On December 17th, Equinox Gold (TSX: EQX) announced that they reached an agreement to sell their Mercedes Gold Mine for US$125 million and a 2% net smelter return. The deal consists of $100 million in cash and 24,730,000 shares of Bear Creek, worth roughly $25 million.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$14.54, or an 80% upside to the current stock price. Out of the 12 analysts covering the stock, 1 analyst has a strong buy rating, 9 have buy ratings and 2 analysts have hold ratings. The street high sits at C$20.00 from Stifel-GMP while the lowest comes in at C$11.75.

In Haywood Capital Markets’ note, they reiterated their buy rating on the name but lowered their 12-month price target to C$15.75 from C$16.00, saying, “A favourable sale price for a non-core asset.” Haywood said that this price was very reasonable since they valued the mine at US$128 million using US$1,800 per ounce gold prices.

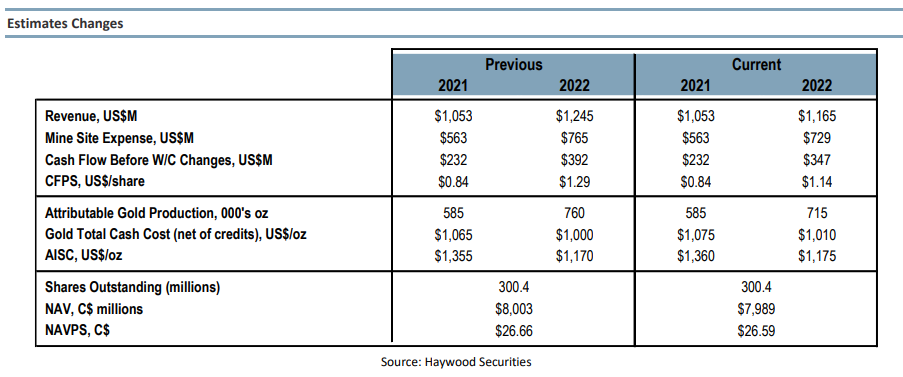

For the impact on Equinox’s 2022 production, Haywood says that the mine was expected to produce roughly 45,000 ounces in 2022, or almost 6% of the companies overall production. While the mine contributed roughly 13% of the companies total income from operations and 9% of the companies cash flow.

Due to this, Haywood had to lower some of its estimates, leading to the price target cut. Below you can see their updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.