On December 17th, Equinox Gold (TSX: EQX) announced that they reached an agreement to sell their Mercedes Gold Mine for US$125 million and a 2% net smelter return payable. The deal consists of $100 million in cash and 24,730,000 shares of Bear Creek, worth roughly $25 million.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$14.54, or an 80% upside to the current stock price. Out of the 12 analysts covering the stock, 1 analyst has a strong buy rating, 9 have buy ratings and 2 analysts have hold ratings. The street high sits at C$20 from Stifel-GMP while the lowest comes in at C$11.75.

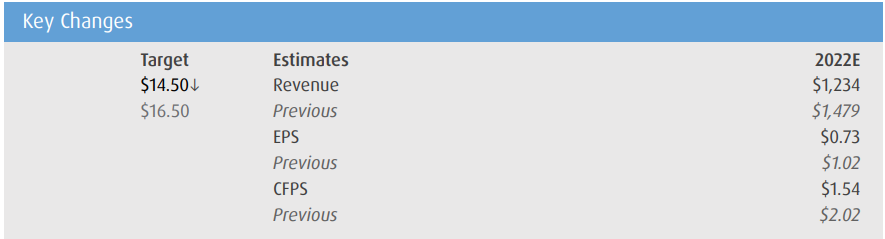

In BMO Capital Markets’ note, they reiterate their outperform rating but lowered their 12-month price target to C$14.50 from C$16.00, saying that although this sale was somewhat anticipated, the price was a little under what they believe the carrying value to be. Though they think the deal is great since the company retains cash, keeps some exposure to the mine, and gains exposure to another mine through its new ownership in Bear Creek Mining.

BMO adds that Mercedes is a non-core asset that only makes up roughly 5% of their production estimate for 2021 and only 2% of the companies resources, while adding that they, “welcome the non-dilutive cash infusion.” They believe that the cash will be used to help fast-track the construction of Greenstone.

Lastly, BMO has updated their estimates to eliminate the Mercedes mine from the companies operations, additionally, they have increased the timeline for the Los Filos mine. They have trimmed their 2022 Aurizona production estimate to “better align with recent run-rates.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.