks, investors may want to consider adding lithium exposure to their portfolios.

Presumably, Tesla may be more inclined to engage with a lithium miner with which it has reached a prior transaction. With that in mind, one situation that investors should monitor closely is Tesla’s relationship with the giant lithium miner Ganfeng Lithium and, in turn, Ganfeng’s linkage with the lithium mine developer Lithium Americas Corp. (TSX: LAC).

In November 2021, Tesla signed a three-year contract (2022 through 2024) to purchase lithium hydroxide from the Jiangxi, China-based miner. The agreement is subject to concrete orders from Tesla. Reportedly, Ganfeng could supply 20% of its production to Tesla.

Ganfeng owns a 51% stake in the Cauchari-Olaroz lithium brine project in Argentina. Lithium Americas will operate the project and it owns the balance, or 49%. Cauchari-Olaroz is forecast to produce 40,000 tonnes of battery-grade lithium carbonate annually for 40 years. The project, which is about 85% complete, is expected to commence production at some point in 2022, although first lithium production may be delayed some months beyond the mid-2022 date that Lithium Americas targeted through much of 2021.

In mid-March, Lithium Americas increased the construction cost estimate for Cauchari-Olaroz by 16% to US$741 million (on a 100% basis) from the last estimate of US$641 million. Various factors were cited for the increase including engineering modifications and inflationary cost pressures.

Lithium Americas also owns a 100% stake in the Thacker Pass lithium project in the U.S. state of Nevada. Thacker Pass may have sufficient resources to produce 60,000 tonnes of battery-grade lithium carbonate per year for 46 years. The U.S. Bureau of Land Management approved the project in January 2021, but that decision has been appealed. It now appears that a U.S. District Court judge may not rule on the appeals until 3Q 2022.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.