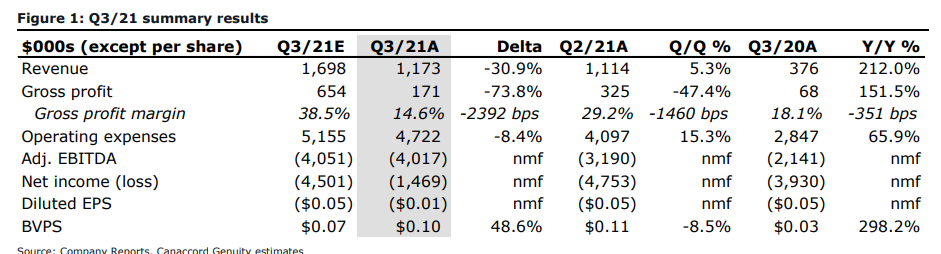

On November 29th Else Nutrition (TSXV: BABY) announced its third quarter financial results. The company reported revenues of $1.17 million, up from $1.1 million last quarter, while gross profits dropped from $0.27 million last quarter to $0.06 million this quarter. The company also saw a larger operating loss than last quarter at $4.55 million.

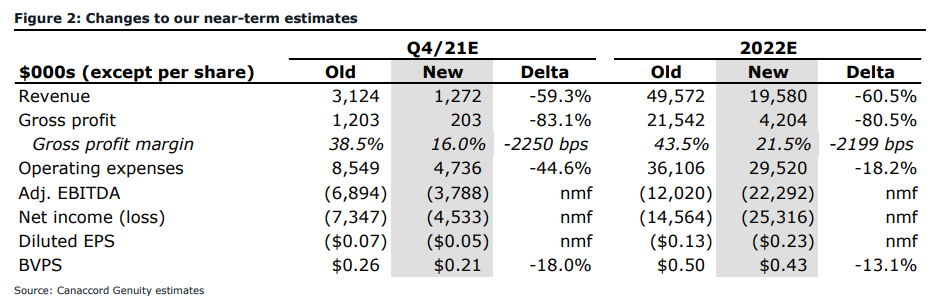

Canaccord Genuity lowered their 12-month price target to C$4.00 from C$5.75 and reiterated their speculative buy rating on the stock, saying that another quarter of misses has them reducing their estimates.

For the results, Else Nutrition came in roughly 31% below Canaccord’s revenue estimate and 74% below their gross profit estimate, while the companies reported ($4.0) million in adjusted EBITDA came in line with Canaccord’s estimates.

Canaccord says that the revenue miss was primarily driven by weaker than expected formula sales. The company reported segment revenues of $0.9 million versus Canaccord’s estimates of $1.4 million. The companies revenue from baby feeding accessories and baby snacks came in line with their expectations.

Canaccord admits that their older market penetration estimates were arbitrary, but now that they have a few quarters of data they have now changed their penetration estimates by roughly 25% in every category.

Now they expect:

- Infant complete nutrition: Reduced from 15.0% to 11.5%

- Toddler complete nutrition: Reduced from 10.0% to 7.5%

- Baby complementary nutrition: Reduced from 3.5% to 2.5%

- Children/kids complete nutrition: Reduced from 2.0% to 1.5%

Below you can see Canaccord’s updated fourth quarter and full-year 2022 estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.