Equinox Gold (TSX: EQX) is one of the few gold producers this cycle to report that they have achieved 2025 guidance. The company this morning released their fourth quarter and full year 2025 production results, highlighted by record annual gold production of 922,827 ounces.

Fourth quarter production totaled 247,024 ounces of gold, a new record for the company, with that figure including 72,091 ounces from Greenstone and 23,207 from Valentine. The quarter notably saw Greenstone improve production by 29% versus Q3, with December averaging nameplate mill throughput of 27,000 tonnes per day.

Valentine meanwhile reached commercial production in November, with Q4 seeing the mine operating at 90% of nameplate capacity. A feasibility study is said to be underway here for a potential expansion, which would see the mine increasing processing rates from 2.5 million to over 4.5 million tonnes per year. That study is scheduled to be released by the end of the first quarter, with the study expected to proposed increasing annual production to 225,000 to 250,000 ounces at Valentine.

For the full year, 2025 saw the production of 922,827 ounces of gold, of which 856,909 ounces of gold fell within 2025 guidance. That production figure places Equinox above the guidance midpoint of 832,500 ounces of production for the year.

WATCH: The Monetary System Is Cracking – Gold Is the Pressure Valve | Ross Beaty – Equinox Gold

“Operational momentum is expected to continue into 2026 with a full year of production from Valentine, continued improvements at Greenstone, and steady contributions from our operations in Nicaragua and Mesquite in the United States,” commented Darren Hall, CEO of Equinox.

The company meanwhile indicated that cash and cash equivalents reached $430 million as of December 31, with debt repayments totaling $214 million since “late Q3 2025.”

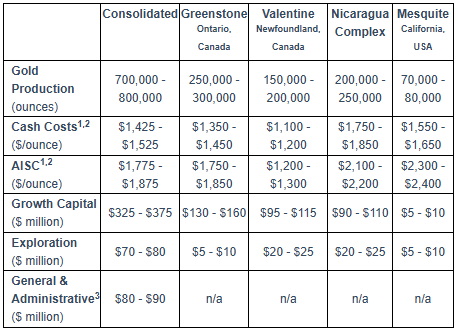

Looking to 2026, Equinox is guiding to consolidated production of 700 to 800 thousand ounces at cash costs between $1,425 and $1,525 an ounce. All in sustaining costs are expected to be in the range of $1,775 to $1,875 an ounce. In terms of capital, growth capital expenditures are expected to be between $325 and $375 million, while exploration expenditures are to be between $70 and $80 million, and G&A expenses between $80 and $90 million.

Full financial results are expected to be released February 18 after the close of markets.

Equinox Gold last traded at $20.25 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.