On November 22nd, Lundin Mining Corporation (TSX: LUN) provided production guidance all the way out to the end of 2024. The company also provided cash cost, capital, and exploration expenditures for 2022.

For the cash cost guidance for 2020, copper sits between $1.55 per pound to $1.80 per pound depending on the mine, while zinc cash cost is expected to be $0.55 per pound and nickel will be a ($0.25) cost per pound in 2022. Nickel will be negative due to significant by-product copper credits, the company says.

The capital expenditure is expected to be $630 million for 2022, primarily due to $370 million going to the Candelaria mine. With the $630 million in capital expenditure during 2022, there will be an expected $45 million in exploration investments. With $40 million of the $45 million being spent supporting “significant in-mine and near-mine targets.”

| Production Guidance | 2022 | 2023 | 2024 |

| Zinc | 188,000 – 203,000 tonnes | 227,000 – 242,000 tonnes | 225,000 – 240,000 tonnes |

| Gold | 153,000 – 163,000 ounces | 155,000 – 165,000 ounces | 153,000 – 163,000 ounces |

| Nickel | 15,000 – 18,000 tonnes | 13,000 – 16,000 tonnes | 9,000 – 12,000 tonnes |

A number of analysts cut their 12-month price target, bringing the 12-month price target down to C$12.24, or a 14.4% upside to the current stock price. Lundin Mining currently has 23 analysts covering the stock with 2 analysts having strong buy ratings, 7 have buy ratings, 13 have hold ratings and 1 analyst has a sell rating. The street high sits at C$16.50 while the lowest comes in at C$8.56.

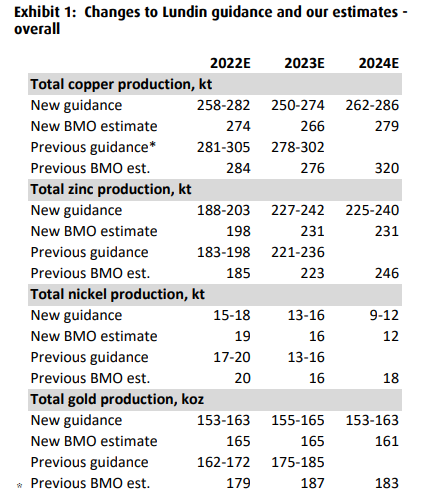

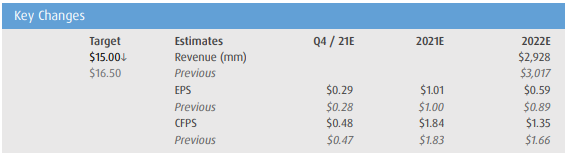

In BMO’s update, they reiterate their market perform rating but lowered their 12-month price target on Lundin Mining to C$15 from C$16.50, saying that the three-year guidance came in below their expectations.

For the three-year production guidance, BMO forecasted copper and zinc production at the low end of Lundin’s old guidance while nickel and gold estimates were at the high end of their old guidance. With the updated guidance, they are now revising these estimates down. You can see the updated production estimates below.

BMO believes that the first half of 2021 will look light as the company expects both production and sales to be weighted heavily towards the second half of 2022. BMO says that the second half weighting comes from Candelario, Chapada, and Eagle but they believe that Neves-Corvo copper production could help make the first half of 2021 look better than expected.

Lastly, the company also modeled 2022 capital and operating expenses to be lower than guidance. They say the major difference is BMO’s commodity price assumptions in 2022. Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.