In the week ended February 26, Bitcoin posted its worst weekly performance in about a year, declining around 17%. Investors’ fears of rising inflation stemming from the hoped-for “reopening” of much of the world caused long-term bond rates to rise and many highly valued stocks to fall. Bitcoin, a standout performer over the last year, did not prove immune to the selling pressure.

Aside from profit taking, another factor could have played a role in the price movement. The biggest, and up-to-now infrequently voiced, concern about Bitcoin — the huge and rapidly increasing amount of the world’s energy supply that is expended in the mining of the cryptocurrency every day — is now beginning to be discussed by financial commentators.

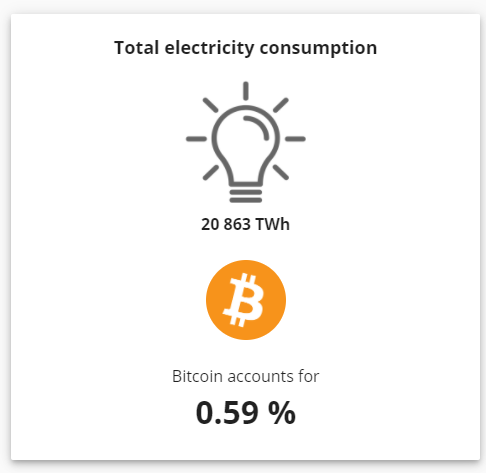

According to the University of Cambridge, Bitcoin mining accounts for 6 of every 1,000 kilowatt-hours of electricity consumed in the world. Put another way, Bitcoin mining consumes more electricity than the entire country of Argentina. In addition, the Oak Ridge Institute of Ohio estimates that Bitcoin mining entails double the energy consumption of copper, gold or platinum mining for each dollar’s worth of material mined.

ESG Concerns

Given that Environmental, Social and Corporate Governance (ESG) factors are now top-of-mind issues for governments, businesses and investors, Bitcoin mining’s growing energy footprint exposes the digital currency and the mining industry to the risks of new or newly imposed regulation. Taking this reasoning further, it is possible that governments could discourage the use of cryptocurrencies and that large institutional investors could decide that ESG considerations preclude investing in Bitcoin or Bitcoin-related securities.

For example, on February 22, Janet Yellen, the newly appointed U.S. Treasury Secretary, declared that using Bitcoin is “an extremely inefficient way of conducting transactions, and the amount of energy that’s consumed in processing those transactions is staggering.” Ms. Yellen has generally not supported Bitcoin going back to her days as Chair of the U.S. Federal Reserve Board from 2014 through 2018.

Even Tesla’s widely touted purchase of US$1.5 billion of Bitcoins could in time have negative implications. A portfolio manager who owns Tesla stock said in a Reuters article discussing the Bitcoin purchase that he was, “of course concerned about the level of carbon dioxide emissions generated from Bitcoin mining.” Tesla CEO Elon Musk himself has frequently discussed the company’s goal of a “zero-emission future.” Owning Bitcoin may not be compatible with such a future.

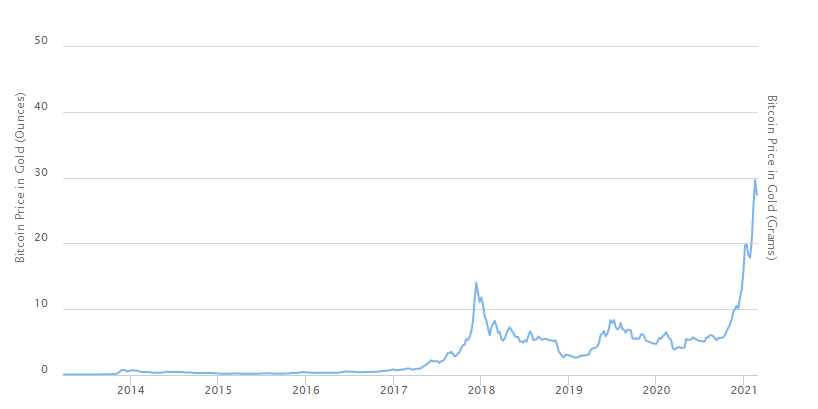

Bitcoin’s Dramatic Outperformance Versus Gold

Bitcoin’s downturn reversed only a small portion of its dramatic outperformance versus gold over the last six months. The figure below tracks the number of ounces required to buy one Bitcoin since 2013. A rising graph denotes Bitcoin outperforming gold and vice versa. If investors remain concerned about the environmental impact of Bitcoin mining, Bitcoin’s short-term negative reversal may persist.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.