On August 4, Equinox Gold Corp. (TSX: EQX) reported its second quarter production results. The company produced 122,656 ounces of gold at a total cash cost of $1,089 and an AISC of $1,382. The company additionally sold 124,712 ounces of gold at an average selling price of $1,806 to bring in revenue of $226.2 million. The company net income was $325.7 million, or earnings per share of $1.10. Equinox now has $333.9 million of cash on hand for the quarter ending June 30, 2021.

Analysts lowered their 12-month price target on Equinox following the production release, bringing the average price target down to $16.65 from $17.31. The street high sits at $22.76 while the lowest comes in at $10.50. There are 12 analysts covering the stock, one analyst has a strong buy rating, 8 have buys and the other 3 have hold ratings.

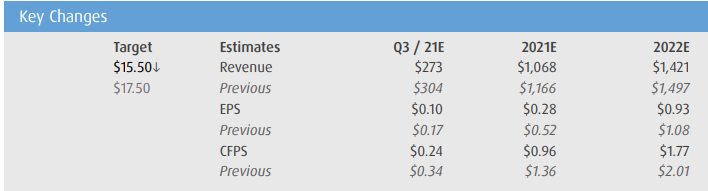

BMO Capital Markets was one of the analysts to lower their price target on Equinox. They now have a $15.50 price target on the firm, down from their $17.50 price target while having an outperform rating. They say that the quarter was tough, but the company outlook is starting to look even better.

Second quarter production came in slightly lower than the first-quarter numbers, due to an overall decrease of output at most of the companies operations. BMO says that the Aurizona mine got it the worst due to heavy rain.

The company reported adjusted earnings per share of $0.01, which was lower than the $0.04 street consensus and $0.09 BMO estimate. The company also cut its consolidated production by 7% down to 560,000 – 625,000 ounces. Specifically, Los Filos guidance was trimmed by 120,000 -140,000 ounces and Castle Mountain had their guidance reduced 29%.

BMO says that that the first half of 2021 was very tough but, “with Mesquite waste stripping now complete, production should increase materially, particularly in Q4.” That, combined with the news that Santa Luz construction is now 50% complete, on budget and on schedule, makes the outlook look very favourable.

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.