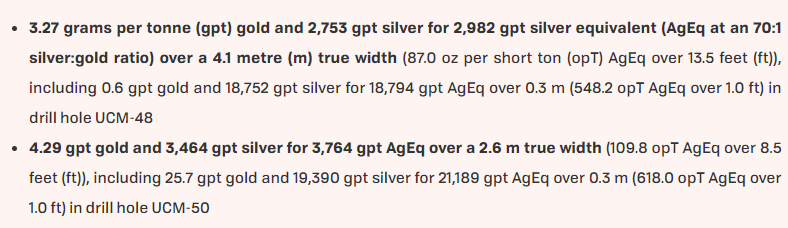

On May 4, Endeavour Silver Corp. (TSX: EDR) announced that it encountered high-grade silver and gold mineralization in the El Curso region of its Guanacevi Mine in Durango, Mexico. Perhaps more importantly, the drilling results indicated an expansion of the El Curso orebody. Key assay results included the following:

Endeavour is producing gold and silver from three regions of Guanacevi — Milache, El Curso and SCS. The goal of the company’s 2021 drilling program is to connect El Curso to the Milache orebody to the west. Ultimately, the company believes Milache, El Curso, and Porvenir Cuatro to the east constitute one continuous orebody 1.5 kilometers in length with an approximate depth of 400 meters. (Porvenir Cuatro has been previously mined.) If this continuous orebody exists, it could be comparable in size to the Porvenir Norte region of the Guanacevi Mine; that region produced precious metals for 14 years.

Endeavour’s Mining Assets

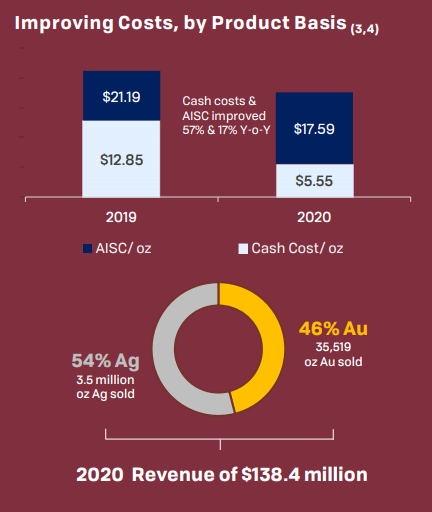

Endeavor has three operating mines (Guanacevi, Bolanitos and El Compas) and another in development (Terronera) in Mexico. The company sold 3.5 million ounces of silver and 35,519 ounces of gold from the operating mines in 2020 and recorded 2020 revenues of US$138.4 million. Equally important, Endeavour was able to reduce its production costs significantly last year, as its cash costs declined to US$5.55 per equivalent ounce of silver produced from US$12.85 in 2019. In turn, this allowed the company to generate US$56.2 million of mine operating cash flow in 2020, up 277% from the prior year.

Silver production at the mines is expected to continue to increase in 2021, allowing silver sales to reach 3.6 to 4.3 million ounces. Gold unit sales should be about flat. Revenues and cash flow should in turn rise as well, reflecting the higher quantity of ounces to be sold and higher precious metals prices, particularly silver.

In July 2020, Endeavour released the results of a constructive final Pre-Feasibility Study on Terronera. Third-party consultant Ausenco Engineering Canada projects the project has an after-tax net present value of US$137 million based on a 5% discount rate and internal rate of return of 30%.

These figures are predicated on what now appear to be quite conservative precious metals prices of US$15.97 and US$1,419 per ounce of silver and gold, respectively. Terranora could produce an average of 5.9 million ounces of equivalent silver over a mine life of ten years.

Improving Financial Results

Endeavour’s operating cash flow reached positive US$27 million in 4Q 2020, up significantly from a US$2 million operating cash flow deficit in 1Q 2020. Silver-equivalent quarterly production increased to 2.1 million ounces from 1.5 million ounces over the same period. Similarly, the company’s cash balance improved to around US$61 million on December 31, 2020 from about US$23 million at year-end 2019.

| (in thousands of US dollars, except for shares outstanding) | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Silver-Equivalent Ounces Produced (thousands) | 2,124 | 1,763 | 1,062 | 1,536 |

| Revenue | $60,747 | $35,586 | $20,201 | $21,927 |

| Operating Income | $12,029 | $393 | ($4,597) | ($8,618) |

| Operating Cash Flow | 26,650 | 15,572 | (909) | (2,349) |

| Cash | $61,083 | $44,917 | $30,498 | $14,990 |

| Debt – Period End | $10,766 | $11,791 | $12,112 | $12,662 |

| Shares Outstanding (Millions) | 157.9 | 157.4 | 154.9 | 142.6 |

Endeavour’s operating performance improved throughout 2020, as rising precious metals production and prices (especially silver prices), as well as declining per-unit costs, caused operating cash to flip from a deficit early in the year to a marked positive by the fourth quarter. Rising production volume and pricing trends seem likely to persist in 2021, potentially allowing Endeavour’s share price to continue to move higher.

Endeavour Silver Corp. last traded at $7.60 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.