Despite missing delivery and revenue estimates in Q3 2022, Tesla (Nasdaq: TSLA) CEO Elon Musk projected optimism on the earnings call by saying the electric vehicle maker could be worth more than the combined market cap of Apple and Saudi Aramco.

“I’m of the opinion that we can far exceed Apple’s current market cap. In fact I see a potential path for Tesla to be worth more than Apple and Saudi Aramco combined,” Musk said.

As of last closing, Apple’s market cap is at US$2.31 trillion while Saudi Aramco ended at US$2.08 trillion. Currently, Tesla’s market cap is at US$695.76 billion.

However, this projection is merely abstract as of now, with Musk adding that it “doesn’t mean it will happen or will be easy.”

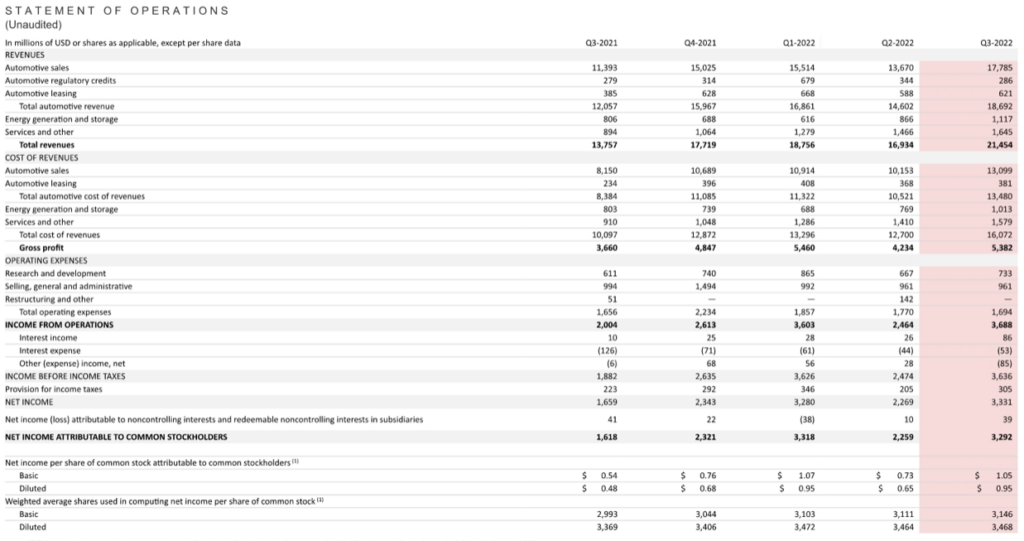

His comments came after the firm filed its Q3 financials which saw US$21.45 billion in revenue, falling short of the street estimates of US$21.96 billion.

The carmaker also previously announced that it has delivered 343,830 vehicles during the quarter, also failing to meet the analysts’s expectation of 358,000 deliveries.

He also said that Tesla is poised to conduct a “meaningful buyback” next year, potentially ranging from $5 billion to $10 billion, assuming board approval.

“I can’t emphasize enough we have excellent demand for Q4 and we expect to sell every car that we make for as far into the future as we can see,” Musk added. “The factories are running at full speed and we’re delivering every car we make, and keeping operating margins strong.”

However, the firm warned about a bottleneck in transportation capacity for delivering new cars in the last weeks of the quarter in its Q3 earnings report, and said it was “transitioning to a smoother delivery pace.”

Musk hyping up the company, however, is not new. At the annual shareholders’ meeting back in August, the Tesla chief said the company was “about to embark on an experiment to seize an untapped opportunity.” Immediately after, he unloaded a total of 7.9 million shares for gross proceeds of $6.89 billion in the three trading sessions following the meeting.

Q3 financials

Total revenues landed at US$21.54 billion, a 56% jump from the year ago period and an increase from last quarter’s US$16.93 billion. Gross margin, however, slumped to 25.1% from 26.6% a year ago but increased marginally from 25.0% in the previous quarter.

Operating expenses came in relatively flat at US$1.69 billion from US$1.77 billion last quarter, and US$1.66 billion last year–this despite the rising inflationary economy.

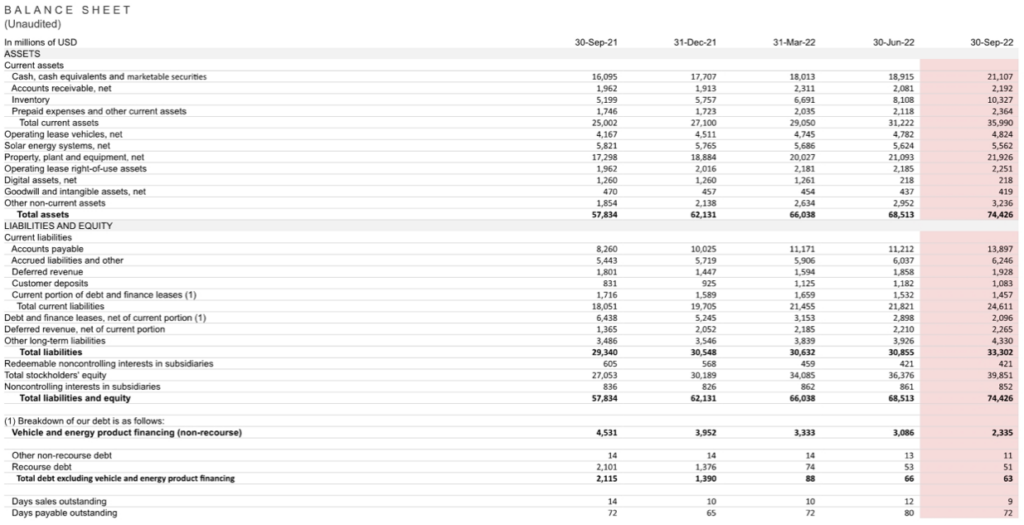

Notably, the company reached its highest current assets balance at US$35.99 billion, a jump from last quarter’s US$31.22 billion. This increase mainly came from a jump in the cash balance from US$18.92 billion last quarter to US$21.11 billion this quarter, and an increase in inventory from US$8.11 billion last quarter to US$10.33 billion this quarter.

In response to another inquiry, Musk discussed his upcoming acquisition of Twitter, saying, “I think it’s an asset that has sort of languished for a long time but has enormous potential,” later adding, “the long-term potential for Twitter is an order of magnitude more than its current worth.”

While he is “excited about the Twitter situation,” he admits that “myself and the other investors are obviously overpaying for it right now.”

Musk is anticipated to sell a portion of his substantial stake in Tesla to help finance the $44 billion takeover.

Tesla last traded at US$213.11 on the Nasdaq.

Information for this briefing was found via Marketwatch, CNBC, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.