Recently Canaccord Genuity sat down with Enthusiast Gaming’s (TSX: EGLX) C-suite to talk about the companies upcoming NASDAQ listing. Analysts said they came away with increased confidence, writing “We see continued upside despite recent share appreciation since the quarter due to momentum in direct sales wins, robust M&A pipe and greater visibility in the US, where digital media and ad peers are ascribed higher valuation multiples.”

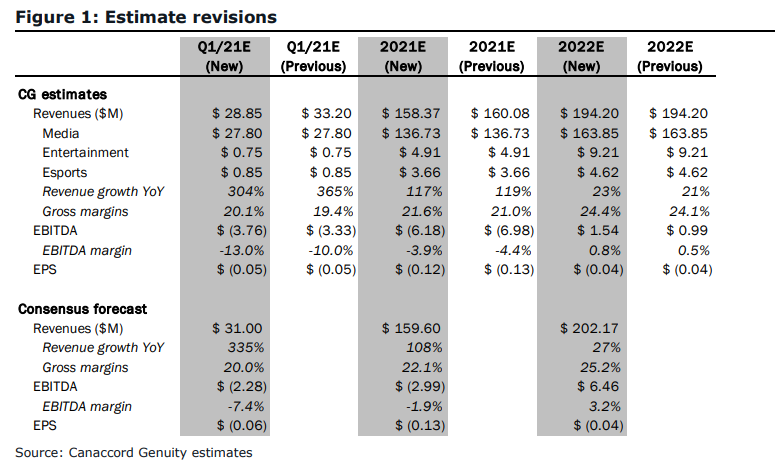

Canaccord Genuity currently has a C$12 price target and buy rating on the name. Although they walked away with more confidence in the name, they have slightly tweaked their forward 2021 and 2022 estimates to be “consistent with previous indications.”

Enthusiast Gaming currently has six analysts covering the company with a weighted 12-month price target of C$12.33. Three analysts have strong buys while another three have buy ratings. Alliance Global Partners has the highest price target with a C$14 target, while B. Riley has the lowest at C$11.50.

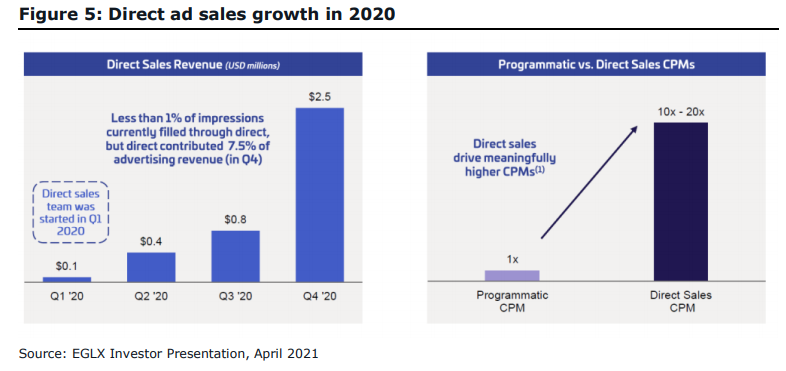

During the meeting, the company said they are still working on a strategy to monetize its roughly 300 million monthly active users. Enthusiast aims to move roughly 10% of its inventory to direct sales during the next two years, while expecting that to grow to 30% of its inventory monetized for the long run. They expect to see 50% gross margins on this revenue stream. Currently, the company says that direct sales only account for 1-2% of their ad volume so Canaccord believes that the company could grow its revenues by 60%+ in the short run while more than doubling in the long run.

Canaccord still believes that the M&A pipeline is robust, suggesting that the company focus on fan communities as they have, “the potential to generate high margins (50-60%) given they have low editorial cost since they are user-edited and curated.” While the company highlighted that they are looking to communities such as Minecraft, Roblox, and League of Legends through M&A.

Below you can see Canaccord’s new estimates after adjusting them from management’s commentary as well as to reflect seasonality during the first quarter. Canaccord says that, “Given multiple drivers of growth which we detail below, we remain confident with management’s ability to best our forecast, although we acknowledge more of a back-end loaded year.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.