Thursday morning Endeavour Silver (TSX: EDR) released their 2021 production guidance for 2021, guiding towards 3.6 – 4.3 million ounces of silver and 31,000 – 35,500 ounces of gold. They added that the all-in sustaining costs are estimated to be $19 – $20 per ounce of silver and said that they expect 2021 costs to be higher than 2020 due to higher royalty and mining duty payments this year.

Endeavour Silver currently has seven analysts covering the company with a weighted 12-month price target of C$6.82. This is slightly up from the average before last month, which was C$6.14. Two analysts have buy ratings while another five have hold ratings on the company.

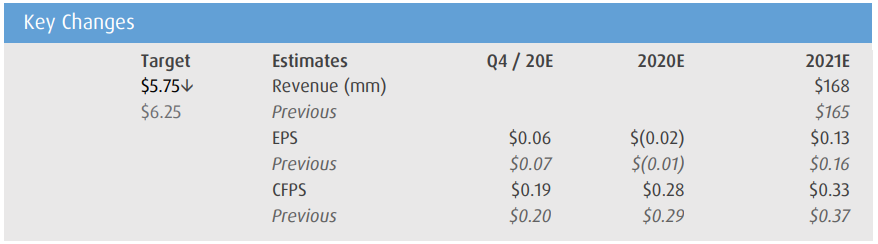

BMO Capital Markets downgrades their 12-month price target on Endeavour Silver to C$5.75 from C$6.25 while reiterating their market perform rating. Ryan Thompson, BMO’s analyst says that they believe this guidance is slightly negative.

He writes “2021 production guidance of 3.6-4.3Moz silver and 31-36koz gold was in line with our prior estimates, however, AISC guidance of $19-20/oz (by-product) came in higher than our estimate of ~$12/oz.”

For the individual mines, Thompson says that Guanacevi silver production and Bolanitos gold production came in above their estimates mainly due to the company sourcing higher-grade ore.

The cash cost guidance of $7.00 – $8.00 per ounce and AISC guidance of $19.00 – $20.00 per ounce are higher than BMO forecasts of $4.6 per ounce and $12.1 per ounce, respectively. Thompson writes “The cost increase is a result of royalties and special mining duties, and is expected to be significantly higher year over year because of concession leases at the El Curso concession (Guanacevi).”

On the flip side, Endeavour’s capital budget came in lower than expected. He writes “The total capital budget of $32.8M comes in below our prior estimate of $47.1M (we previously incorporated Terronera capex in 2021).”

Below you can see the key changes BMO has made to its 2021 estimates.

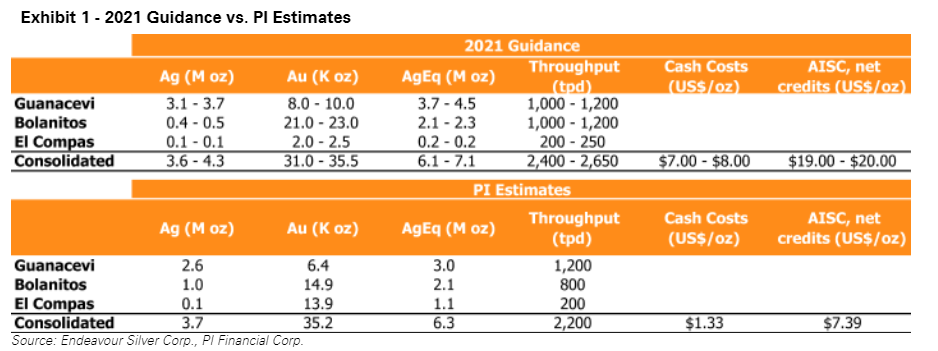

PI Financial also put out a very short note on the guidance numbers, where they reiterated their C$4.80 price target and neutral rating.

Chris Thompson, PI Financial analyst headlines “Maintaining Leverage to Silver: 2021 Production Guidance In-Line, Costs Higher.”

He adds that the 2021 production guidance was generally in line, except for cash operating and all-in sustaining costs are higher than their estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.